EPR Properties (EPR) Announces Year-End Results and Dividend Increase

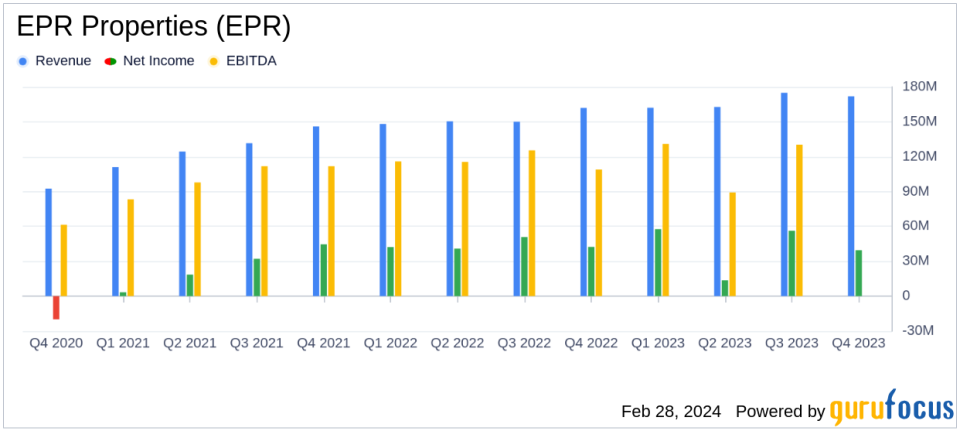

Total Revenue: $705.7 million for 2023, compared to $658.0 million in 2022.

Net Income: $148.9 million available to common shareholders for 2023, a slight decrease from $152.1 million in 2022.

Earnings Per Share (EPS): $1.97 per diluted common share for 2023, down from $2.03 in 2022.

Funds From Operations (FFO): Adjusted FFO per diluted common share at $5.22 for 2023, up from $4.89 in 2022.

Investment Spending: $269.4 million in 2023, with significant investments in resort and day spas, and a climbing gym acquisition.

Liquidity: Strong position with $78.1 million in cash and no borrowings on the $1.0 billion credit facility.

Dividend: Monthly cash dividend to common shareholders increased by 3.6%.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 28, 2024, EPR Properties (NYSE:EPR), a leading real estate investment trust specializing in experiential properties, released its 8-K filing, announcing its financial results for the fourth quarter and the full year ended December 31, 2023. The company reported a total revenue of $705.7 million for the year, an increase from the previous year's $658.0 million. However, net income available to common shareholders saw a slight decrease to $148.9 million, or $1.97 per diluted common share, compared to $152.1 million, or $2.03 per diluted common share in 2022.

EPR Properties is a real estate investment trust that focuses on leasing experiential properties across the United States and Canada. The company's portfolio includes theaters, family entertainment centers, ski resorts, and educational facilities. With the majority of its revenue stemming from the experiential sector, EPR Properties has a significant presence in states like Texas, Florida, New York, and California.

The company's performance in 2023 reflects its resilience despite challenges in the market. The slight decrease in net income can be attributed to various factors, including market volatility and investment in new properties. However, the increase in total revenue and adjusted FFO per diluted common share indicates a strong underlying performance and the company's ability to generate cash flow from its operations.

One of the financial highlights for EPR Properties in 2023 was its investment spending, which totaled $269.4 million. This included significant investments in three premier resort and day spas in the Northeastern U.S. and the acquisition of a climbing gym in Belmont, California. These investments demonstrate the company's commitment to growth and its strategy to diversify its experiential property portfolio.

The company's strong liquidity position, with $78.1 million in cash and no borrowings on its $1.0 billion unsecured revolving credit facility, provides it with the financial flexibility to pursue further investments and manage its debt profile effectively. Only $136.6 million of its consolidated debt is maturing in 2024, all of which is at fixed interest rates.

EPR Properties also announced an increase in its monthly dividend to common shareholders by 3.6%, reflecting confidence in its financial outlook for 2024. The company introduced guidance for FFOAA per diluted common share for 2024, projecting an increase of 3.2% at the midpoint over 2023 after adjusting for deferred rent and interest collections.

President and CEO Greg Silvers commented on the results:

"We concluded 2023 with positive momentum, as we executed on our investment spending and delivered strong earnings growth. We also saw sustained strength in our customers businesses, with continued consumer spending on experiences and strong North American box office growth of over 20% compared to 2022."

Looking ahead, EPR Properties is focused on disciplined capital deployment and delivering reliable earnings growth. The company's investment strategy, coupled with a strong balance sheet, positions it well for navigating the future and continuing to provide value to its shareholders.

For a more detailed analysis of EPR Properties' financial results, including income statements and balance sheets, investors are encouraged to review the full earnings report and supplemental information available on the company's website.

Value investors and potential GuruFocus.com members interested in following EPR Properties' progress can find more insights and data on GuruFocus.com, where financial expertise meets in-depth analysis.

For further information, please contact EPR Properties or visit the company's website at www.eprkc.com.

Explore the complete 8-K earnings release (here) from EPR Properties for further details.

This article first appeared on GuruFocus.