With EPS Growth And More, German American Bancorp (NASDAQ:GABC) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in German American Bancorp (NASDAQ:GABC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for German American Bancorp

German American Bancorp's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, German American Bancorp has grown EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

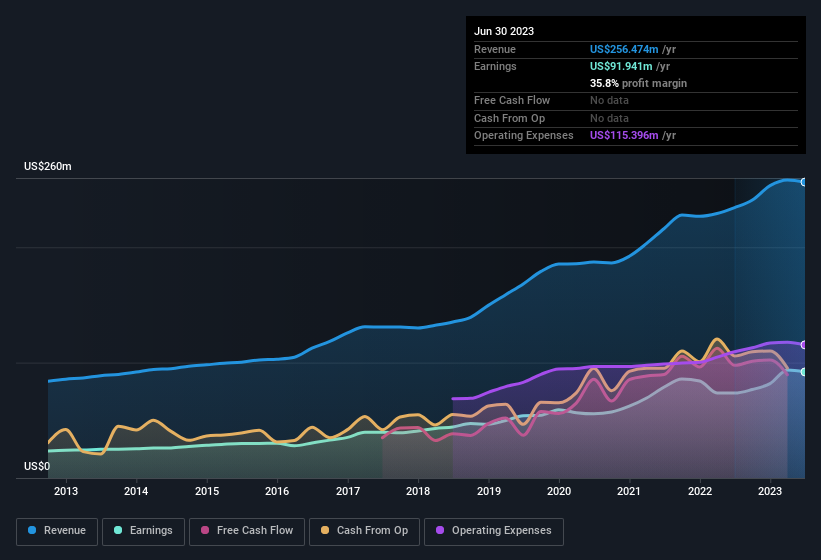

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that German American Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note German American Bancorp achieved similar EBIT margins to last year, revenue grew by a solid 9.4% to US$256m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of German American Bancorp's forecast profits?

Are German American Bancorp Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that German American Bancorp insiders spent a staggering US$1.5m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, German American Bancorp will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was Lead Independent Director Thomas Seger who made the biggest single purchase, worth US$432k, paying US$26.49 per share.

The good news, alongside the insider buying, for German American Bancorp bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$41m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 4.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, D. Dauby, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to German American Bancorp, with market caps between US$400m and US$1.6b, is around US$3.4m.

German American Bancorp's CEO took home a total compensation package of US$1.4m in the year prior to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add German American Bancorp To Your Watchlist?

One important encouraging feature of German American Bancorp is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We don't want to rain on the parade too much, but we did also find 1 warning sign for German American Bancorp that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, German American Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here