Equinor (EQNR) Commences Production From Norway's Bauge Field

Equinor ASA EQNR commenced production from the Bauge subsea field in the southern Norwegian Sea.

Bauge is one of two satellite development projects planned to feed into the recently upgraded Njord facilities. The Bauge satellite project came online after delaying for more than a year.

The Bauge field is tied back to the Njord platform, with estimated recoverable reserves of 50 million barrels of oil equivalent. The Bauge field involves two oil producers in a subsea template, pipelines and an umbilical connecting the wells to the Njord A platform. Equinor operates the field with a 42.5% interest.

Bauge was discovered in 2013. The plan for the field’s development and operation was approved in June 2017. The Norwegian content of the Bauge project is well more than 90%. The project was delivered within the budget of NOK 4.6 billion.

Oil produced from the Bauge field is carried from the Njord A platform to the Njord Bravo floating storage and offloading unit. From there, it is transported to the market by tankers. Then again, the gas from the field is supplied to the Asgard Transport System through a pipeline from Njord A to the Karsto terminal.

After six years of upgradation activities, Equinor resumed production at the Njord field at the end of 2022. The upgrade was initially expected to be completed two years ago. However, it has turned out to be more challenging than expected partly due to the pandemic.

Per Equinor, Njord will produce for another 20 years, intending to produce another 250 million barrels of oil equivalent over the field’s lifetime. Notably, Bauge shows how a minor discovery can become a profitable development.

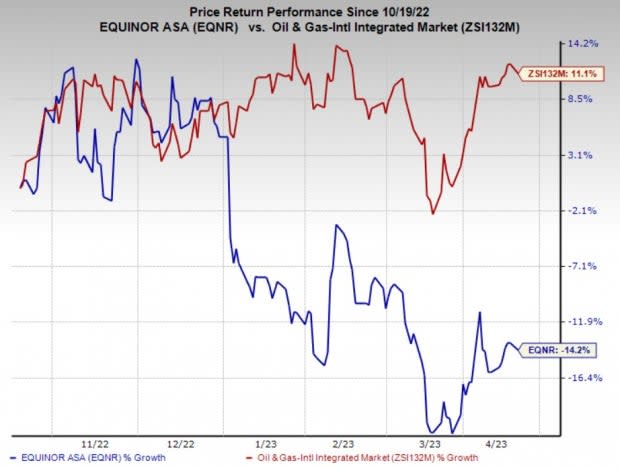

Price Performance

Shares of EQNR have underperformed the industry in the past six months. The stock has declined 14.2% against the industry’s 11.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Products Partners’ EPD fourth-quarter 2022 adjusted earnings per limited partner unit of 65 cents beat the Zacks Consensus Estimate of 60 cents. Strong quarterly earnings were driven by higher contributions from the NGL, and Natural Gas Pipelines & Services businesses.

Enterprise Products Partners is strongly committed to returning cash to shareholders. EPD’s board of directors increased its cash distribution to 49 cents per unit, suggesting a 3.2% hike from the last paid-out distribution of 47.5 cents.

Dril-Quip Inc.’s DRQ fourth-quarter adjusted earnings of 6 cents per share beat the Zacks Consensus Estimate of a loss of 4 cents. Strong quarterly earnings were supported by an increase in product bookings due to improving market conditions.

For 2023, the company expects adjusted EBITDA to improve at 40-50% incremental margins, depending on the booking mix during the year. Also, DRQ’s balance sheet is free of debt load, which highlights its sound financial position.

Sunoco LP’s SUN fourth-quarter 2022 earnings of 42 cents per unit missed the Zacks Consensus Estimate of 77 cents. Weak quarterly earnings resulted from the higher total cost of sales and operating expenses.

Sunoco has witnessed upward estimate revisions for 2023 earnings in the past 30 days. For 2023, Sunoco expects adjusted EBITDA of $850-$900 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Dril-Quip, Inc. (DRQ) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report