Equitable Holdings' (EQH) Board Okays New 10% Dividend Hike

Equitable Holdings, Inc.’s EQH board of directors approved an increase in quarterly dividends, in line with its plan disclosed earlier. The company will pay out 22 cents per share, reflecting a hike of 10% from the previous dividend.

The new dividend will be paid out on Jun 12, 2023, to stockholders of record as of Jun 5. Based on the increased rate, the annual dividend comes to 88 cents per share. The dividend yield, based on the new payout and its May 24 closing price is 3.6%, higher than the industry average of 2.5%.

EQH also declared a $328.13 per share quarterly dividend on Series A 5.25% Non-Cumulative Perpetual Preferred Stock, a $618.75 semi-annual dividend on Series B 4.95% Non-Cumulative Perpetual Preferred Stock and a $268.75 quarterly dividend on Series C 4.30% Non-Cumulative Perpetual Preferred Stock.

Regarding its financial position, Equitable Holdings exited the first quarter with total investments, and cash and cash equivalents of $101.2 billion, while long-term debt was only $3,819 million. Moreover, EQH has a robust cash-generating ability. By 2027, it expects to generate around $2 billion in cash annually. In 2023 alone, it expects to generate $1.3 billion in cash. This will aid EQH’s capital-deployment initiatives.

Its strong cash generation ability will likely support a 60-70% payout ratio target. In the first quarter of 2023, EQH paid out $72 million of cash dividends and repurchased $214 million worth of shares.

Investors interested in this stock can take a look at its growth opportunities. The company’s Equitable business is likely to continue gaining on retirement products as the older population is expected to significantly increase in the future. Also, acquisitions and partnerships form one of the main growth strategies of EQH. In July 2022, it acquired the alternative investment management firm CarVal Investors L.P. through its subsidiary AllianceBernsteinHolding L.P. AB.

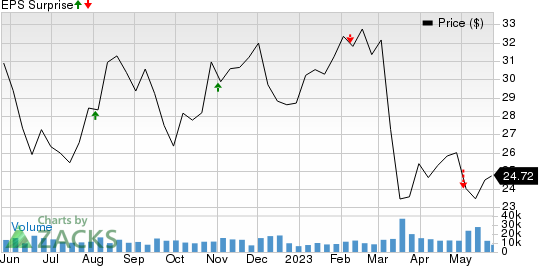

The Zacks Consensus Estimate for its 2023 bottom line is pegged at $5.17 per share, suggesting a 1.8% year-over-year increase. The same for 2024 implies a 23.4% jump from the year-ago level. In the last four quarters, EQH’s earnings beat estimates once, met once and missed on the other two occasions.

Equitable Holdings, Inc. Price and EPS Surprise

Equitable Holdings, Inc. price-eps-surprise | Equitable Holdings, Inc. Quote

Zacks Rank & Key Picks

Equitable Holdings currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are Lemonade, Inc. LMND and Argo Blockchain plc ARBK, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Lemonade’s 2023 earnings suggests 15.9% year-over-year growth. Also, the consensus mark for LMND’s 2023 revenues implies a 53.6% year-over-year rise.

The Zacks Consensus Estimate for Argo Blockchain’s 2023 bottom line has improved 47.9% over the past month. During this time, ARBK witnessed two upward estimate revisions against none in the opposite direction.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

Equitable Holdings, Inc. (EQH) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report

Argo Blockchain PLC Sponsored ADR (ARBK) : Free Stock Analysis Report