EQB Leads Trio of Solid Canadian Dividend Stocks

Amidst a buoyant session for the Toronto stock market, where sectors such as tech and materials are gaining momentum, investors may find reassurance in the stability offered by dividend-paying stocks. In the current landscape, where the Bank of Canada holds interest rates steady amidst positive economic signals, a good dividend stock combines resilient performance with consistent payouts to shareholders.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

First National Financial (TSX:FN) | 6.60% | ★★★★★☆ |

Canadian Imperial Bank of Commerce (TSX:CM) | 5.43% | ★★★★★☆ |

Richards Packaging Income Fund (TSX:RPI.UN) | 3.95% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.79% | ★★★★★☆ |

IGM Financial (TSX:IGM) | 6.35% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.16% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.32% | ★★★★★☆ |

Savaria (TSX:SIS) | 3.09% | ★★★★★☆ |

Primo Water (TSX:PRMW) | 2.22% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

EQB (TSX:EQB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EQB Inc., operating primarily through its subsidiary Equitable Bank, offers a range of personal and commercial banking services to customers across Canada, with a market capitalization of approximately CA$3.23 billion.

Operations: EQB Inc. generates its revenue primarily from banking services, with a reported segment income of CA$1.12 billion.

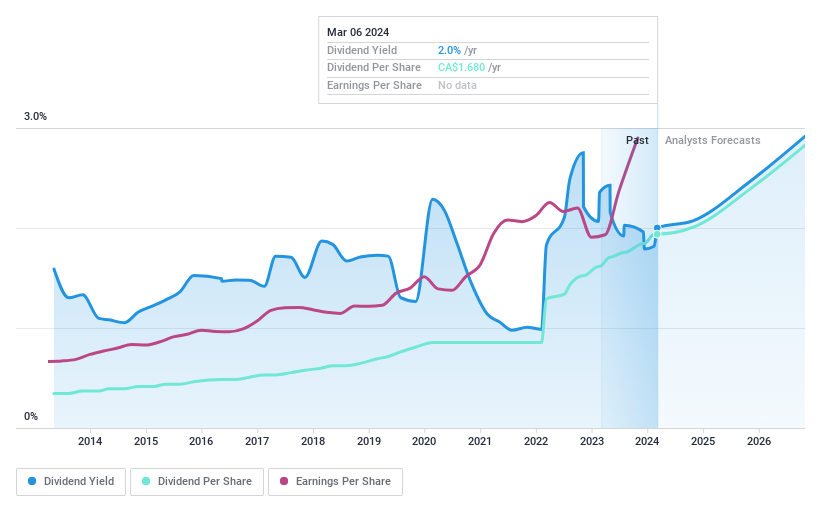

Dividend Yield: 2%

EQB Inc. reported robust earnings with a net income of CA$104.23 million and an EPS of CA$2.68, reflecting a 51.8% growth over the past year. Despite a low dividend yield of 2%, which trails the top Canadian dividend payers, EQB has demonstrated commitment to increasing shareholder value through consistent dividend hikes—20% year-over-year—and share repurchases, signaling confidence in its financial health and future prospects. Analyst consensus suggests potential stock price appreciation, while dividends are well-covered by earnings with a conservative payout ratio forecast to remain sustainable over the next three years.

Unlock comprehensive insights into our analysis of EQB stock in this dividend report.

Our valuation report unveils the possibility EQB's shares may be trading at a discount.

First National Financial (TSX:FN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First National Financial Corporation is a Canadian company specializing in the origination, underwriting, and servicing of commercial and residential mortgages with a market capitalization of approximately CA$2.40 billion.

Operations: First National Financial Corporation generates its revenue through the origination, underwriting, and servicing of both commercial and residential mortgages in Canada.

