Equinor (EQNR) Acquires Minority Interest in Bayou Bend Project

Equinor ASA EQNR announced that it acquired a 25% interest in the Bayou Bend project across the Gulf Coast in Southeast Texas.

Bayou Bend is set to become one of the largest carbon capture and storage (“CCS”) projects in the United States. The project has gross potential storage resources of more than one billion metric tons.

Bayou Bend is Equinor’s first announced low-carbon solutions project on the Gulf Coast. It covers 100,000 gross acres onshore in Chambers and Jefferson Counties, and 40,000 gross acres offshore Beaumont and Port Arthur.

Texas Gulf Coast generates 100 million metric tons of carbon dioxide per year. The project’s site near major industrial zones will offer potential decarbonization options for industries like refining, cement, steel, chemicals and manufacturing. Notably, commercial CCS solutions are crucial for hard-to-abate industries to achieve net-zero emissions.

Due to the growing urgency from investors and environmentalists to curb climate change, creating a more reliable roadmap to energy transition is necessary to address climate priorities and energy security challenges for a secure and sustainable energy future.

Oil and gas companies are getting actively involved in CCS projects, as those offers a transition pathway for the rapid and effective reduction of CO2 emissions beyond what can be achieved by alternative methods like electrification and renewable fuels. Thus, the use of CCS in reducing industrial emissions offers an excellent opportunity.

Although Equinor generated significant profits this year, its renewable business incurred losses in the first half of 2023. The project supports the company’s low-carbon solutions portfolio, and its plans to mature and develop 15-30 million tons of equity carbon dioxide transport and storage capacity per year by 2035.

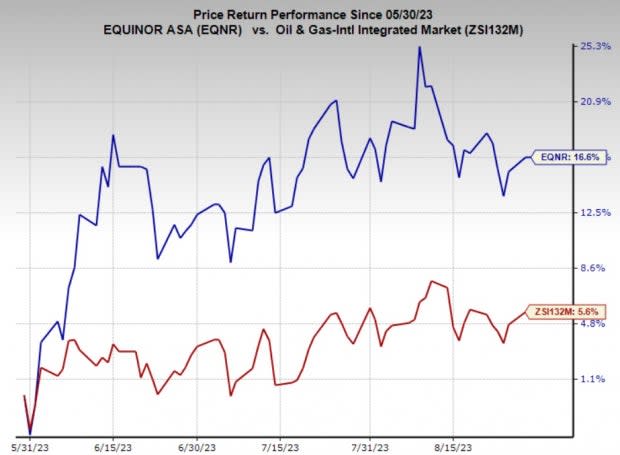

Price Performance

Shares of EQNR have outperformed the industry in the past three months. The stock has gained 16.6% compared with the industry’s 5.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #4 (Sell).

Some better-ranked players in the energy sector are USA Compression Partners, LP USAC, currently sporting a Zacks Rank of 1 (Strong Buy), and Global Partners GLP and Evolution Petroleum Corporation EPM, carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners is one of the largest independent natural gas compression services providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 55 cents, respectively.

Global Partners is a leading operator of gasoline stations and convenience stores. Over the past 60 days, GLP has witnessed upward earnings estimate revisions for 2023 and 2024, respectively.

The Zacks Consensus Estimate for Global Partners’ 2023 and 2024 earnings per share is pegged at $3.46 and $3.69, respectively. GLP currently has a Zacks Style Score of A for Value and Growth.

Evolution Petroleum is an independent energy company. EPM has a Zacks Style Score of A for Growth and B for Value.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Global Partners LP (GLP) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report