Equitrans Midstream Looks Like a Good Bet

Equitrans Midstream Corp. (NYSE:ETRN) has been on a roller coaster ride since it was spun off of EQT Corp. (NYSE:EQT) in 2018. The midstream company, which has assets based in the Appalachian Basin of the U.S., provides infrastructure and services for gathering and transport of hydrocarbons (mainly natural gas) as well as providing water services to producers in the region.

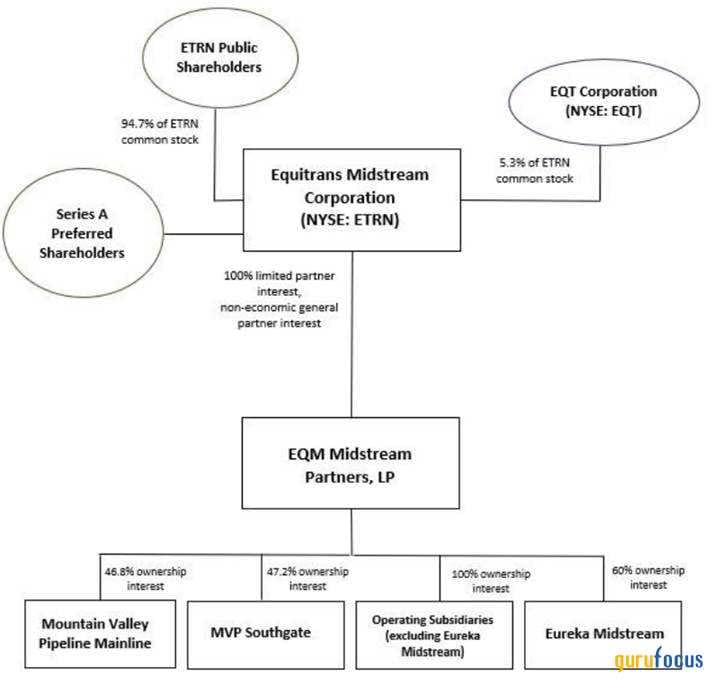

Company's organizational and ownership structure

The following diagram shows the company's organizational and ownership structure:

Geographical reach and core assets

The Appalachian Basin covers a vast area of approximately 185,000 square miles, stretching about 1,000 miles from the Northeast to the Southwest. It spans across parts of New York, Pennsylvania, Eastern Ohio, West Virginia and Western Maryland in the northern section, and also reaches into Northwestern Georgia and Northeastern Alabama in the south. The main oil and gas-producing formations in this region include the Marcellus Shale, Utica Shale and Point Pleasant formation.

Equitrans Midstream serves clientele in Pennsylvania, West Virginia, and Ohio by means of three core assets: the gathering system comprised predominantly of high-pressure gathering lines for dry gas; the transmission system, encompassing FERC-regulated interstate pipelines and storage systems and the water network, primarily consisting of pipelines and facilities supporting well completion and produced water handling.

Revenue and operations

The majority of Equitrans' natural gas gathering, transmission and storage services are rendered through long-term contracts, often featuring firm reservation fees. This contract structure bolsters the stability of the company's cash flows, with approximately 73% of operating revenues derived from the reservation fees. By concentrating operations primarily in southwestern Pennsylvania, northern West Virginia and southeastern Ohiohighly productive areas in the Marcellus and Utica Shalesthe company hones its focus on prolific resource development zones.

Mountain Valley Pipeline

Equitrans Midstream has a roster of significant project undertakings, with the paramount project being the Mountain Valley Pipeline. Now more than 90% complete, this endeavor grappled with regulatory and environmental hurdles, but is gradually making progress toward its anticipated conclusion by the year's end.

Amidst legal and stakeholder challenges, the intervention of the Biden administration has lent support to the Mountain Valley Pipeline. Recent legislation designates the pipeline as of national importance. Equitrans, operating through a subsidiary, maintains a 48.1% ownership stake and operational responsibility for the pipeline. The project's objectives encompass augmenting Appalachian production and facilitating gas exports overseas.

