With EPS Growth And More, McCoy Global (TSE:MCB) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like McCoy Global (TSE:MCB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide McCoy Global with the means to add long-term value to shareholders.

See our latest analysis for McCoy Global

McCoy Global's Improving Profits

Over the last three years, McCoy Global has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, McCoy Global's EPS grew from CA$0.16 to CA$0.32, over the previous 12 months. It's not often a company can achieve year-on-year growth of 106%. That could be a sign that the business has reached a true inflection point.

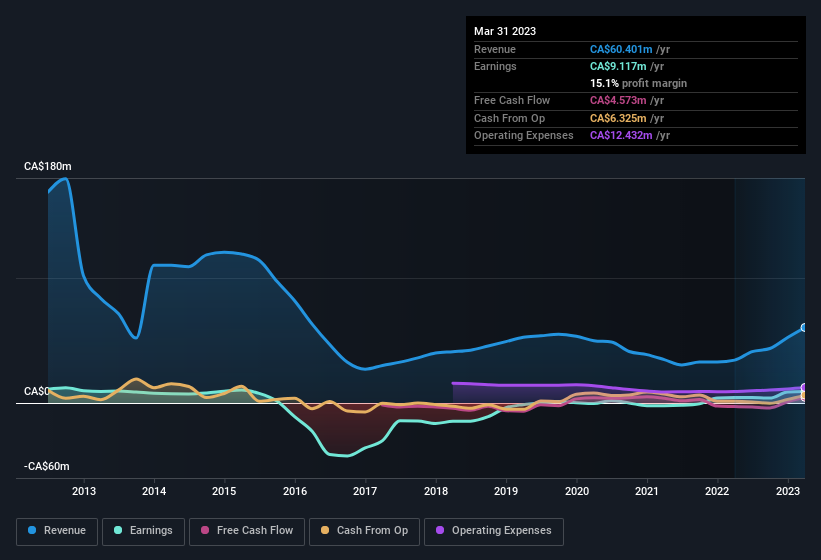

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. McCoy Global shareholders can take confidence from the fact that EBIT margins are up from 1.1% to 9.1%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

McCoy Global isn't a huge company, given its market capitalisation of CA$37m. That makes it extra important to check on its balance sheet strength.

Are McCoy Global Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for McCoy Global shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that President James Rakievich bought CA$7.7k worth of shares at an average price of around CA$1.02. It seems that at least one insider is prepared to show the market there is potential within McCoy Global.

Should You Add McCoy Global To Your Watchlist?

McCoy Global's earnings per share have been soaring, with growth rates sky high. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put McCoy Global on your watchlist. Before you take the next step you should know about the 3 warning signs for McCoy Global that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, McCoy Global isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here