Equifax Inc (EFX) Reports Solid Revenue Growth in Q4 2023 Despite Mortgage Market Headwinds

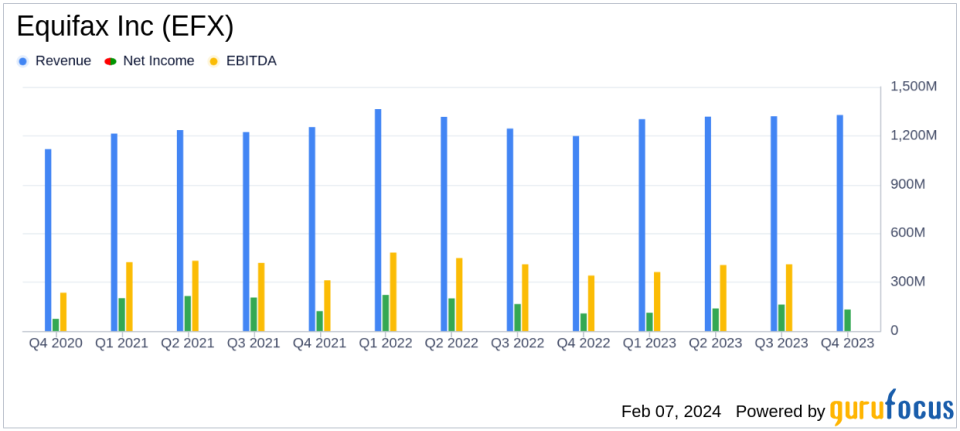

Revenue Growth: Q4 revenue increased by 11% to $1.327 billion, with a full-year uptick of 3% to $5.265 billion.

Net Income: Q4 net income rose to $132.4 million, with diluted EPS at $1.06, up from $0.88 in Q4 2022.

Workforce Solutions Performance: Exceptional Q4 with 27% non-mortgage Verification Services revenue growth.

International Expansion: Strong Q4 international revenue growth of 20% on a reported basis and 22% on a local currency basis.

2024 Guidance: Revenue expected to reach $5.720 billion, with an Adjusted EPS of $7.35.

Strategic Priorities: EFX2025 strategic priorities focus on leveraging new cloud capabilities and accelerating new product roll-outs.

On February 7, 2024, Equifax Inc (NYSE:EFX) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading credit bureau in the United States, reported a robust 11% increase in Q4 revenue to $1.327 billion, overcoming challenges in the mortgage market. The full-year revenue also saw growth, rising by 3% to $5.265 billion despite a 17% decline in mortgage revenue due to higher rates.

Equifax's Workforce Solutions segment, which accounts for a significant portion of its revenue, had a particularly strong quarter with a 10% revenue increase. This was bolstered by a 27% surge in non-mortgage Verification Services revenue, driven by growth in Government and Talent businesses. The US Information Solutions (USIS) segment also contributed with a 5% revenue growth, while the International segment reported a 20% increase on a reported basis and 22% on a local currency basis, with organic local currency revenue growth of 6%.

Financial Highlights and Challenges

Equifax's financial achievements in Q4 reflect the company's resilience in a challenging mortgage market. The 11% revenue growth and a 19% increase in Adjusted EPS to $1.81 per share are significant, considering the mortgage sector's downturn. The company's strategic focus on non-mortgage revenue streams, which now account for over 80% of total revenue, has paid off, with a 14% local currency revenue growth in this area.

However, the company is not immune to market conditions. The 17% decline in mortgage revenue in 2023, and the expected 16%+ decline in U.S. mortgage credit inquiries for 2024, pose challenges. Equifax's guidance for 2024 reflects these headwinds, although it also anticipates outperforming the U.S. mortgage market by about 24% across USIS and Workforce Solutions.

Strategic Priorities and Future Outlook

CEO Mark W. Begor highlighted the company's strong performance in line with the EFX2025 strategic priorities, despite the mortgage market's headwinds. He expressed confidence in the company's momentum entering 2024, with expectations of strong double-digit non-mortgage revenue growth. The completion of the cloud transformation and investments in new products, data, analytics, and AI capabilities are expected to drive growth in 2024 and beyond.

Equifax's 2024 guidance includes a midpoint expectation for revenue of $5.720 billion, up 8.6%, with non-mortgage local currency revenue growth expected to be over 10.5%. Adjusted EPS is projected at $7.35, reflecting organic revenue growth and additional cost savings from cloud spending reductions, as well as higher costs from the normalization of incentive plans.

For value investors and potential GuruFocus.com members, Equifax's latest earnings report and future guidance offer a promising outlook. The company's strategic initiatives and focus on innovation, coupled with its strong performance in non-mortgage segments, position it well for continued growth despite sector-specific challenges.

For more detailed financial information and the full earnings release, please refer to Equifax's 8-K filing.

Explore the complete 8-K earnings release (here) from Equifax Inc for further details.

This article first appeared on GuruFocus.