Epizyme (EPZM) Stock Dives on Public Offering of Common Stock

Epizyme EPZM announced that it is floating a secondary issue of 56,666,667 shares of its common stock to the public at an issue price of $1.50 per share (excluding underwriting discounts), approximately amounting to $85 million.

EPZM also granted an option to underwriters of the issue to purchase an additional 8.5 million shares at the same price.

Epizyme plans to use the net proceeds from this new issue combined with its existing cash balance to fund the clinical studies (both ongoing and planned) of its pipeline candidates. The studies include the confirmatory studies evaluating tazemetostat for follicular lymphoma (FL) and epithelioid sarcoma (ES) indications and the basket studies evaluating tazemetostat across multiple new types of hematological malignancies and solid tumors.

EPZM will also use the funds from the proceeds to accelerate the commercial adoption of Tazverik. In 2020, tazemetostat was granted an approval by the FDA under an accelerated pathway to treat ES and FL indications. Tazemetostat is marketed by Epizyme under the trade name Tazverik, which is currently the only FDA-approved drug in the company’s portfolio of marketed drugs.

Epizyme will also use the proceeds to expand its pipeline and for its general corporate purposes, including working capital requirements.

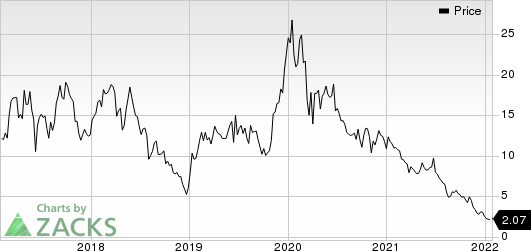

Shares of Epizyme plummeted 44.2% on Jan 27 after the announcement. The fall in share price was likely attributable to the issuance of a large number of shares, which dilutes Epizyme’s current shareholder base. Per an SEC filing by EPZM, its common stock outstanding as of Dec 31, 2021, is approximately 106 million. Notably, the secondary issue accounts for the issuance of the common stock, which is more than half of this figure. Moreover, the issue price per share of $1.50 also did not go well with investors. As a matter of fact, the issue price is at a 21% discount to the closing price on Jan 26, wherein the stock closed at $1.90.

Epizyme’s stock has plunged 90.7% in the past year compared with the industry’s 39.7% decline.

Image Source: Zacks Investment Research

The secondary offering is expected to close on Jan 31, 2021.

We note that while the equity issue could not cheer investors, it does give a boost to Epizyme’s existing cash balance. Earlier this month, EPZM provided some information on its financial guidance for 2022. It expects the current cash runway to extend into fourth-quarter 2022, after taking into account the expected adjusted operating expenses for the current year. Operating expenses are estimated in the range of $170-$190 million.

Apart from tazemetostat, Epizyme has another pipeline candidate, EZM0414, an oral SETD2 inhibitor, which is being evaluated in a phase I/Ib study for relapsed/refractory multiple myeloma and diffuse large B-cell lymphoma indications.

Epizyme, Inc. Price

Epizyme, Inc. price | Epizyme, Inc. Quote

Zacks Rank & Stocks to Consider

Epizyme currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the biotech sector are Alkermes ALKS, Axsome Therapeutics AXSM and Vir Biotechnology VIR. While Alkermes and Vir Biotechnology each sport a Zacks Rank #1 (Strong Buy) at present, Axsome Therapeutics currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ earnings per share estimates for 2022 have increased from 70 cents to 71 cents in the past 60 days. Shares of Alkermes have risen 15.9% in the past year.

Earnings of Alkermes beat estimates in all the last four quarters, the average being 147%.

Axsome Therapeutics’ loss per share estimates for 2022 have narrowed from $3.67 to $3.64 in the past 60 days.

Earnings of Axsome Therapeutics beat estimates in three of the last four quarters while the same missed the mark on one occasion, the average surprise being 0.6%.

Vir Biotechnology’s bottom-line estimates for 2022 have been revised from a loss of 47 cents per share to earnings of $6.82 in the past 60 days.

Earnings of Vir Biotechnology beat estimates in two of the last four quarters, missing the mark on the other two occasions, the average surprise being 13%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Epizyme, Inc. (EPZM) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report

Vir Biotechnology, Inc. (VIR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research