Equinor (EQNR) Extends Drilling Contracts Worth NOK $18.4B

Equinor ASA EQNR has reinforced its commitment to the Norwegian Continental Shelf by extending contracts for four years with three major drilling service providers.

The agreements with Archer, KCA Deutag Drilling Norway and Odfjell Operations, estimated to be worth NOK 18.4 billion ($1.75 billion), promise to sustain employment and operational continuity in the region.

The four-year extensions are pivotal for the energy sector, ensuring job retention for 2,000 individuals each year, with additional employment opportunities created through subcontracting. The contracts span a diverse array of installations, highlighting the strategic importance of these collaborations in maintaining Norway’s offshore energy infrastructure.

Covering 19 platforms, the contracts delineate service delivery in drilling, completion, intervention, plugging, maintenance and modification. The platforms under these agreements include notable installations such as Grane; Gullfaks A, B, and C; Heidrun; and the significant Johan Sverdrup field.

Initially sealed in 2018, these contracts featured three optional two-year extensions, with the first exercised in 2022. The recent decision to activate the remaining options underscores Equinor’s confidence in its partners, extending the working relationship until at least October 2028.

The renewed contracts not only signify a substantial financial investment but also reflect a strategic choice to promote operational efficiency, safety improvements and energy management. Equinor's selective approach, through a limited competition assessing technical and commercial criteria, has led to some redistribution among suppliers for four of the 19 platforms, optimizing the partnership landscape.

The latest development is a testament to the robustness of Norway's offshore drilling sector and its pivotal role in the broader energy market. Equinor's proactive engagement with experienced service providers fortifies the industry's foundation, promising continued energy production and technological advancement.

As Equinor and its partners navigate the complexities of offshore drilling, their collective efforts are set to sustain the vitality of the Norwegian Continental Shelf's energy production for years to come, bolstering the local economy and securing energy supplies in the challenging maritime frontier.

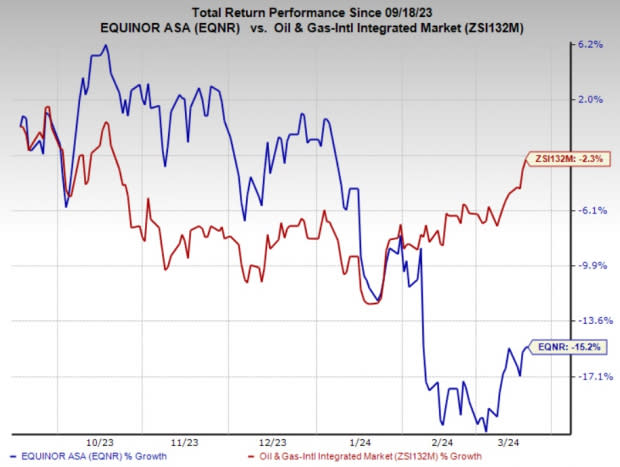

Price Performance

EQNR shares have underperformed the industry in the past six months. The stock has lost 15.2% compared with the industry’s 2.3% decline.

Image Source: Zacks Investment Research

Zacks Ranks & Stocks to Consider

Equinor currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked companies mentioned below. The three companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RPC Inc. RES derives strong and stable revenues from diverse oilfield services that include pressure pumping, coiled tubing and rental tools. In 2023, the company paid out $34.6 million in dividends, whereas share repurchases totaled $21.1 million.

The Zacks Consensus Estimate for RPC’s 2024 and 2025 earnings per share (EPS) is pegged at 88 cents and $1.13, respectively. The company has a Zacks Style Score of A for Growth and Value.

Murphy USA Inc. MUSA is a leading independent retailer of motor fuel and convenience merchandise in the United States.

The Zacks Consensus Estimate for MUSA’s 2024 and 2025 EPS is pegged at $25.58 and $25.36, respectively. The company has a Zacks Style Score of B for Value and A for Growth. It has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

Energy Transfer ET is a publicly traded limited partnership focused on diverse energy assets in the United States. The company’s core operations involve natural gas midstream services, transportation, storage, crude oil facilities and marketing assets.

The Zacks Consensus Estimate for ET’s 2024 EPS is pegged at $1.44. The company has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ET’s 2024 earnings are expected to rise 32.1% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report