With EPS Growth And More, Comstock Resources (NYSE:CRK) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Comstock Resources (NYSE:CRK). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Comstock Resources

Comstock Resources' Improving Profits

Over the last three years, Comstock Resources has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Comstock Resources' EPS grew from US$1.37 to US$3.43, over the previous 12 months. It's not often a company can achieve year-on-year growth of 150%.

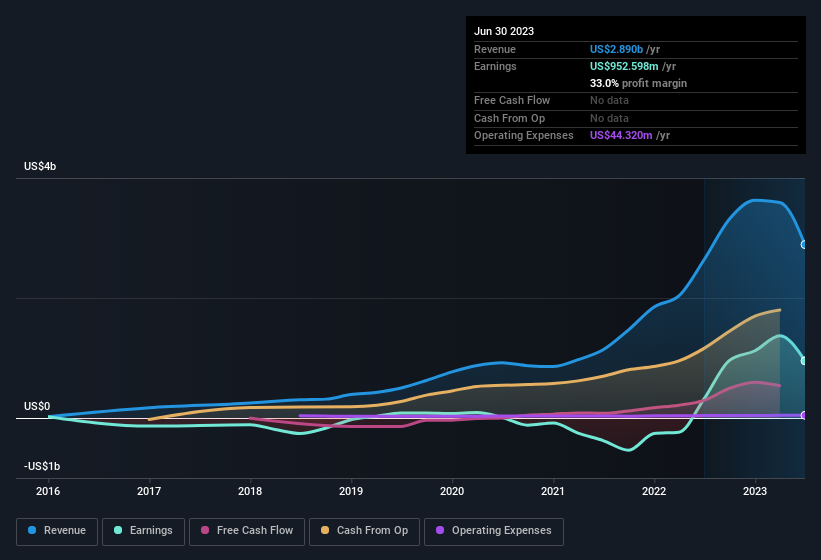

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Comstock Resources' EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Comstock Resources.

Are Comstock Resources Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Comstock Resources insiders spent a whopping US$4.0m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the Chairman of the Board of Directors & CEO, Miles Allison, who made the biggest single acquisition, paying US$975k for shares at about US$19.50 each.

On top of the insider buying, it's good to see that Comstock Resources insiders have a valuable investment in the business. Holding US$58m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

Does Comstock Resources Deserve A Spot On Your Watchlist?

Comstock Resources' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Comstock Resources deserves timely attention. However, before you get too excited we've discovered 4 warning signs for Comstock Resources (1 is a bit concerning!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Comstock Resources, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.