Equinor's (EQNR) Empire Wind Makes Headway Toward Approval

The Empire Wind project, developed by Equinor ASA EQNR and BP plc BP, completed its environmental impact analysis conducted by the U.S. Bureau of Ocean Energy Management (“BOEM”), advancing the project to the last phase of the permitting procedure.

The ultimate Environmental Impact Statement assesses the possible environmental consequences of the actions specified in Empire Wind’s construction and operating plan. BOEM intends to announce a verdict regarding project approval and, if applicable, specify approval conditions in the upcoming autumn.

Equinor and BP are developing two offshore wind ventures, referred to as Empire Wind 1 and Empire Wind 2, within their leased area, situated 12 nautical miles south of Long Island, NY, and 16.9 nautical miles to the east of Long Branch, NJ.

With the approval, Empire Wind is anticipated to become the fifth large-scale offshore wind farm. The Empire Offshore Wind project is expected to generate enough electricity to power more than a million homes in New York.

Each of the two projects will operate as standalone entities with electrical isolation from one another. The companies plan to use up to 57 turbines at the 816-MW Empire Wind 1 project and up to 90 at the 1,260-MW Empire Wind 2 project.

Several projects were awarded, and spikes in inflation forced energy companies to hedge equipment and labor at much higher prices than expected. Financial challenges have impacted the projects, leading the two companies to announce their intention to raise the power pricing by as much as 54% across their collective development portfolio in New York.

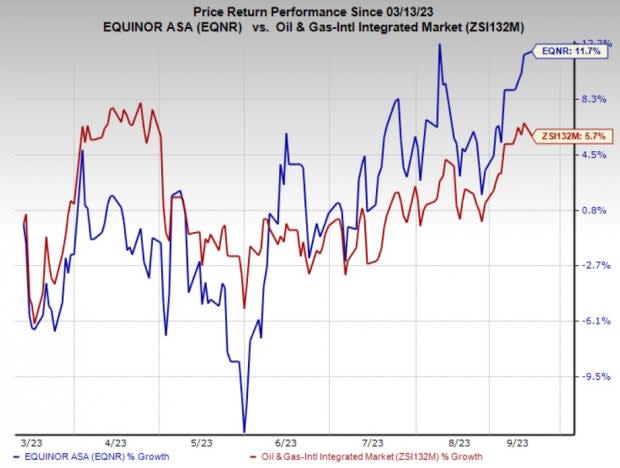

Price Performance

Shares of EQNR have outperformed the industry in the past six months. The stock has gained 11.7% compared with the industry’s 5.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Core Laboratories N.V.’s CLB strong presence in the emerging shale plays and its global footprint will provide for steady growth rates, going forward. CLB’s technology-heavy portfolio of proprietary products and services gives it the opportunity to optimize production from new and existing fields.

Core Labs has witnessed upward earnings estimate revision for 2023 and 2024 in the past 30 days. The consensus estimate for CLB’s 2023 and 2024 earnings per share is pegged at 88 cents and $1.17, respectively.

Murphy USA MUSA is a leading independent retailer of motor fuel and convenience merchandise in the United States. Over the past 30 days, MUSA has witnessed upward earnings estimate revisions for 2023 and 2024, respectively.

The Zacks Consensus Estimate for Murphy USA’s 2023 and 2024 earnings per share is pegged at $21.44 and $21.37, respectively. MUSA currently has a Zacks Style Score of A for Value and Momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report