Equitrans Midsteam looks like a Good Bet

Equitrans Midstream Corp (NYSE:ETRN) stock has been through a roller coaster ride since it was spun out of EQT Corporation in 2018. Equitrans Midstream Corp (NYSE:ETRN) is a mid-stream company with assets based in the Appalachian basin of the United States. The company provides infrastructure and services for gathering and transport of hydrocarbons (mainly natural gas) as well as providing water services to producers in the region. Equitrans was spun out of EQT Corporation (EQT) in November 2018 when EQT separated its upstream and midstream assets to better align with specific classes of investors.

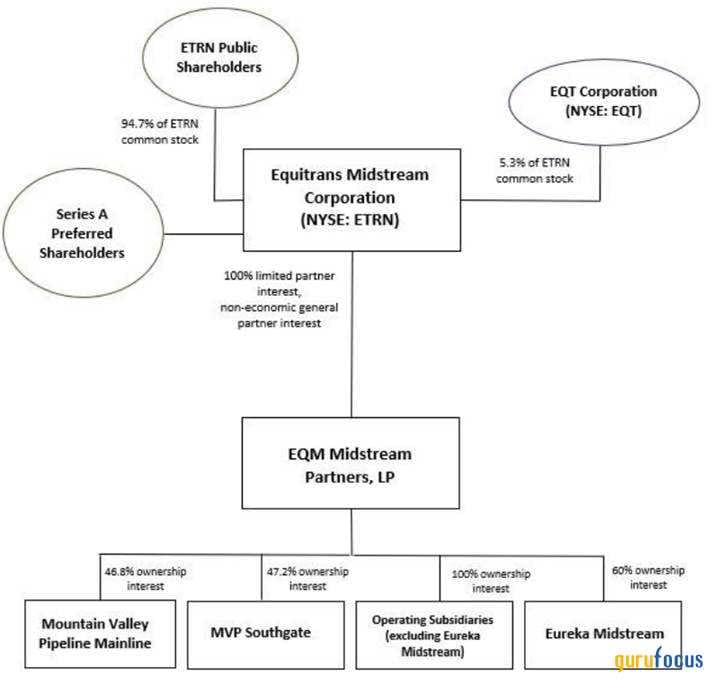

Company's Organizational and Ownership Structure

The following diagram shows the Company's organizational and ownership structure :

Geographical Reach and Core Assets

The Appalachian Basin covers a vast area of approximately 185,000 square miles, stretching about 1,000 miles from the Northeast to the Southwest. It spans across parts of New York, Pennsylvania, Eastern Ohio, West Virginia, and Western Maryland in the northern section, and also reaches into Northwestern Georgia and Northeastern Alabama in the south. The main oil and gas-producing formations in this region include the Marcellus Shale, Utica Shale, and Point Pleasant formation.

Equitrans Midstream Corp (NYSE:ETRN) serves its clientele in Pennsylvania, West Virginia, and Ohio by means of three core assets: the gathering system comprising predominantly high-pressure gathering lines for dry gas; the transmission system, encompassing FERC-regulated interstate pipelines and storage systems; and the water network, primarily consisting of pipelines and facilities supporting well completion and produced water handling.

Revenue and Operations

The majority of Equitrans' natural gas gathering, transmission, and storage services are rendered through long-term contracts, often featuring firm reservation fees. This contract structure bolsters the stability of the company's cash flows, with approximately 73% of operating revenues derived from firm reservation fees. By concentrating operations primarily in southwestern Pennsylvania, northern West Virginia, and southeastern Ohiohighly productive areas in the Marcellus and Utica Shalesthe company hones its focus on prolific resource development zones.

Mountain Valley Pipeline

Equitrans Midstream Corp (NYSE:ETRN) has a roster of significant project undertakings, with the paramount project being the Mountain Valley Pipeline (MVP). Now being more than 90% complete, this endeavor grappled with regulatory and environmental hurdles, resulting in a gradual progression towards its anticipated conclusion by the year's end.

Amidst legal and stakeholder challenges, the intervention of the Biden administration has lent support to the Mountain Valley Pipeline. Recent legislation designates the pipeline as of national importance and sets forth a mandate for permits to be granted by June 2023. Equitrans, operating through a subsidiary, maintains a 48.1% ownership stake and operational responsibility for the pipeline. The project's objectives encompass augmenting Appalachian production and facilitating gas exports overseas.

