Equinor (EQNR) Acquires Poland Wind Farm From Helios Group

Equinor ASA EQNR announced that it acquired an onshore wind farm in Poland from the Helios Group.

The 26-megawatt Wilko wind farm is situated in the Wielkopolska province. It will be operated by Wento, a Polish subsidiary of Equinor. Wento is a developer of solar, wind and energy storage projects in Poland.

Through Wento, Equinor developed a strong solar portfolio in Poland. The latest acquisition will add to Wento’s portfolio of operated assets and transform it into a multi-tech power producer.

The acquisition broadens Equinor’s renewable energy portfolio in Poland and delivers on its market-driven power production strategy. Notably, Equinor expects the wind farm to provide immediate production and cash flow.

Equinor estimates the accumulated power generation from the acquired wind farm to be 105-gigawatt hours per year. This is equivalent to the electricity requirement of 50,000 Polish households.

Equinor’s energy trading house, Danske Commodities, will be responsible for selling the produced energy in the Polish power market. Danske Commodities has more than 10 years of experience in the Poland power market.

To combat climate change and capitalize on the rising clean energy demand, Equinor is actively investing in renewable energy projects, comprising power generation from solar and wind energy.

With the latest agreement, Equinor further expands its extensive energy offer in Poland, which includes gas supply through the Baltic Pipe, massive offshore wind projects, solar power and now onshore wind.

Poland’s energy production is overpowered by conventional sources, with coal being the largest share. The latest deal highlights Equinor’s pledge to support the country’s energy transition and decarbonization goals.

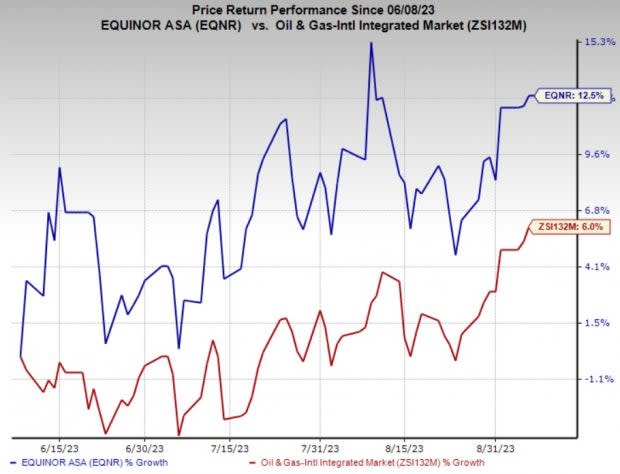

Price Performance

Shares of EQNR have outperformed the industry in the past three months. The stock has gained 12.5% compared with the industry’s 6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Core Laboratories N.V.’s CLB strong presence in the emerging shale plays and its global footprint will provide for steady growth rates, going forward. CLB’s technology-heavy portfolio of proprietary products and services gives it the opportunity to optimize production from new and existing fields.

Core Labs has witnessed upward earnings estimate revision for 2023 and 2024 in the past 30 days. The consensus estimate for CLB’s 2023 and 2024 earnings per share is pegged at 88 cents and $1.17, respectively.

Global Partners GLP is a leading operator of gasoline stations and convenience stores. Over the past 60 days, GLP has witnessed upward earnings estimate revisions for 2023 and 2024, respectively.

The Zacks Consensus Estimate for Global Partners’ 2023 and 2024 earnings per share is pegged at $3.46 and $3.69, respectively. GLP currently has a Zacks Style Score of A for Value and Growth.

Evolution Petroleum Corporation EPM is an independent energy company. EPM has a Zacks Style Score of A for Growth and B for Value.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Global Partners LP (GLP) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report