If You Like EPS Growth Then Check Out Golden Ocean Group (NASDAQ:GOGL) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Golden Ocean Group (NASDAQ:GOGL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Golden Ocean Group

Golden Ocean Group's Improving Profits

Over the last three years, Golden Ocean Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Golden Ocean Group's EPS shot from US$0.24 to US$0.42, over the last year. You don't see 72% year-on-year growth like that, very often.

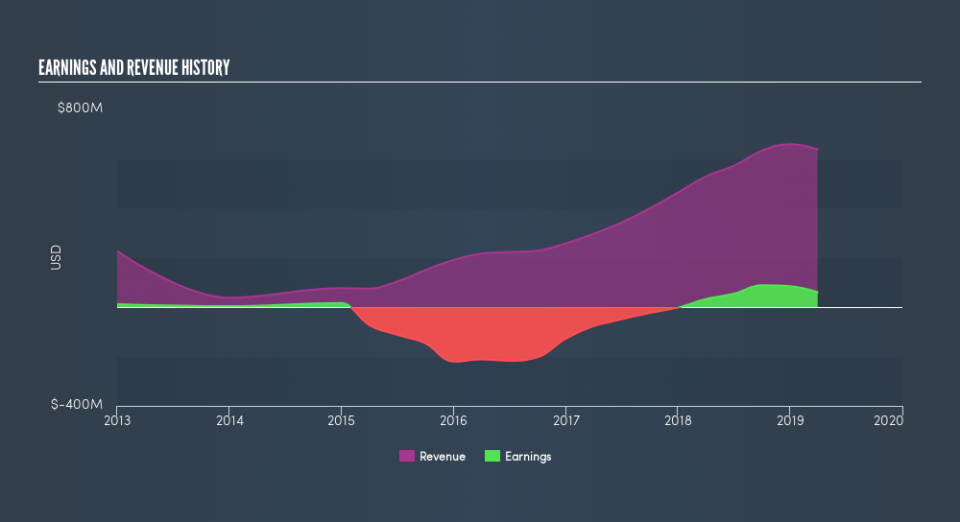

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Golden Ocean Group shareholders can take confidence from the fact that EBIT margins are up from 16% to 20%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Golden Ocean Group EPS 100% free.

Are Golden Ocean Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Golden Ocean Group shareholders can gain quiet confidence from the fact that insiders shelled out US$465k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Director, Ulrika Laurin, who made the biggest single acquisition, paying US$333k for shares at about US$6.66 each.

Is Golden Ocean Group Worth Keeping An Eye On?

Golden Ocean Group's earnings per share growth has been so hot recently that thinking about it is making me blush. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Golden Ocean Group on your watchlist. Of course, just because Golden Ocean Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Golden Ocean Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.