With EPS Growth And More, German American Bancorp (NASDAQ:GABC) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like German American Bancorp (NASDAQ:GABC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide German American Bancorp with the means to add long-term value to shareholders.

Check out our latest analysis for German American Bancorp

How Quickly Is German American Bancorp Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. German American Bancorp managed to grow EPS by 7.4% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that German American Bancorp's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While German American Bancorp may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

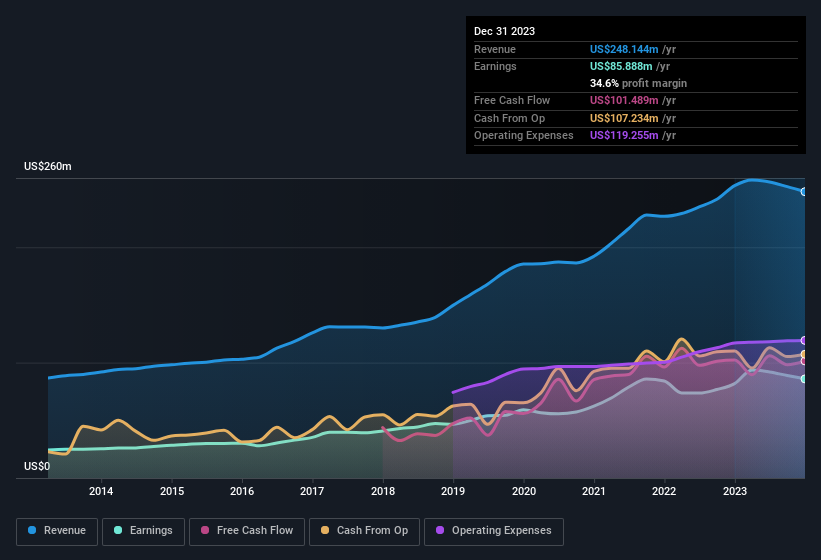

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of German American Bancorp's forecast profits?

Are German American Bancorp Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that German American Bancorp insiders spent a whopping US$3.8m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. Zooming in, we can see that the biggest insider purchase was by Lead Independent Director Thomas Seger for US$432k worth of shares, at about US$26.49 per share.

On top of the insider buying, it's good to see that German American Bancorp insiders have a valuable investment in the business. To be specific, they have US$49m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 4.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, D. Dauby, is paid less than the median for similar sized companies. For companies with market capitalisations between US$400m and US$1.6b, like German American Bancorp, the median CEO pay is around US$3.3m.

The CEO of German American Bancorp only received US$1.4m in total compensation for the year ending December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is German American Bancorp Worth Keeping An Eye On?

One positive for German American Bancorp is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with German American Bancorp , and understanding this should be part of your investment process.

The good news is that German American Bancorp is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.