These Equity ETFs Are Fighting Inflation

Inflation has been top of mind for investors in recent months, and fund issuers are taking notice.

Fidelity rolled out its inflation equities ETF in late 2019, when the inflation rate was around 2%. Horizon Kinetics followed suit in early 2021 when it launched its first—and so far only—ETF, at a time when inflation was even lower.

However, that situation has changed, with the inflation rate now hovering close to 8%, and those two funds are getting a lot more attention.

During the last 12 months, the Horizon Kinetics Inflation Beneficiaries ETF (INFL) has pulled in a stunning $987 million, while the Fidelity Stocks for Inflation ETF (FCPI) drew in $247.6 million. Today, the funds have total assets of $1.39 billion and $260.5 million, respectively.

Both funds have been offering significant outperformance over the past 12 months, surpassing cap-weighted broad market funds targeting similar universes.

INFL’s numbers are all the more stunning, as its issuer was not well-known in the ETF industry when it launched the fund, and it remains Horizon Kinetics’ sole product in the space. FCPI, which had launched more than a year prior to INFL, has been slower to gather assets despite Fidelity’s greater brand recognition.

However, the two funds are achieving this outperformance in very different ways, even though they both invest in equities. Index-based FCPI targets U.S. stocks, while actively managed INFL takes a broader, global view. While the former comes with an expense ratio of 0.29%, the latter charges almost three times as much: 0.85%.

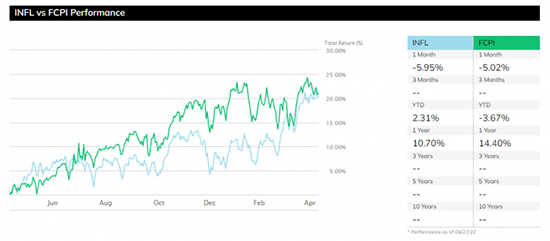

Performance

These funds are clearly doing something right. FCPI is a total market U.S. fund, and it has offered returns of -3.67% relative to -12.89% for the Vanguard Total Stock Market ETF (VTI) year –to date through April 27. It has also recorded a 14.4% return over the 12-month period versus a -2.53% return for VTI.

Similarly, INFL—a global total market equity fund—is up 2.31% year to date relative to a 12.77% decline for the plain vanilla iShares MSCI ACWI ETF (ACWI). On a 12-month basis, INFL was up 10.70% relative to a 5.83% decline for VTI.

Essentially, FCPI has outperformed over the 12-month period, while INFL sits well ahead of its rival for the year-to-date period.

(For a larger view, click on the image above)

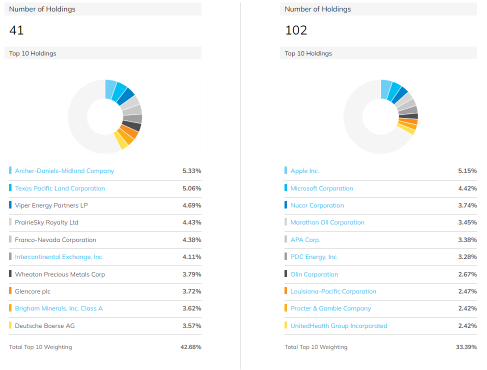

Digging Into Holdings

Despite being a global fund, INFL has a much more concentrated portfolio (41 holdings) than FCPI (102 holdings). Interestingly, even though INFL has a 49% weighting to U.S. companies, there is no overlap with FCPI’s portfolio.

INFL’s top three holdings are Archer-Daniels-Midland at 5.33%, Texas Pacific Land at 5.06% and Viper Energy Partners at 4.69%. Meanwhile, FCPI’s top three are Apple at 5.15%, Microsoft at 4.42% and Nucor Corp. at 3.74%.

(For a larger view, click on the image above)

However, if you zoom out a bit, there are some similarities in exposure type, though not many. INFL’s top sectors include finance at nearly one-third of the entire portfolio, followed by non-energy minerals at 21.11% and process industries at 13.43%. Meanwhile, FCPI’s top sectors are energy minerals at 12.19% of the portfolio, finance at 11.56% and technology services at 11.12%.

Energy minerals has a 10.51% weighting in INFL, while the technology services category has 4.39% weighting in the portfolio. Non-energy minerals have a 6.39% weighting in FCPI, while process industries are not among the top sectors for the fund.

(For a larger view, click on the image above)

Factor Exposures

Factor exposures between the two funds are also fairly all over the place, though both have notable loadings toward the low size and momentum factors. FCPI has a 0.33 exposure to low size and a 0.54 exposure to momentum, while INFL has exposures of 0.84 and 0.67 to the respective factors.

Interestingly, FCPI has a -0.13 exposure to low volatility, while INFL’s exposure is 0.30. FCPI’s second-largest exposure is a 0.45 loading to value, while INFL has an exposure of -0.03.

(For a larger view, click on the image above)

FCPI has more than 78% of its portfolio allocated to large cap stocks and 22% allocated to midcap stocks. However, INFL has a little more than 48% allocated to large cap stocks and almost 31% to midcaps. Its portfolio includes roughly 20% and 1%, respectively, allocated to small caps and microcaps.

FCPI and INFL are both accomplishing their goal of offering market-beating equity returns in an inflationary environment; however, even though they have a strong 0.83 correlation with each other, they are going about it in very different ways. INFL actively selects a concentrated portfolio from a global field of equities, while FCPI tracks an index solely targeting the U.S.

Contact Heather Bell at heather.bell@etf.com

Recommended Stories