Resource Equity Partners Reaffirms Need for Change at Cathedral Energy Services Ltd.

Cathedral remains significantly undervalued due to ongoing leadership issues, governance concerns, and flawed strategy.

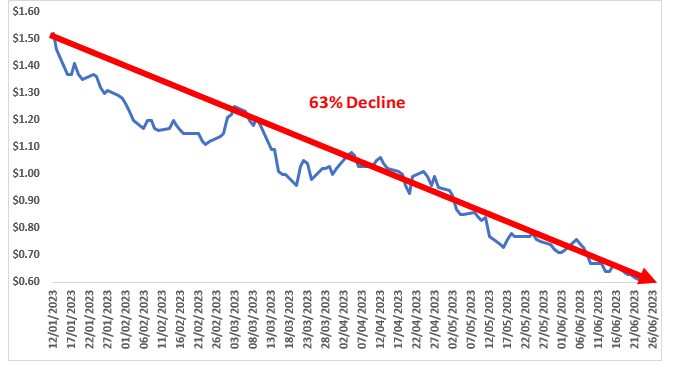

Cathedral's share price has declined rapidly from its 52-week high of $1.52 in January 2023 to $0.57 / share, well below its April 2022 private placement price of $0.70 / share.

Cathedral misses consensus street EBITDA estimates by $12 million in Q1 2023 despite having 5 certified Chartered Professional Accountants on the Board and Executive; currently being covered by 5 reputable investment banks.

Board and Executive are misaligned with shareholders; shareholder capital is being further eroded to advance Board and Executive entrenchment.

Resource Equity Partners believes a more effective Board and Executive can unlock substantial upside over the current share price and reinforces an actionable path to $2.50+ per share.

CALGARY, AB / ACCESSWIRE / June 27, 2023 / Resource Equity Partners ("Resource Equity"), on behalf of a significant shareholder of Cathedral Energy Services Ltd. (CET) ("Cathedral" or the "Company"), has published a second letter to shareholders of Cathedral calling on the Company to undertake immediate change and reiterates a path to significant value creation for all Cathedral shareholders.

All figures in this news release are expressed in Canadian dollars.

The full text of the letter is set out below.

June 27, 2023

Dear Fellow Shareholders,

Resource Equity Partners ("Resource Equity") represents a significant shareholder of Cathedral Energy Services Ltd. (CET) ("Cathedral" or the "Company"). Since our initial public letter published on April 11, 2023, we are disappointed that the board of directors (the "Board") and executive management team (the "Executive") of Cathedral have failed to effect any meaningful change, critically assess and correct Cathedral's flawed strategy, and provide investors with better insight and transparency into Cathedral's true state of affairs. Despite persistently raising these corporate governance concerns since late 2022, Resource Equity continues to be ignored by the Board and Executive. Cathedral has failed to address ANY of the concerns outlined in our first letter and has yet to present a viable strategy for creating shareholder value.

IMPORTANT INFORMATION AND TIMELINE

In addition to the historical information and timeline provided in our initial letter, we feel it is important to bring shareholders' attention to recent facts and events (all sourced from Cathedral's public disclosures) that have unfolded since the beginning of 2023. These developments continue to erode value at Cathedral and demonstrate a continuation of the poor track record we previously highlighted. These facts and events are indicative of legacy organizational issues, particularly within the culture and approach of the Board and Executive.

Timeline:

Date | Event | Price Per Share / Decline |

January 12, 2023 | Cathedral's share price reaches a 52-week high | $1.52 / share |

January 13, 2023 | Cathedral releases a corporate update representing a robust Q1 2023 and provides a capital spending and management update: "Cathedral is operating over 60 active jobs in Canada, a level that if sustained, will represent some of the most robust levels of activity in Cathedral's history. In the US, our Altitude division is on track to grow its Q1-2023 job count to approximately 60-65 active rigs, marking clear progress from the second half 2022 activity levels of 50-55 jobs. Finally, Cathedral's US motor rental business, Discovery Downhole Services, also expects to operate near full capacity at high levels of utilization with the implementation of incremental price increases during the fourth quarter of 2022 and anticipated in the first quarter of the year." The "Capital Spending Update" is significant, announcing an increased budget from the $35 million (released in the Company's Q3 2022 Interim Financial Report) to $46 million. The "Management Update" announces the re-emergence of ex-CEO and long-term Interim CFO, Scott MacFarlane. | $1.42 ↓ 7% |

January 16, 2023 | Cathedral ends the week at $1.32 / share | $1.32 ↓ 13% |

March 30, 2023 | Cathedral announces delay in filing its 2022 annual financial statements | $0.98 ↓ 36% |

April 14, 2023 | Cathedral announces record fourth quarter and strongest annual results in corporate history | $1.01 ↓ 34% |

April 20, 2023 | Cathedral ends the week at $0.91 / share | $0.91 ↓ 40% |

May 8, 2023 | Cathedral announces proceeds from warrant exercise of $16 million | $0.84 ↓ 45% |

May 11, 2023 | Cathedral held its Annual General Meeting ("AGM") at 3:00 pm (MST) on May 11, 2023. Despite calls for a refreshed Board, including the addition of a woman nominee, Cathedral once again ignored shareholders and continued to support its entrenched legacy Board with no new additions. Cathedral announced its Q1 2023 financial results. Cathedral's Q1 2023 EBITDA missed street consensus projections by $12 million. The Company strategically released its Q1 2023 results at 5:30 EST (3:30 MST) during the AGM and just minutes after the director elections occurred, failing to provide shareholders with an opportunity to digest, let alone read, the missed Q1 2023 financial results ahead of the AGM. | $0.80 ↓ 47% |

May 12, 2023 | Cathedral announces AGM director election results | $0.71 ↓ 53% |

June 26, 2023 | Cathedral's share price reaches a low of $0.57 per share | $0.57 ↓ 63% |

Cathedral's only other public comparable, Phoenix Energy Services Corp., is down 28% during this same period compared to Cathedral's 63%.

