Equinor (EQNR) Gets Permit to Use Drilling Rig at Norway Field

Equinor ASA EQNR received approval from the Norway offshore safety regulator to use a semi-submersible rig for production drilling at the North Sea field.

The approval received involves production drilling activities, including plugging and abandonment operations. It also involves the completion of two wells, M-1 BH on Statfjord Ost and F-4 CH on Statfjord Nord.

Developed in 2012, the COSL Promoter is a semi-submersible drilling rig designed to operate up to 750 meters below the water surface. It is owned by the drilling contractor COSL Drilling.

Statfjord is an offshore oil and gas field that straddles the Norwegian and British continental shelves. The field is situated in the Tampen area of the northern North Sea. Statfjord has been producing oil and natural gas for more than 40 years.

The submersible drilling rig will be central to Equinor’s upstream activities, thereby supporting its operations at the Statfjord Ost and Statfjord Nord fields. This will contribute to the company’s energy endeavors in the region.

Discovered in 1977, Statfjord Nord has been developed with two production templates and one water injection template tied back to the Statfjord C platform. Production from the field began in 1995.

Then again, the Statfjord Ost field has been developed with two subsea production templates and one water injection template tied back to the Statfjord C platform. Beside this, two production wells have been drilled from the Statfjord C platform. The field started producing in 1994.

Equinor’s endeavors to improve the recovery of resources in mature fields are commendable. The company has operations across all major hydrocarbon-producing regions of the world, with a strong focus on the Norwegian Continental Shelf.

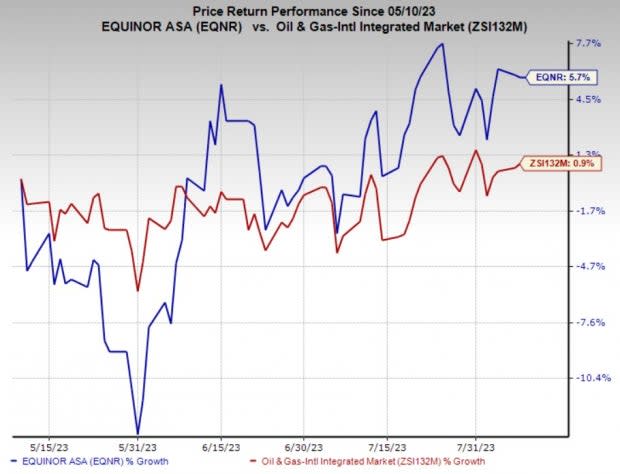

Price Performance

Shares of Equinor have outperformed the industry in the past three months. The stock has gained 5.7% compared with the industry’s 0.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Equinor currently flaunts a Zack Rank #1 (Strong Buy).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Baker Hughes Company BKR reported second-quarter 2023 adjusted earnings of 39 cents per share, beating the Zacks Consensus Estimate of 32 cents. Strong quarterly results were primarily driven by higher contributions from the Oilfield Services and Equipment, and Industrial & Energy Technology business units.

For 2023, Baker Hughes expects revenues of $24.8-$26 billion. The company projects revenues of $6.4-$6.6 billion for the third quarter.

Crestwood Equity Partners LP CEQP reported second-quarter 2023 adjusted earnings of $1.16 per unit, surpassing the Zacks Consensus Estimate of 26 cents. Strong quarterly earnings resulted from fantastic contributions from the Storage and Logistics business unit.

For this year, the partnership projects adjusted EBITDA of $780-$860 million.

Oceaneering International OII reported a second-quarter 2023 adjusted profit of 18 cents per share, which missed the Zacks Consensus Estimate of 30 cents. This underperformance was due to a lower-than-expected operating income from the Subsea Robotics and Manufactured Products segments.

For 2023, Oceaneering projects consolidated EBITDA of $2275-$310 million and a continued free cash flow generation of $90-$130 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Crestwood Equity Partners LP (CEQP) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report