With EPS Growth And More, Fuller Smith & Turner (LON:FSTA) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Fuller Smith & Turner (LON:FSTA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Fuller Smith & Turner

Fuller Smith & Turner's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Fuller Smith & Turner's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 42%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

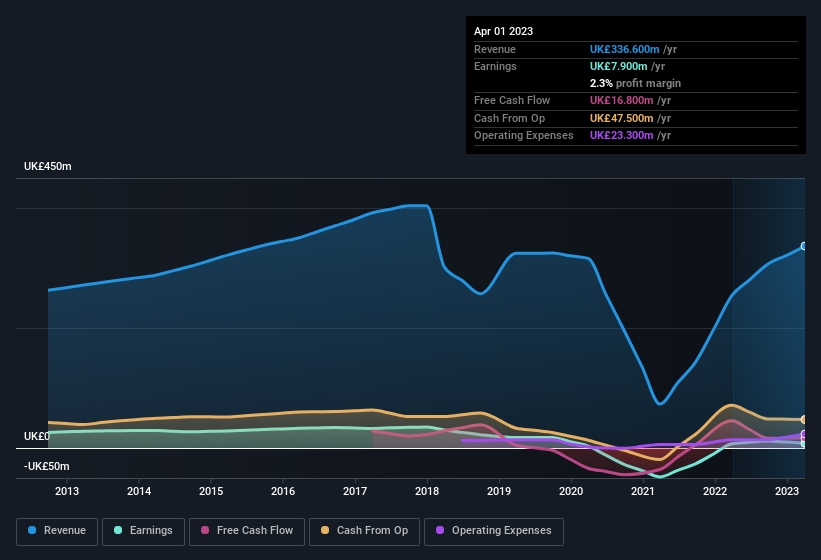

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Fuller Smith & Turner shareholders can take confidence from the fact that EBIT margins are up from 5.2% to 7.8%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Fuller Smith & Turner?

Are Fuller Smith & Turner Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Fuller Smith & Turner insiders refrain from selling stock during the year, but they also spent UK£125k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Non-Executive Director Richard H. Fuller for UK£96k worth of shares, at about UK£4.57 per share.

It's reassuring that Fuller Smith & Turner insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Fuller Smith & Turner, with market caps between UK£156m and UK£622m, is around UK£794k.

Fuller Smith & Turner offered total compensation worth UK£639k to its CEO in the year to April 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Fuller Smith & Turner Worth Keeping An Eye On?

Fuller Smith & Turner's earnings have taken off in quite an impressive fashion. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests Fuller Smith & Turner may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. You still need to take note of risks, for example - Fuller Smith & Turner has 2 warning signs we think you should be aware of.

The good news is that Fuller Smith & Turner is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here