Is EPAM Systems Significantly Undervalued?

Today, we're examining the stock performance and intrinsic value of EPAM Systems Inc (NYSE:EPAM). With a daily gain of 2.13% and a 3-month gain of 0.25%, the company's Earnings Per Share (EPS) stands at 9. But is the stock significantly undervalued? Let's delve into a comprehensive valuation analysis to decipher this.

Company Introduction

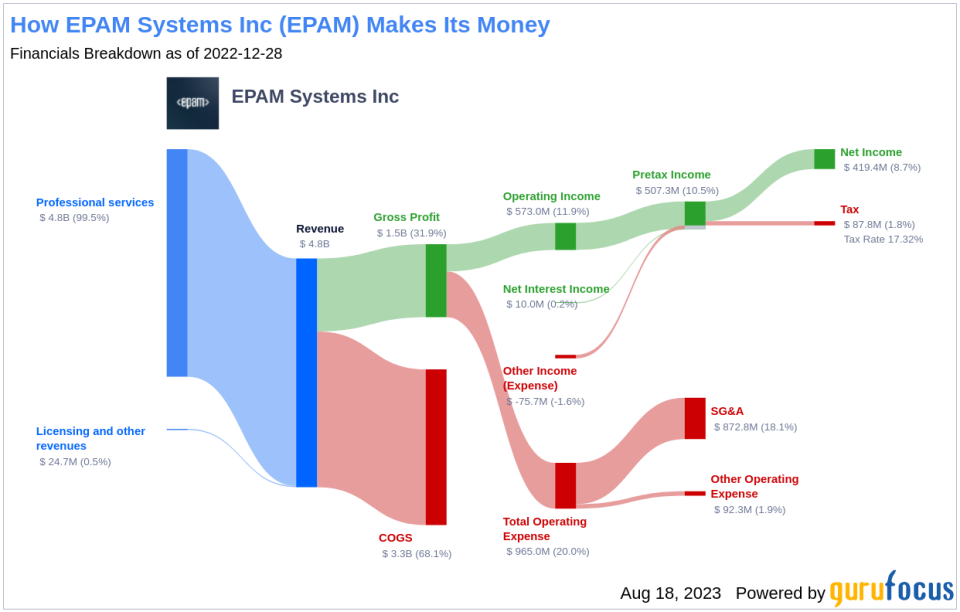

EPAM Systems Inc, a global provider of software product development and digital platform engineering services, caters to clients worldwide. The company's services range from Software Product Development, Custom Application Development to Application Testing, Enterprise Application Platforms, and Infrastructure Management. With a primary focus on innovative and scalable software solutions, EPAM Systems serves various industries, including financial services, travel, software, life sciences, and healthcare.

Despite the current stock price of $238.68, our analysis indicates that the fair value or GF Value of EPAM Systems stands at a whopping $590.96. This implies that the stock might be significantly undervalued. The company's market cap is $13.80 billion, with sales reaching $4.80 billion.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides a visual representation of the stock's fair trading value. If the stock price significantly surpasses the GF Value Line, it is likely overvalued with potentially poor future returns. Conversely, if it's significantly below the GF Value Line, the stock might be undervalued, suggesting higher future returns.

For EPAM Systems, the GF Value suggests that the stock is significantly undervalued. This implies that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

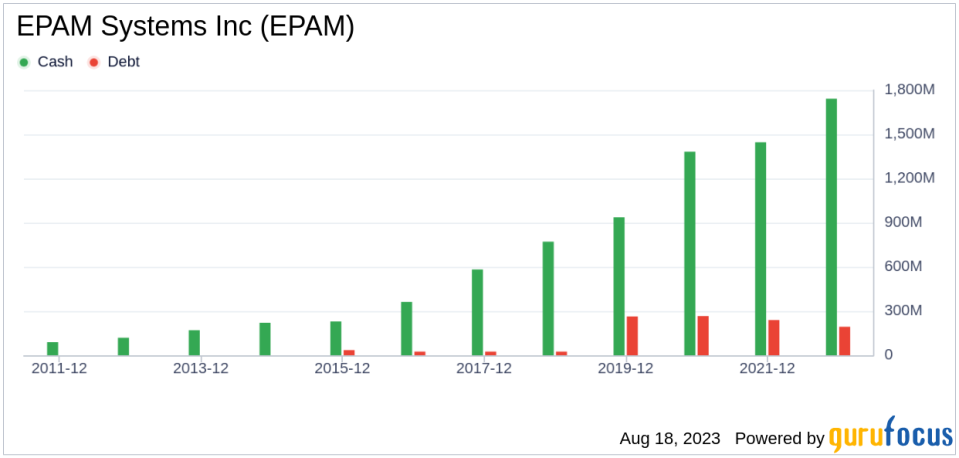

EPAM Systems' financial strength is a crucial consideration for investors to avoid potential capital loss. With a cash-to-debt ratio of 10.22, EPAM Systems ranks better than 65.92% of companies in the Software industry, indicating a strong balance sheet.

Profitability and Growth

EPAM Systems' profitability is strong, with high profit margins offering better performance potential. The company has been profitable for 10 years over the past decade. Its operating margin of 12.72% is better than 78.82% of companies in the Software industry.

The growth of EPAM Systems is also impressive, with a 3-year average annual revenue growth of 27%, ranking better than 82.71% of companies in the Software industry. The 3-year average EBITDA growth rate is 19.8%, which ranks better than 66.72% of companies in the Software industry.

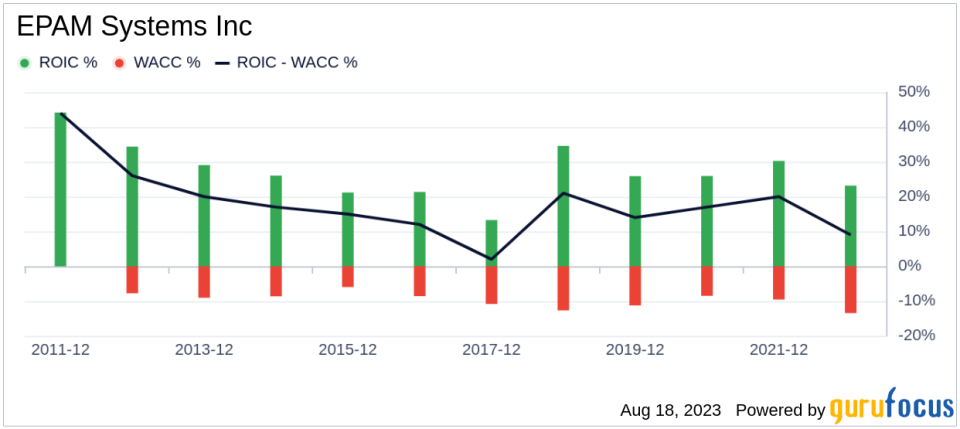

ROIC vs WACC

Comparing the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) provides another perspective on a company's profitability. EPAM Systems' ROIC stands at 24.03, surpassing its WACC of 13.58, indicating efficient cash flow generation relative to the capital invested in the business.

Conclusion

In conclusion, EPAM Systems' stock appears to be significantly undervalued. The company's financial condition is robust, and its profitability is strong. With growth rates better than 66.72% of companies in the Software industry, EPAM Systems presents a promising investment opportunity. To learn more about EPAM Systems' stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.