Equifax (EFX) Q4 Earnings Beat Estimates, Revenues Plunge Y/Y

Equifax Inc. EFX reported stellar fourth-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate.

Adjusted earnings (excluding 64 cents from non-recurring items) of $1.52 per share beat the Zacks Consensus Estimate by 2.7% but decreased 17.4% on a year-over-year basis.

Revenues of $1.2 billion beat the Zacks Consensus Estimate by 1.5% but decreased 4.4% year over year on a reported basis and 2% on a local-currency basis.

Let’s check out the numbers in detail.

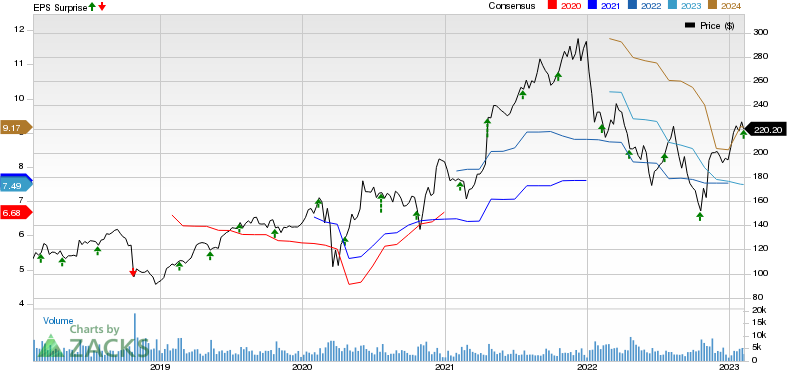

Equifax, Inc. Price, Consensus and EPS Surprise

Equifax, Inc. price-consensus-eps-surprise-chart | Equifax, Inc. Quote

Segmental Revenues

Revenues in the USIS division were $405.9 million, down 6% from the year-ago quarter’s level. Within the division, Online Information Solutions’ revenues of $308 million were down 2% from the year-ago quarter’s figure. Mortgage Solutions’ revenues of $26 million declined 36% year over year. Financial Marketing Services’ revenues were $71.9 million, down 9% year over year.

Revenues in the International division totaled $283.7 million, down 1% year over year on a reported basis and on a local-currency basis. The Asia Pacific revenues of $84.6 million fell 4% year over year on a reported basis but grew 6% on a local-currency basis.

Revenues from Europe amounted to $81.5 million, down 10% year over year on a reported basis but up 3% on a local-currency basis. Latin America revenues of $53.3 million grew 18% year over year on a reported basis and 31% on a local-currency basis. Canada revenues of $64.3 million were up 1% year over year on a reported basis and 7% on a local-currency basis.

Revenues in the Workforce Solutions segment totaled $508.4 million, down 4% from the year-ago quarter’s figure. Within the segment, Verification Services’ revenues of $398.6 million were down 7% year over year. Employer Services’ revenues of $109.8 million were up 5% year over year.

Operating Results

Adjusted EBITDA in the fourth quarter of 2022 totaled $371.1 million, down 8% from the year-ago quarter’s level. Adjusted EBITDA margin fell to 31% from 32.2% in the year-ago quarter.

Adjusted EBITDA margin for the USIS division was 35.3% compared with 39.4% in the year-ago quarter. Adjusted EBITDA margin for the International segment was 25.8% compared with 29.9% in the prior-year quarter. Workforce Solutions’ adjusted EBITDA margin was 46.8% compared with 48.4% a year ago.

Balance Sheet and Cash Flow

Equifax exited fourth-quarter 2022 with cash and cash equivalents of $285.2 million compared with $241.7 million at the end of the prior quarter. Long-term debt was $4.82 billion, comparatively flat from the year-ago quarter.

EFX utilized $325.4 million of cash from operating activities while capex was $156.1 million. Also, Equifax paid out dividends of $47.8 million to its shareholders in the reported quarter.

Q1 and Full-Year 2023 Guidance

For the first quarter of 2023, Equifax expects revenues between $1.27 billion and $1.29 billion. The midpoint of the guided range ($1.28 billion) meets the Zacks Consensus Estimate.

Adjusted EPS is anticipated in the range of $1.30-$1.40. The Zacks Consensus Estimate of $1.74 lies above the guided range.

For 2023, revenues are now expected between $5.275 billion and $5.375 billion. The Zacks Consensus Estimate of $5.22 billion lies below the guided range.

Adjusted EPS is now anticipated in the range of $7.05-$7.35. The Zacks Consensus Estimate of $7.49 exceeds the guidance.

Currently, Equifax carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots

Robert Half International Inc. RHI reported mixed fourth-quarter 2022 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed.

Quarterly earnings of $1.37 per share beat the Zacks Consensus Estimate by 1.5% but declined 9.3% year over year. Revenues of $1.73 billion missed the Zacks Consensus Estimate by 0.6% and decreased 2.4% year over year.

Automatic Data Processing, Inc. ADP reported better-than-expected second-quarter fiscal 2023 results.

Adjusted earnings per share of $1.96 beat the Zacks Consensus Estimate by 0.5% and grew 19% from the year-ago fiscal quarter’s reading. Total revenues of $4.4 billion beat the Zacks Consensus Estimate by 0.3% and improved 9.1% from the year-ago fiscal quarter’s reading on a reported basis and 10% on an organic constant-currency basis.

Booz Allen Hamilton Holding Corp. BAH reported impressive third-quarter fiscal 2023 results, with both earnings and revenues beating the respective Zacks Consensus Estimate. Quarterly adjusted earnings (excluding 84 cents from non-recurring items) per share of $1.07 beat the Zacks Consensus Estimate by 4.9% and increased 4.9% on a year-over-year basis.

Total revenues of $2.3 billion beat the Zacks Consensus Estimate by 4% and increased 12.1% on a year-over-year basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report