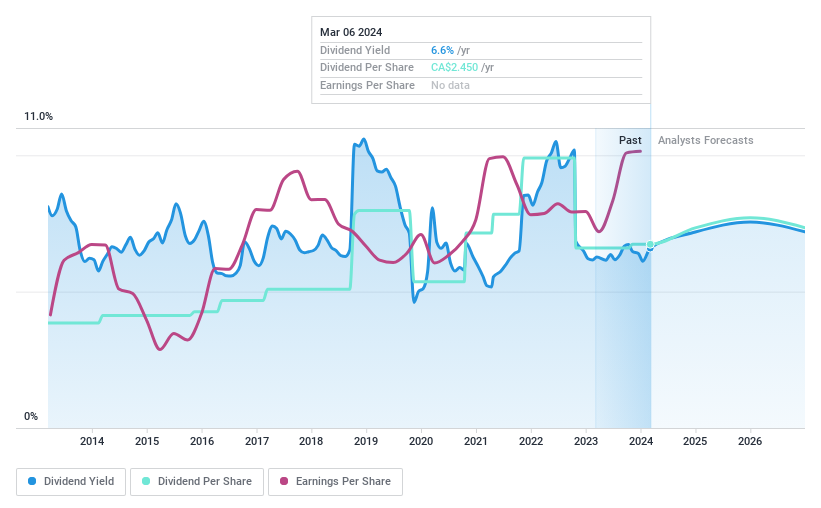

Dividend Yield: 6.6%

First National Financial Corporation showcased a notable increase in net income to CA$252.81 million, with a corresponding rise in basic EPS to CA$4.15. Despite a dividend yield of 6.6%—among the higher echelons in Canada—the payouts are challenged by limited cash flow coverage, though earnings cover the dividends with a payout ratio of 58.1%. The company has maintained dividend stability over a decade; however, debt is less comfortably serviced by operating cash flow, indicating potential financial stress points amid its dividend commitments.

Dive into the specifics of First National Financial here with our thorough dividend report.

Our valuation report here indicates First National Financial may be undervalued.

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$8.39 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from two core segments: Asset Management, which generated CA$1.18 billion, and Wealth Management, contributing CA$2.22 billion in revenues.

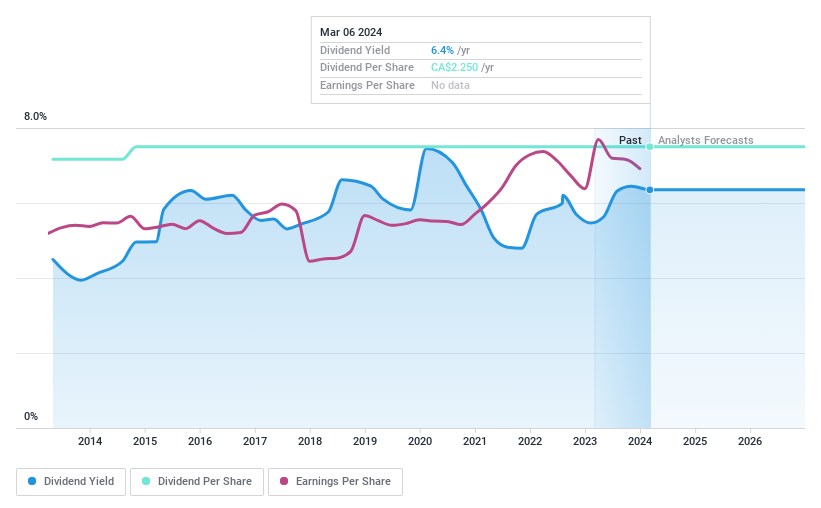

Dividend Yield: 6.4%

IGM Financial's recent earnings report reflects a solid year-over-year growth, with net income reaching CA$1.15 billion. The company has declared a forthcoming dividend of 56.25 cents per share, underscoring its commitment to shareholder returns amidst a stable decade-long dividend history. Although earnings are projected to dip slightly over the next three years, both earnings and cash flows adequately cover the current dividends, with payout ratios of 57.9% and 78.4%, respectively. However, IGM's yield is marginally lower than the top quartile of Canadian dividend payers.

Delve into the full analysis dividend report here for a deeper understanding of IGM Financial.

Upon reviewing our latest valuation report, IGM Financial's share price might be too pessimistic.

Next Steps

Discover the full array of 21 Top Dividend Stocks right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com