If EPS Growth Is Important To You, Chemtrade Logistics Income Fund (TSE:CHE.UN) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Chemtrade Logistics Income Fund (TSE:CHE.UN), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Chemtrade Logistics Income Fund

How Fast Is Chemtrade Logistics Income Fund Growing Its Earnings Per Share?

Over the last three years, Chemtrade Logistics Income Fund has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Chemtrade Logistics Income Fund's EPS catapulted from CA$1.01 to CA$2.13, over the last year. It's a rarity to see 112% year-on-year growth like that.

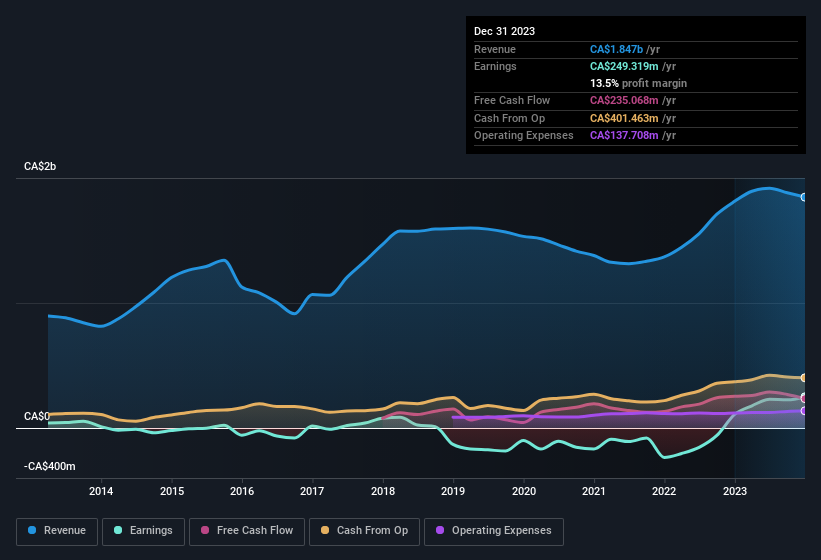

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 3.4 percentage points to 15%, in the last twelve months. Which is a great look for the company.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Chemtrade Logistics Income Fund?

Are Chemtrade Logistics Income Fund Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Chemtrade Logistics Income Fund insiders walking the walk, by spending CA$353k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the CEO, President & Trustee, Scott Rook, who made the biggest single acquisition, paying CA$90k for shares at about CA$8.15 each.

Should You Add Chemtrade Logistics Income Fund To Your Watchlist?

Chemtrade Logistics Income Fund's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over Chemtrade Logistics Income Fund could be in your best interest. Before you take the next step you should know about the 3 warning signs for Chemtrade Logistics Income Fund (1 makes us a bit uncomfortable!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Chemtrade Logistics Income Fund, you'll probably love this curated collection of companies in CA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.