Equinor (EQNR) Q3 Earnings Lag Estimates, Revenues Fall Y/Y

Equinor ASA EQNR reported third-quarter 2023 adjusted earnings per share of 92 cents, which missed the Zacks Consensus Estimate of 97 cents. The bottom line also declined from the year-ago quarter’s level of $2.12.

Total quarterly revenues declined to $26,024 million from $43,633 million recorded in the prior-year quarter. The top line also missed the Zacks Consensus Estimate of $54,117 million.

Weak quarterly earnings can be attributed to reduced production volumes and lower prices of liquids and gas in Norway.

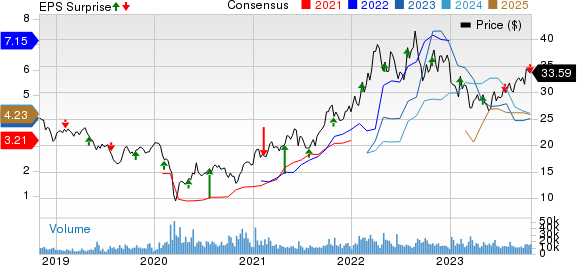

Equinor ASA Price, Consensus and EPS Surprise

Equinor ASA price-consensus-eps-surprise-chart | Equinor ASA Quote

Segmental Analysis

Exploration & Production Norway (E&P Norway): The segment reported adjusted earnings of $6,087 million, down 71% from $21,079 million registered in the year-ago quarter. Lower gas production, coupled with a sharp decline in gas prices, affected the segment.

The company’s average daily production of liquids and gas declined 6% year over year to 1,283 thousand barrels of oil equivalent per day (MBoe/d). The figure also missed our estimate of 1,388.3 MBoe/d. The underperformance resulted from the shutdown of Hammerfest LNG and a delayed start-up after a turnaround on the Troll-A platform and the third-party-operated Nyhamna gas processing facility. This impacted the production of natural gas-producing assets.

E&P International: The segment’s adjusted operating profit totaled $809 million, down 14% from the year-ago quarter’s level of $942 million. Lower liquids and gas prices primarily affected the segment.

The average daily equity production of liquids and gas increased to 355 MBoe/d from 324 MBoe/d in the year-ago quarter and surpassed our estimate of 263 MBoe/d. The segment was aided by the restart of production at Brazil’s Peregrino field and the positive contribution from Buzzard field in the U.K. following the Suncor acquisition in July 2023.

E&P USA: Through the segment, Equinor generated an adjusted quarterly profit of $343 million, down 61% from $889 million recorded in the September-end quarter of 2022. The segment was affected by a natural decline in the Appalachian basin and several mature fields in the Gulf of Mexico.

The integrated firm’s average equity production of liquids and gas was 369 MBoe/d, up from 329 MBoe/d in the year-ago quarter. The metric was also above our projection of 293.2 MBoe/d. The segment was aided by the ongoing increase in production from the partner-operated Vito field in the U.S. Gulf of Mexico.

Marketing, Midstream & Processing: The segment reported adjusted earnings of $876 million, down 46% from $1,623 million reported a year ago.

Renewables: The segment reported an adjusted loss of $108 million, wider than a reported loss of $46 million in the year-ago quarter. Lower prices and higher costs from projects under development primarily hurt the segment.

Free Cash Flow

In the September-end quarter, Equinor generated a negative free cash flow of $1,479 million against a free cash flow of $2,402 million in the year-ago period. The underperformance resulted from declining operating cash flows.

Balance Sheet

As of Sep 30, 2023, Equinor reported $14,420 million in cash and cash equivalents. The company’s long-term debt was $24,488 million.

2023 Outlook

Equinor’s projections for 2023 production growth went down to 1.5% from the previously estimated 3%.

The company reiterated its organic capital spending budget of $10-11 billion for the year. For the 2024-2026 period, the oil major expects average organic capital spending of $13 billion per annum.

Zacks Rank & Stocks to Consider

Equinor currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy sector are Liberty Energy Inc. LBRT and Matador Resources Company MTDR, both currently sporting a Zacks Rank #1 (Strong Buy), and APA Corporation APA carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty reported third-quarter 2023 earnings of 85 cents per share, which beat the Zacks Consensus Estimate of 74 cents. The Denver-CO-based oil and gas equipment company’s outperformance reflects the impacts of strong execution and increased service pricing.

Liberty’s board of directors announced a cash dividend of 7 cents per common share, payable on Dec 20, 2023, to stockholders of record as of Dec 6, 2023. The dividend increased 40% from the previous quarter’s level.

Matador Resources reported third-quarter 2023 adjusted earnings of $1.86 per share, which beat the Zacks Consensus Estimate of $1.59. MTDR’s milestone led to better-than-expected third-quarter results, with the highest-ever total production averaging more than 135,000 barrels of oil and natural gas equivalent per day.

For the fourth quarter of 2023, MTDR expects an average daily oil equivalent production of 145,000 BOE. The recent guidance indicates a 2% upward revision from the previously mentioned 143,000 BOE/D.

APA released supplemental information regarding its financial and operational results for the third quarter of 2023. The company expects its quarterly total adjusted production and adjusted oil production to be in the upper half of its guidance range. This can be mainly attributed to strong Permian oil and U.K. North Sea volumes.

APA expects adjusted production and adjusted oil production figures to fall within the upper half of its guided range. The company anticipates adjusted production in the range of 337-339 Mboe/d and adjusted oil production in the band of 159-161 Mboe/d. It is scheduled to release third-quarter results on Nov 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APA Corporation (APA) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report