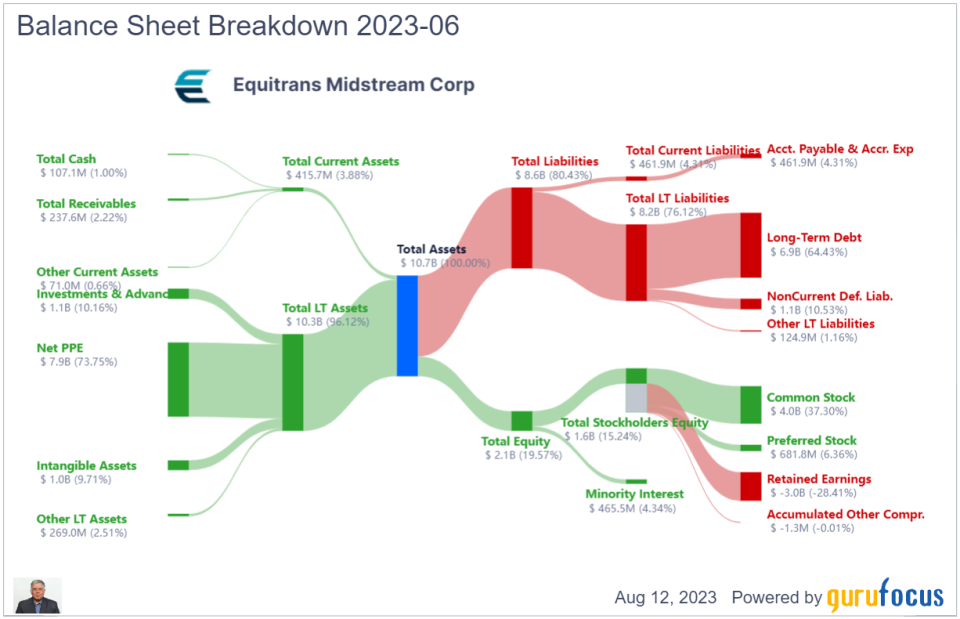

Balance Sheet Overview

Following is a snapshot of Equitrans Midstream Corp (NYSE:ETRN) balance sheet as of June 2023.

Equitrans Midstream Corp (NYSE:ETRN) has high leverage mainly due to ongoing capital projects. Debt is high with debt to ebitda 14.4. The company is targeting Long-term target leverage of less than 4.0x (Leverage ratio is ETRN consolidated debt/(adjusted EBITDA + deferred revenue).

Cash Flow

The company took large write downs in 2019, 2021, 2022 for the delayed MVP project and may be forced to do so again. However the company is generating operating and free cash flow which covers its dividend. Current Annual dividend is $0.60 per common share.

Conclusion

Equitrans Midstream Corp (NYSE:ETRN)'s investment thesis is centered on its leading footprint in the Appalachian Basin, with a premier gathering, transmission, and water infrastructure positioned to benefit from core development in the Marcellus and Utica Shales. As one of the largest natural gas gatherers in the United States, the company is anchored by over 5 Bcf per day of MVCs(Minimum Volume Commitments) and has commercial alignment with EQT Corp (who holds a minority position in the company), enabling optimized drilling plans and significant midstream capital efficiencies.

Equitrans Midstream Corp (NYSE:ETRN) looks to be an interesting stock with great capital appreciation potential. If the company executes as per plan the stock can double from here in three to five years in addition to paying a nice dividend. If not, there is downside but probably not a whole lot. Overall given the solid upside and the limited downside Equitrans looks like a reasonable bet. There is also the chance of a bigger pipeline company acquiring Equitrans. If that happens a price in the thirties could be expected. Note that the stock did trade in the 20s at IPO, so this is not a stretch by any means.

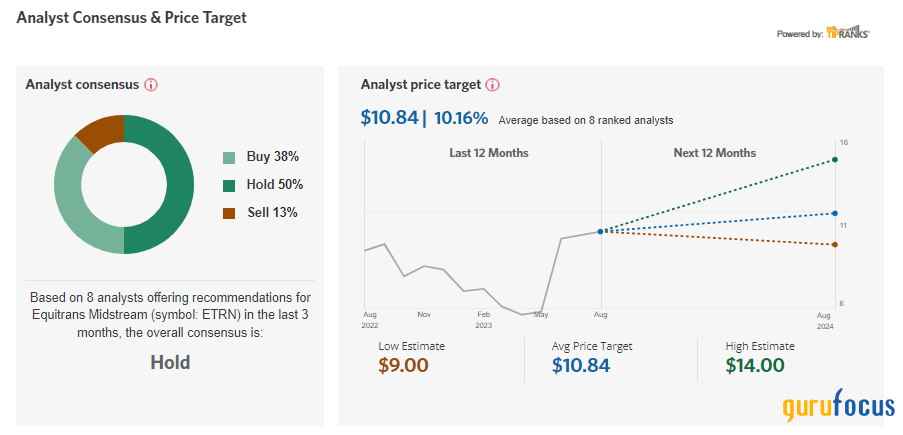

The 8 Analysts tracked by Tipranks have a consensus of "hold" on the stock. Morningstar has a 3 -year fair value of $15 on the stock. Meanwhile we are getting a 6.08% dividend yield while we wait for the major projects to get completed.

This article first appeared on GuruFocus.