Equinor (EQNR) Completes Divestment of Statfjord Stake to OKEA

Equinor ASA EQNR has concluded the divestment of a 28% operating interest in PL037, encompassing the Statfjord area, to fellow Norwegian oil and gas company OKEA.

The transaction, valued at $220 million, includes a contingent payment component dependent on oil and gas prices over the next three years. The move is part of Equinor’s long-term portfolio optimization strategy and commitment to high-grading its assets.

Details of the Transaction

Equinor retains a 78.6% operating interest in the Statfjord Unit, with the remaining 3.4% held by Var Energi. Post-transaction, the company will continue to operate the Statfjord field, holding a 54.7% working interest in collaboration with OKEA. The Statfjord area comprises the Statfjord Unit, Statfjord Ost Unit, Statfjord Nord and Sygna Unit, with OKEA acquiring significant stakes in each.

OKEA’s Acquired Stakes

Per the deal, OKEA secures a 23.93% stake in the Statfjord Unit, a 28% stake in Statfjord Nord, a 14% stake in the Statfjord Ost Unit, and a 15.4% stake in the Sygna Unit. The acquisitions strategically position OKEA in the key units within the Statfjord area, enhancing its presence in the Norwegian oil and gas sector.

Transaction Timeline and Postponement

Announced in March 2023, the transaction was expected to complete by the end of 2023. However, OKEA postponed the acquisition’s finalization after Equinor’s 2024 updated projections for the Statfjord area revealed a 10-15% reduction in volumes over the assets’ lifetime, coupled with an increase in costs. The volume reduction primarily stems from production regularity and well performance, particularly in the near term.

OKEA’s Decision to Proceed

Despite the challenges presented by the revised projections, OKEA decided to proceed with the transaction. In acknowledgment of the changed circumstances, OKEA recognized an impairment ranging from $108 million to $157 million in its financial statements for the fourth quarter of 2023.

Initial Asset Estimates and Future Plans

The acquired assets were initially estimated to possess net 2P reserves of 41 MMboe and net 2C resources of 8 MMboe, with an additional upside potential of 14 MMboe identified by OKEA through drilling beyond 2028 and cost-reduction initiatives. The acquisition was anticipated to contribute 13,000-15,000 boepd in 2023 and grow to 16,000-20,000 boepd in 2024.

Equinor's Strategic Vision

Equinor remains committed to the Statfjord region's diversification and high value-creation in the years to come. By developing innovative approaches, the company aims to extend the field's lifetime until 2040 and reduce emissions by 50% by 2030. The transaction, coupled with recent acquisitions from Wellesley in Norway, underscores Equinor's commitment to long-term portfolio optimization and high grading.

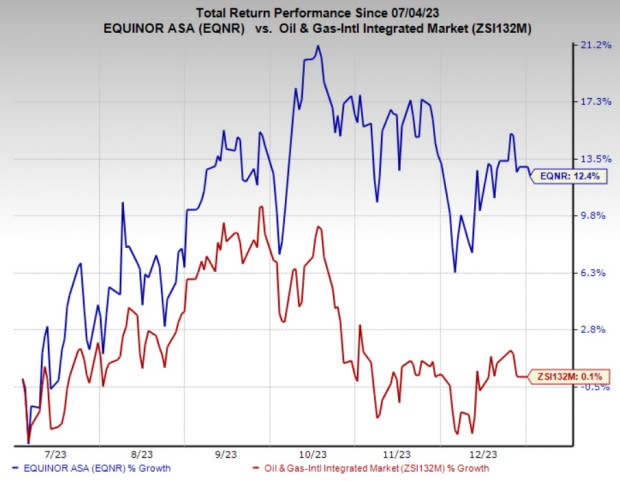

Price Performance

Shares of Equinor have outperformed the industry in the past six months. The stock has gained 12.4% compared with the industry’s 0.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Equinor carries a Zack Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cenovus Energy Inc. CVE is a leading integrated energy firm. The Zacks Consensus Estimate for CVE’s 2023 and 2024 earnings per share (EPS) is pegged at $1.69 and $2.37, respectively.

Cenovus stands out in terms of financial stability compared with its industry peers, maintaining a stronger balance sheet. This is evident through its consistently lower debt-to-capitalization ratio, which remains at 20%.

Sunoco LP SUN is among the biggest motor fuel distributors in the U.S. wholesale market in terms of volume. The Zacks Consensus Estimate for SUN’s 2023 and 2024 EPS is pegged at $5.19 and $3.83, respectively.

Sunoco has a core competency in terms of its history of disciplined expense management. Over the past few years, it has demonstrated a remarkable ability to control total operating expenses, with an annual growth rate of only around 2% since 2019.

The Williams Companies WMB is a premier energy infrastructure provider in North America. WMB has a thriving deepwater transportation business. The company’s deepwater portfolio includes a 3,500-mile natural gas and oil gathering and transmission pipeline, and is important for future cash flows.

WMB’s debt maturity profile is in good shape, with its $4.5-billion revolver maturing in 2023. It is also paying shareholders an attractive dividend yielding around 5%. Beside this, the company has a share repurchase program worth $1.5 billion, highlighting its commitment to shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report