Equinor (EQNR) Q4 Earnings Miss Estimates, Revenues Beat

Equinor ASA EQNR reported fourth-quarter 2023 adjusted earnings per share of 64 cents, which missed the Zacks Consensus Estimate of $1.08. The bottom line also declined from the year-ago quarter’s $1.84.

Total quarterly revenues declined to $29,054 million from $34,321 million in the prior-year quarter. However, the top line beat the Zacks Consensus Estimate of $27,351 million.

Weak quarterly earnings can be attributed to lower prices of liquids and gas in Norway.

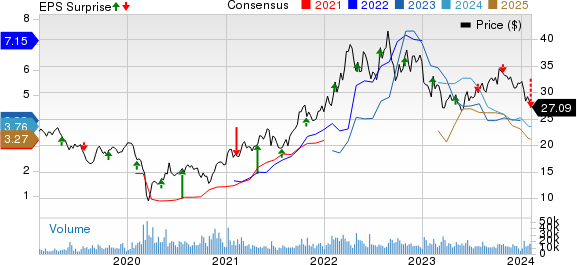

Equinor ASA Price, Consensus and EPS Surprise

Equinor ASA price-consensus-eps-surprise-chart | Equinor ASA Quote

Segmental Analysis

Exploration & Production Norway (E&P Norway): The segment reported adjusted earnings of $7,571 million, down 48% from the $14,594 million registered in the year-ago quarter. Lower prices of liquids and gas affected the segment.

The company’s average daily production of liquids and gas increased 4% year over year to 1,464 thousand barrels of oil equivalent per day (MBoe/d). The figure also beat our estimate of 1,439 MBoe/d. The strong performance was attributed to consistent high production levels and operational efficiency at Johan Sverdrup, along with the early commencement of production at the Breidablikk field. These factors compensated for the natural decline experienced in several fields and the unexpected extension of turnaround activities at Troll C.

E&P International: The segment’s adjusted operating profit totaled $690 million, up 2% from the year-ago quarter’s $676 million. Higher liquids and gas production primarily aided the segment.

The average daily equity production of liquids and gas increased to 362 MBoe/d from 343 MBoe/d in the year-ago quarter and surpassed our estimate of 357 MBoe/d. The production results can primarily be attributed to the Peregrino field achieving plateau production in the fourth quarter, coupled with the 2023 production. Additionally, positive contributions from the Buzzard field in the U.K., following the Suncor acquisition in July 2023, and a notable decrease in turnaround effects in the fourth quarter further increased the overall production level.

E&P USA: Through the segment, Equinor generated an adjusted quarterly profit of $168 million, down 65% from $474 million in the December-end quarter of 2022. The segment was affected by a natural decline in several assets.

The integrated firm’s average equity production of liquids and gas was 372 MBoe/d, up from 302 MBoe/d in the year-ago quarter. The metric was also above our projection of 352 MBoe/d. The ramp-up of the Vito field, which commenced production earlier in 2023, contributed significantly to the rise. Additionally, the Caesar Tonga field experienced an uptick in production subsequent to the installation of new flowlines, which were put into service in late 2022. The introduction of new wells in the Appalachia basin further bolstered production from this region.

Marketing, Midstream & Processing: The segment reported adjusted earnings of $424 million, down 70% from $1,416 million a year ago.

Renewables: The segment reported an adjusted loss of $179 million, wider than a reported loss of $87 million in the year-ago quarter. Lower prices and higher costs from projects under development primarily hurt the segment.

Free Cash Flow

In the December-end quarter, Equinor generated a negative free cash flow of $3,262 million against a free cash flow of $1,669 million in the year-ago period. The underperformance resulted from declining operating cash flows.

Balance Sheet

As of Dec 31, 2023, Equinor reported $9,641 million in cash and cash equivalents. The company’s long-term debt was $24,520 million.

Outlook

Equinor forecasts stable oil and gas production for 2024. Additionally, it anticipates doubling its annual power production from renewable sources from that reported in 2023.

The company revealed its organic capital spending budget of $13 billion for the year.

Zacks Rank & Stocks to Consider

Equinor currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following company that presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Subsea 7 S.A. SUBCY helps build underwater oil and gas fields. It is a top player in the Oil and Gas Equipment and Services market, which is expected to grow as oil and gas production moves further offshore.

The Zacks Consensus Estimate for SUBCY’s 2024 EPS is pegged at 79 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. SUBCY’s 2024 earnings are expected to soar 163.3% year over year.

Vaalco Energy EGY is an independent energy company principally engaged in the acquisition, exploration, development, and production of crude oil and natural gas.

The Zacks Consensus Estimate for EGY’s 2024 EPS is pegged at $1.49. It has witnessed upward earnings estimate revisions for 2024 in the past 60 days. The company’s earnings for 2024 are expected to surge 325.7% year over year.

Energy Transfer ET is a publicly traded limited partnership focused on diverse energy assets in the United States. Its core operations involve natural gas midstream services, transportation, storage, crude oil facilities and marketing assets.

The Zacks Consensus Estimate for ET’s 2024 EPS is pegged at $1.17. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. The company’s earnings for 2024 are expected to rise 13.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vaalco Energy Inc (EGY) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report