Equinor (EQNR) Achieves First Oil From Peregrino C Platform

Equinor ASA EQNR achieved the first oil from the Peregrino phase 2 project in Brazil.

Located in the Campos Basin, Peregrino is the largest field operated by Equinor outside of Norway. Peregrino phase 2 produced oil through a new wellhead platform and drilling rig, Peregrino C.

Peregrino is the first of several major field developments in Brazil. Equinor operates the Peregrino field with a 60% interest.

Peregrino phase 2 involves a new platform with drilling facilities and living quarters tied to the existing Peregrino FPSO. The new platform will offer 350 long-term jobs offshore and onshore in Brazil. The project also involved a new pipeline for importing gas to the Peregrino C platform for power generation.

In April 2020, production at the Peregrino offshore field was suspended after detecting a ruptured water-injection riser during a leak test. Since then, Equinor has carried out a major program of maintenance, upgrades and repairs on the FPSO vessel. Equinor began producing oil from the Peregrino field last July after more than two years since production was suspended.

Equinor made significant investments to reduce carbon dioxide emissions from the Peregrino field, in line with its low-carbon strategy. Phase 2 is expected to lower absolute emissions by 100,000 tons of carbon dioxide per year from the field.

The Peregrino phase 2 project will likely extend the offshore field’s life and add 250-300 million barrels of oil. Despite the covid-related challenges, the phase 2 project was accomplished within the original cost estimates of $3 billion.

The commencement of Peregrino Phase 2 is a major step in Equinor’s growth strategy in Brazil. The project enables the company to bring valuable new resources into production, while investing in technology to reduce emissions. Notably, Peregrino Phase 2 will increase field production to 110,000 barrels per day at the plateau and reduce its emission intensity by 50%.

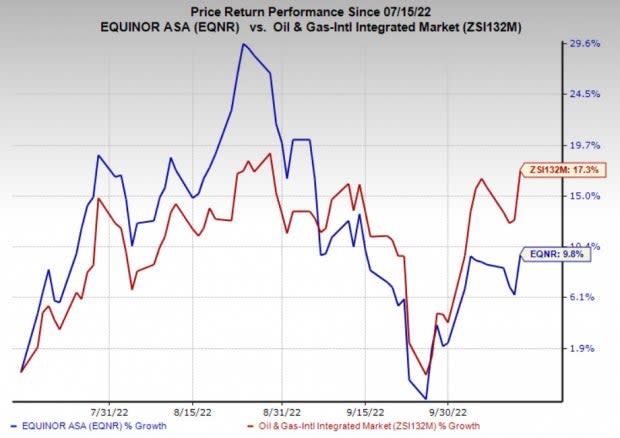

Price Performance

Shares of Equinor have underperformed the industry in the past three months. The stock has gained 9.8% compared with the industry’s 17.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Equinor currently carries a Zack Rank #2 (Buy).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty Energy LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s debt-to-capitalization stands at just 16% compared with many of its peers, which are hugely burdened with debts, accounting for around 50% of their total capital structure.

Liberty Energy has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days. The company currently has a Zacks Style Score of A for Growth and B for Value. LBRT is expected to see an earnings surge of 272.6% in 2022.

Exxon Mobil Corporation XOM is one of the leading integrated energy companies in the world. At the end of second-quarter 2022, XOM’s total cash and cash equivalents were $18.9 billion, and long-term debt was $39.5 billion. The firm has significantly lower debt exposure than other integrated majors.

ExxonMobil has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company has a Zacks Style Score of A for Growth and Momentum, and B for Value. XOM is expected to see earnings growth of 144.2% for 2022.

EQT Corporation EQT is a pure-play Appalachian explorer, which is one of the largest natural gas producers in the United States. For 2022, the company expects a free cash flow of $2.2-$2.5 billion, suggesting an increase from $934.7 million reported last year.

EQT Corp has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company has a Zacks Style Score of B for Growth. EQT is expected to see earnings growth of 369.6% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

EQT Corporation (EQT) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research