With EPS Growth And More, Mastermyne Group (ASX:MYE) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Mastermyne Group (ASX:MYE), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Mastermyne Group

How Fast Is Mastermyne Group Growing Its Earnings Per Share?

Over the last three years, Mastermyne Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Mastermyne Group's EPS soared from AU$0.049 to AU$0.071, in just one year. That's a commendable gain of 44%.

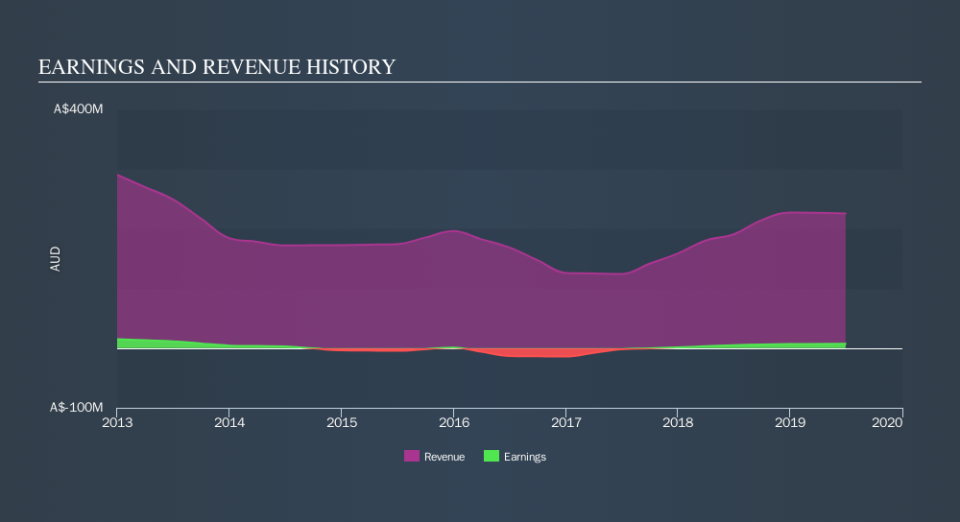

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Mastermyne Group's EBIT margins were flat over the last year, revenue grew by a solid 18% to AU$226m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Mastermyne Group is no giant, with a market capitalization of AU$102m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mastermyne Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Mastermyne Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Julie Whitcombe, the Independent Non-Executive Director of the company, paid AU$10k for shares at around AU$0.84 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Mastermyne Group insiders own more than a third of the company. Actually, with 38% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have AU$39m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Mastermyne Group To Your Watchlist?

For growth investors like me, Mastermyne Group's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Of course, just because Mastermyne Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Mastermyne Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.