If EPS Growth Is Important To You, Civista Bancshares (NASDAQ:CIVB) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Civista Bancshares (NASDAQ:CIVB), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Civista Bancshares with the means to add long-term value to shareholders.

View our latest analysis for Civista Bancshares

How Fast Is Civista Bancshares Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Civista Bancshares has grown EPS by 11% per year. That's a pretty good rate, if the company can sustain it. It's also worth noting that the EPS growth has been assisted by share buybacks, indicating the company is in a position to return capital to shareholders.

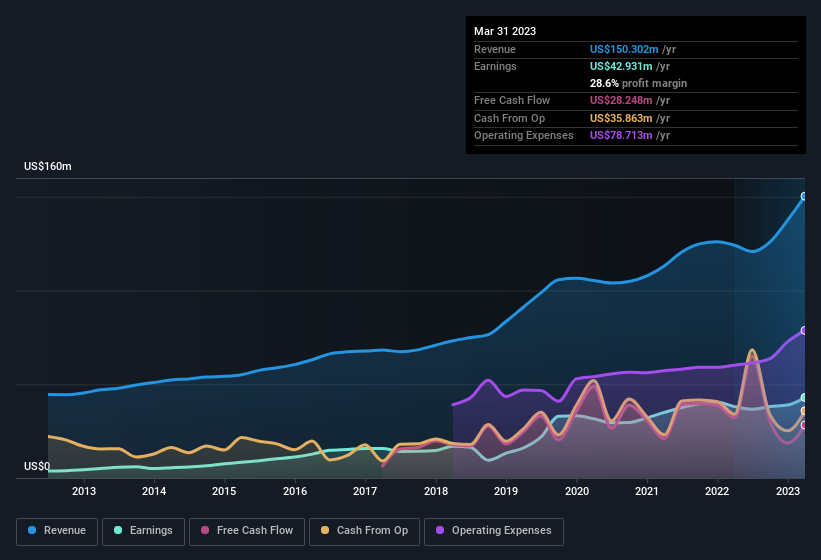

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Civista Bancshares' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Civista Bancshares achieved similar EBIT margins to last year, revenue grew by a solid 21% to US$150m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Civista Bancshares.

Are Civista Bancshares Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in Civista Bancshares both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. Zooming in, we can see that the biggest insider purchase was by company insider Gerald Wurm for US$63k worth of shares, at about US$17.87 per share.

The good news, alongside the insider buying, for Civista Bancshares bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$14m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 5.4% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Dennis Shaffer is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Civista Bancshares, with market caps between US$100m and US$400m, is around US$1.8m.

The Civista Bancshares CEO received US$924k in compensation for the year ending December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Civista Bancshares To Your Watchlist?

As previously touched on, Civista Bancshares is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Civista Bancshares , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Civista Bancshares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here