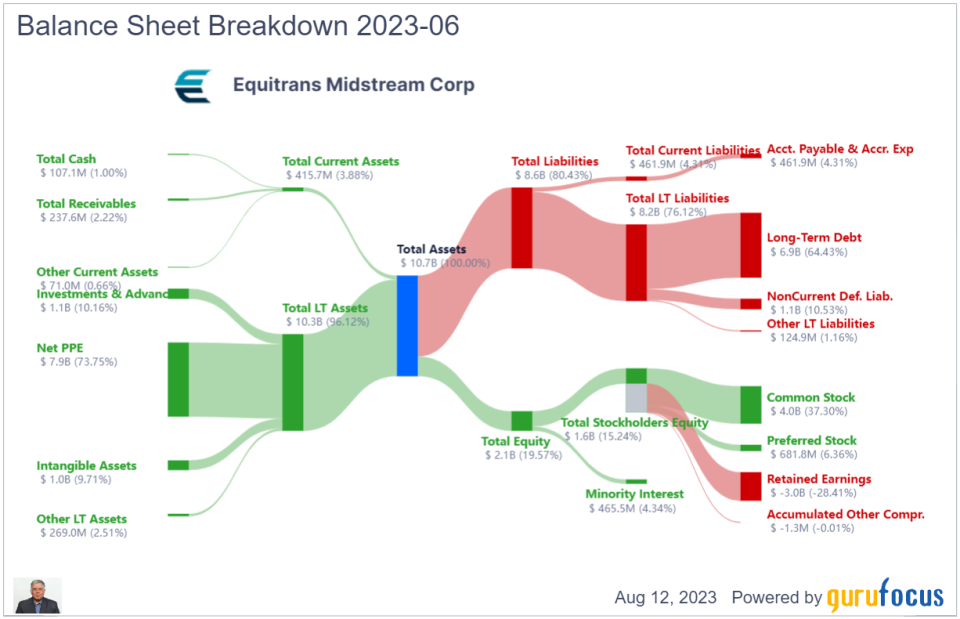

Balance sheet overview

The following is a snapshot of Equitrans' balance sheet as of June 2023.

The company has high leverage, mainly due to ongoing capital projects. Debt is high with the debt-to-Ebitda ratio currently at 14.4. The company is targeting long-term leverage of less than 4 (leverage ratio is calculated as consolidated debt divided by the sum of adjusted Ebitda and deferred revenue).

Cash flow

The company took large write downs in 2019, 2021 and 2022 for the delayed pipeline and related projects and may be forced to do so again. However, Equitrans is generating operating and free cash flow which covers its dividend. The current annual dividend is 60 cents per common share.

$ Millions | |||||||||||

Fiscal Period | |||||||||||

Cash Flow from Operations | |||||||||||

Free Cash Flow | |||||||||||

Cash Flow for Dividends | - | -497 | -357 | -318 | -318 | -318 | -80 | -80 | -80 | -80 | -80 |

Conclusion

Equitrans Midstream's investment thesis is centered on its leading footprint in the Appalachian Basin, with a premier gathering, transmission and water infrastructure positioned to benefit from core development in the Marcellus and Utica Shales. As one of the largest natural gas gatherers in the U.S., the company is anchored by over 5 billion cubic feet per day of minimum volume commitments and has commercial alignment with EQT (which also holds a minority position in the company), enabling optimized drilling plans and significant midstream capital efficiencies.

The company looks to be an interesting income stock with excellent capital appreciation potential. If it executes as planned, the stock can double in three to five years in addition to paying a nice dividend. If not, there is downside, but probably not a whole lot.

Overall, given the solid upside and the limited downside, Equitrans looks like a reasonably good bet. There is also the chance of a bigger pipeline company acquiring it. If that happens, a price in the $30 range (a triple) can be expected. Note that the stock did trade in the $20s at the time of its initial public offering, so this is not too much of a stretch by any means.

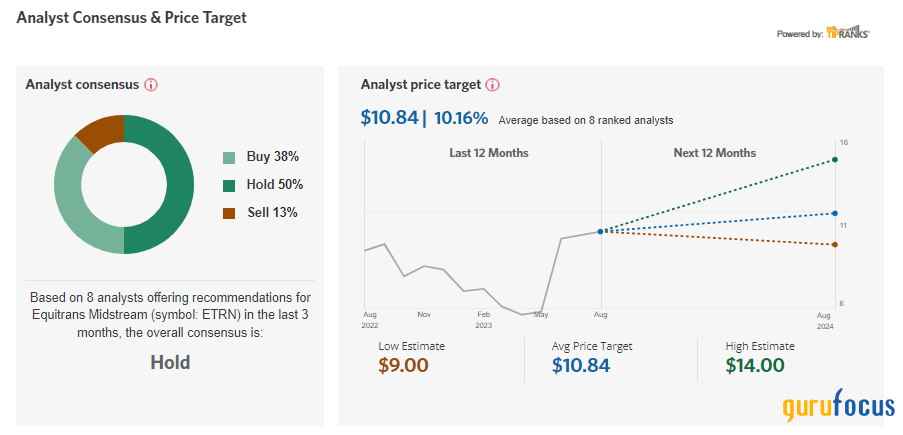

The eight analysts tracked by Tipranks have a consensus of "hold" on the stock. Morningstar has a three-year fair value of $15 on the stock. Meanwhile, we are getting a 6.08% dividend yield while we wait for the major projects to get completed.

This article first appeared on GuruFocus.