CATHEDRAL'S Q1 2023 EBITDA MISS AND MORE GOVERNANCE CONCERNS

Cathedral's disappointing Q1 2023 EBITDA miss of $12 million raises confusion amongst investors, particularly given Cathedral is a microcap business, operating in an industry it should be familiar with. Adding to this perplexity is the fact Cathedral is covered by five reputable investment banks and boasts numerous Chartered Accountants on the Board (Maxwell, Tremblay and Brown) and Executive (MacFarlane and Hearn). Surprisingly, none of these accountants are present in the US, which happens to be the largest area of Cathedral's business operations. Furthermore, the involvement of the legacy Interim CFO and former CEO, Scott MacFarlane, the long-term Chairman and now Executive Chairman, Rod Maxwell, and the current CEO and President, Tom Connors, in day-to-day operations leaves one questioning who is truly leading the business and evaluating the underlying financial performance of Cathedral?

In May 2023, Cathedral introduced Mike Hearn as the newly appointed Senior Vice President, Corporate Development. Notably, in April 2023, Stifel FirstEnergy commented in their research that "former Storm Resources CFO Mr. Michael Hearn has joined the Executive team and could be announced as the new CFO in due course. We would view this as a very strong hire for CET". As of today, however, Scott MacFarlane continues to hold the Interim CFO position.

We strongly recommend replacing several of the current Canadian board members to address the deficient and limited skillsets currently hindering the Board and hurting Cathedral. Immediate action must be taken to recruit experienced and suitable independent directors to help lead and support urgently needed business integration, governance, diversity, and ESG initiatives.

In the Company's Q1 2023 results, Management openly acknowledged that Cathedral's underperformance was a result of missed opportunities in the US and higher repair and maintenance charges. Management candidly admitted that Cathedral needs to prioritize strengthening its core business.

Cathedral's "size and scale" strategy needs to be critically reassessed. Cathedral's actions and underperformance demonstrate the Company currently lacks the ability to effectively integrate historical acquisitions, streamline operations, and pursue acquisitions beyond its current capacity.

We strongly advise Cathedral's Board and Executive against pursing new acquisitions in the US until they have thoroughly grasped the underlying fundamentals of their existing US divisions. The significant Q1 2023 EBITDA miss clearly indicates there is still much for the Company to address before considering any further expansion opportunities.

We would also like to draw shareholders' attention to the 132% increase in audit related fees and we ask Cathedral to provide a forthright and transparent explanation for the substantial increase.

Shareholders deserve better than the current underperformance and financial results provided by Cathedral, which have negatively impacted the Company's reputation amongst the investment community. While Cathedral may assert they are on track to achieve over $100 million of EBITDA in 2023, what truly matters is how the market values cash flow and its sustainability over time.

We are deeply concerned Cathedral may continue to pursue acquisitions that are unlikely to be accretive due to the Company's low enterprise value multiple (roughly 2x X 2023 projected EBITDA). Such acquisitions would likely require taking on additional debt, as an equity financing would result in dilution below the Company's last financing of $0.70 per share and below current market value of $0.57 per share. Proceeding with a prejudicial and unnecessary dilutive equity financing would only further reinforce the Board's history of eroding shareholder value.

We would like to remind the Board and Executive the true measure of value creation for shareholders is the increase in value per share, not overall growth or size.

In a separate letter sent to the Board earlier today, we urged the Company to immediately replace Rod Maxwell, Ian Brown, and Scott Sarjeant with new independent directors and Scott MacFarlane as Interim CFO. We remain available to work with Cathedral to identify directors with the skillsets and experience required to properly refocus Cathedral and generate long term shareholder value.

Sincerely,

Chad Robinson

President, Resource Equity Partners

About Resource Equity Partners

Based in Calgary, Alberta, Resource Equity is a private equity firm founded in 2012 by a team of successful entrepreneurs and executives with a passion for building great teams and companies. We have first-hand industry experience building, operating, and monetizing successful energy companies. Our strength is working with entrepreneurs and owners to evolve and expand their businesses with the right strategy, financing, and people required to execute a carefully considered growth plan. We are focused on the energy transition and specifically invest in technology, product, and service companies whose attributes are focused on a substantial reduction (and in some cases a complete elimination) of CO2 and NOx emissions around the processes of energy extraction.

In March 2023, our shareholder filed a statement of claim against Cathedral for constructive dismissal centered around significant and legacy governance issues. We reject Cathedral's suggestions that our sustained and repeated attempts to increase shareholder value are motivated by personal grievances related to the shareholder's ongoing legal action.

This news release in no way constitutes the solicitation of proxies by Resource Equity, its shareholder, or affiliates.

Contacts:

Chad Robinson

President, Resource Equity Partners

crobinson@resource-ep.com

Alyssa Barry

Media Relations at irlabs

alyssa@irlabs.ca

SOURCE: Resource Equity Partners

View source version on accesswire.com:

https://www.accesswire.com/763807/Resource-Equity-Partners-Reaffirms-Need-for-Change-at-Cathedral-Energy-Services-Ltd