If EPS Growth Is Important To You, Proteome Sciences (LON:PRM) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Proteome Sciences (LON:PRM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Proteome Sciences with the means to add long-term value to shareholders.

View our latest analysis for Proteome Sciences

Proteome Sciences' Improving Profits

In the last three years Proteome Sciences' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Proteome Sciences boosted its trailing twelve month EPS from UK£0.0019 to UK£0.0023, in the last year. There's little doubt shareholders would be happy with that 22% gain.

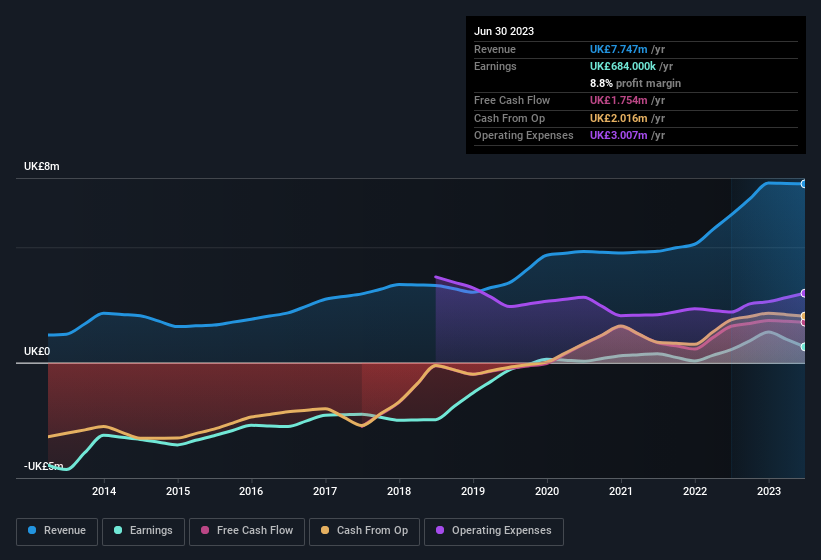

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Proteome Sciences shareholders can take confidence from the fact that EBIT margins are up from 15% to 17%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Proteome Sciences is no giant, with a market capitalisation of UK£14m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Proteome Sciences Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Proteome Sciences shares, in the last year. Add in the fact that Martin Diggle, the company insider of the company, paid UK£7.9k for shares at around UK£0.039 each. It seems that at least one insider is prepared to show the market there is potential within Proteome Sciences.

Is Proteome Sciences Worth Keeping An Eye On?

One positive for Proteome Sciences is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Proteome Sciences seems free from that morose affliction. Despite there being a solitary insider adding to their holdings, it's enough to consider adding this to the watchlist. We don't want to rain on the parade too much, but we did also find 4 warning signs for Proteome Sciences (2 make us uncomfortable!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Proteome Sciences, you'll probably love this curated collection of companies in GB that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.