If You Like EPS Growth Then Check Out Circa Enterprises (CVE:CTO) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Circa Enterprises (CVE:CTO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Circa Enterprises

How Fast Is Circa Enterprises Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Circa Enterprises grew its EPS by 13% per year. That's a good rate of growth, if it can be sustained.

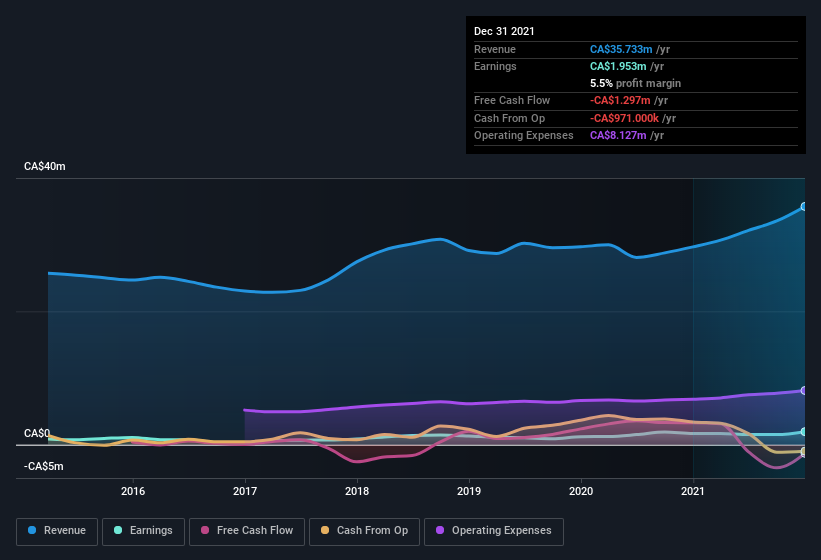

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Circa Enterprises maintained stable EBIT margins over the last year, all while growing revenue 20% to CA$36m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Circa Enterprises is no giant, with a market capitalization of CA$14m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Circa Enterprises Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Circa Enterprises insiders both bought and sold shares over the last twelve months, but they did end up spending CA$18k more on stock than they received from selling it. So, on balance, the insider transactions are mildly encouraging. We also note that it was the Independent Director, Robert Johnston, who made the biggest single acquisition, paying CA$40k for shares at about CA$1.18 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Circa Enterprises insiders own more than a third of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, Circa Enterprises is a very small company, with a market cap of only CA$14m. That means insiders only have CA$6.9m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Is Circa Enterprises Worth Keeping An Eye On?

One important encouraging feature of Circa Enterprises is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Circa Enterprises (1 is concerning) you should be aware of.

As a growth investor I do like to see insider buying. But Circa Enterprises isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.