If You Like EPS Growth Then Check Out HCI Group (NYSE:HCI) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like HCI Group (NYSE:HCI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for HCI Group

HCI Group's Improving Profits

In the last three years HCI Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, HCI Group's EPS shot from US$1.50 to US$4.03, over the last year. You don't see 168% year-on-year growth like that, very often.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, HCI Group's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

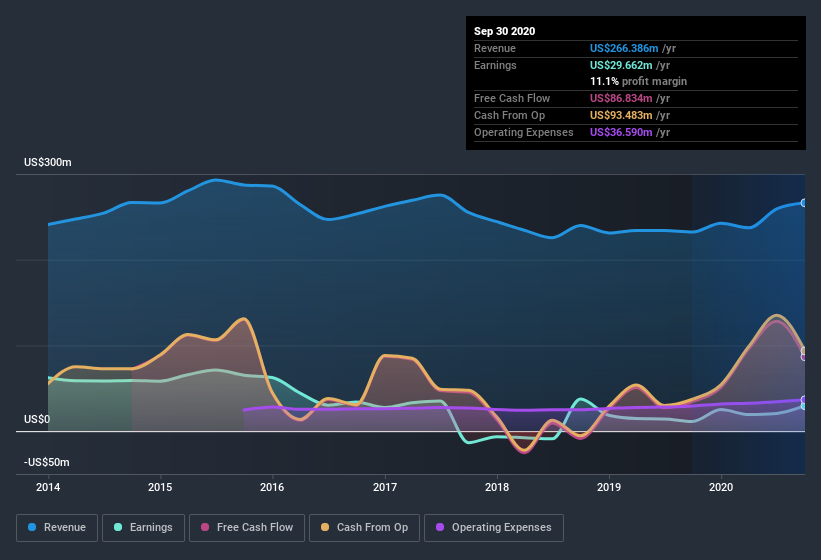

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future HCI Group EPS 100% free.

Are HCI Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did HCI Group insiders refrain from selling stock during the year, but they also spent US$147k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Independent Director Susan Watts for US$50k worth of shares, at about US$39.72 per share.

The good news, alongside the insider buying, for HCI Group bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at US$91m, they have plenty of motivation to push the business to succeed. At 22% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

Is HCI Group Worth Keeping An Eye On?

HCI Group's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest HCI Group belongs on the top of your watchlist. You still need to take note of risks, for example - HCI Group has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of HCI Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.