Equinix Inc (EQIX) Reports Robust Earnings Growth and Record Leasing Activity in 2023

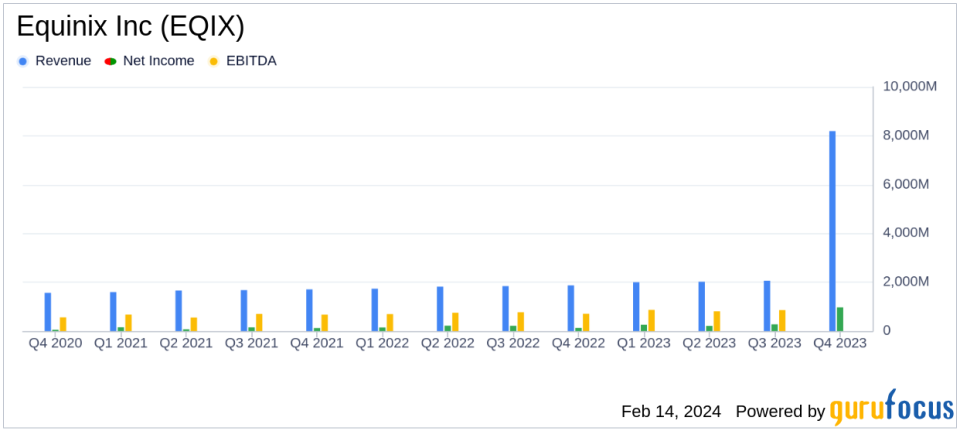

Revenue: Increased by 13% year-over-year to $8.188 billion in 2023.

Operating Income: Grew by 20% from the previous year to $1.443 billion.

Net Income: Jumped by 38% to $969 million, with EPS up by 34% to $10.31.

Adjusted EBITDA: Rose by 10% to $3.702 billion, representing a 45% margin.

AFFO: Increased by 11% to $3.019 billion, with AFFO per share up by 9% to $32.11.

2024 Guidance: Revenue projected to grow by 7-9% to between $8.793 - $8.893 billion.

On February 14, 2024, Equinix Inc (NASDAQ:EQIX) released its 8-K filing, detailing a year of significant financial growth and operational achievements. The company, a global leader in data center and colocation services, operates 248 data centers across 71 markets worldwide, serving a diverse customer base that spans various industries.

Fiscal Performance Highlights

Equinix's revenue growth is a testament to its consistent performance, with the company closing nearly 17,000 deals in 2023. A significant driver of this growth was the record 90 megawatts of xScale leasing, reflecting heightened demand for hyperscale infrastructure to support AI and cloud deployments.

The company's net income saw a substantial increase, primarily due to robust operating performance and other income, although this was partially offset by higher income taxes. Adjusted EBITDA and AFFO also saw healthy increases, with the latter exceeding the company's long-term expectations.

Strategic Developments and Future Outlook

Equinix's CEO and President, Charles Meyers, highlighted the company's strong year, emphasizing the importance of digital transformation and AI in driving demand for Equinix's services. He stated:

"2023 was another strong year for Equinixwe delivered more than $8 billion of revenues, achieving an amazing 21 years of consecutive quarterly revenue growth, all while driving AFFO per share performance above the top end of our long-term expectations."

The company continues to expand its global footprint, with 49 major builds underway, including new data centers and the expansion of existing ones. Equinix's commitment to sustainability is also evident, with significant progress toward its goal of becoming climate neutral by 2030.

Financial Statements Analysis

Equinix's balance sheet remains strong, with a significant increase in cash and cash equivalents to $2.095 billion. The company's property, plant, and equipment net also grew, reflecting ongoing investments in infrastructure to support growth.

The cash flow statements show that net cash provided by operating activities increased, allowing the company to invest in its expansion efforts. However, there was a notable increase in cash used in investing activities, primarily due to purchases of property, plant, and equipment.

Investor Considerations

For value investors, Equinix's consistent revenue growth, robust operating margin, and strong adjusted EBITDA margin are key indicators of the company's financial health and efficiency. The increase in AFFO per share is particularly relevant for REIT investors, as it reflects the company's ability to generate cash flow from its operations.

Equinix's forward-looking guidance suggests continued confidence in its business model, with projected revenue and AFFO growth in 2024. This guidance, coupled with the company's strategic investments and commitment to sustainability, positions Equinix as a compelling investment opportunity for those interested in digital infrastructure and real estate investment trusts.

For a more detailed analysis and to stay updated on Equinix Inc's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Equinix Inc for further details.

This article first appeared on GuruFocus.