With EPS Growth And More, McMillan Shakespeare (ASX:MMS) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in McMillan Shakespeare (ASX:MMS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for McMillan Shakespeare

McMillan Shakespeare's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that McMillan Shakespeare's EPS has grown 32% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

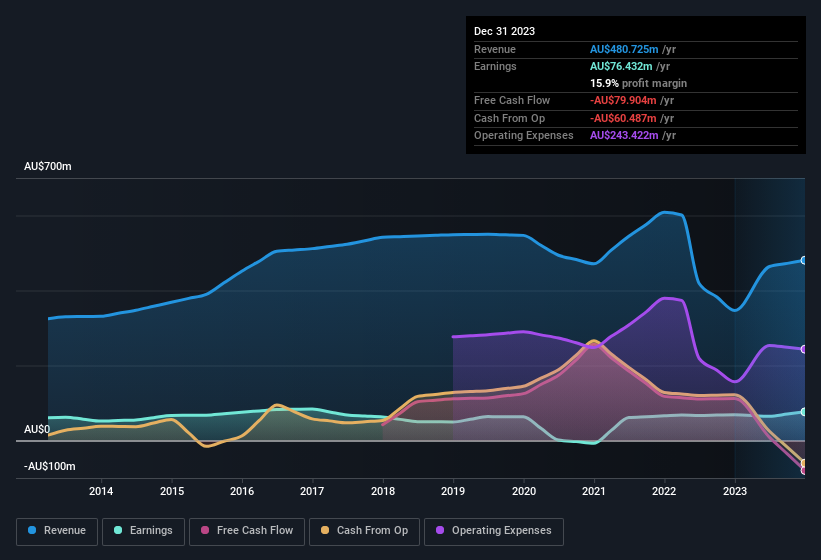

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that McMillan Shakespeare's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. McMillan Shakespeare maintained stable EBIT margins over the last year, all while growing revenue 39% to AU$481m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of McMillan Shakespeare's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are McMillan Shakespeare Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling McMillan Shakespeare shares, in the last year. Add in the fact that Kathryn Parsons, the Independent Non-Executive Director of the company, paid AU$9.7k for shares at around AU$19.30 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, it's good to see that McMillan Shakespeare insiders have a valuable investment in the business. With a whopping AU$90m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because McMillan Shakespeare's CEO, Rob De Luca, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between AU$615m and AU$2.5b, like McMillan Shakespeare, the median CEO pay is around AU$1.6m.

McMillan Shakespeare offered total compensation worth AU$1.2m to its CEO in the year to June 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is McMillan Shakespeare Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into McMillan Shakespeare's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. However, before you get too excited we've discovered 3 warning signs for McMillan Shakespeare that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of McMillan Shakespeare, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.