Equity Residential (EQR) Q1 FFO In Line, '21 FFO Lower-end View Up

Equity Residential’s EQR first-quarter 2021 normalized funds from operations (FFO) per share of 68 cents came in line with the Zacks Consensus Estimate. Rental income of $597.6 million exceeded the consensus mark of $586.8 million.

However, on a year-over-year basis, normalized FFO per share declined 21.8% and rental income fell 12.4%, reflecting the adverse impact of the pandemic on its business.

According to Equity Residential's president and CEO Mark J. Parrell, “While the first quarter’s results reflect the significant impact of the pandemic on our business, we continue to see substantial signs of improvement as cities begin to reopen and affluent renters return”.

The REIT noted that it has witnessed a 1.6% improvement in same store physical occupancy since the end of fourth-quarter 2020 for its residential properties, increasing to 96.0% on Apr 22, 2021 from 94.4% on Dec 31, 2020. Percentage of residents renewing by quarter/month increased to 56% in April from 53 in first-quarter 2021 and 51% in fourth-quarter 2020.

Also, across all markets, there has been an improvement in pricing trends with a roughly 14% portfolio-wide sequential increase from December 2020 through April 2021.

Blended rate is down 7.2% in April compared with the decline of 12.1% in first-quarter 2021 and 13% in fourth-quarter 2020.

Also, in the first quarter, the company collected roughly 97% of its projected residential revenues.

Management expects to further lower concessions and increase rental rates as it heads into the prime leasing period amid strong demand across its markets.

Parrell also noted, “We are producing occupancy and pricing trends better than our original expectations and are therefore pleased to raise our full year same store revenue guidance range by 100 basis points to -6.0% to -8.0%.”

Quarter in Detail

Residential same-store revenues (includes 77,060 apartment units) were down 10.6% year over year to $570.9 million, while expenses flared up 3.9% to $205.96 million. As a result, same-store net operating income (NOI) declined 17.1% to $364.97 million, year on year.

Average rental rate decreased 9.3% year on year to $2,601 during the March-end quarter, while physical occupancy contracted 140 basis points to 95% for the same-store portfolio.

During the reported quarter, the company neither acquired nor sold any assets.

Balance Sheet

Equity Residential exited first-quarter 2021 with cash and cash equivalents of $35.45 million, down from the $42.6 million recorded at the end of 2020.

Outlook

For full-year 2021, the company has revised its guidance and now projects normalized FFO per share of $2.70-$2.80 compared with the $2.60-$2.80 guided earlier, mainly reflecting higher expected same-store NOI. The Zacks Consensus Estimate for the same is currently pinned at $2.74.

The company’s full-year outlook incorporates same-store revenue decline of 6-8% compared with a 7-9% fall guided earlier. Expenses are expected to be up 3-4%, which remains unrevised. Consequently, NOI is estimated to shrink 11-13% compared with the 12-15% projected earlier. Physical occupancy is expected to be 95-96% as against the 94.8-95.8% guided earlier.

For second-quarter 2021, the company projects normalized FFO per share at 67-71 cents. The Zacks Consensus Estimate for the same is currently pinned at 69 cents.

Equity Residential currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

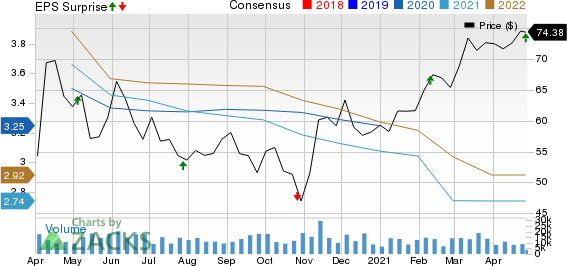

Equity Residential Price, Consensus and EPS Surprise

Equity Residential price-consensus-eps-surprise-chart | Equity Residential Quote

Performance of Other Residential REITs

Essex Property Trust Inc. ESS reported first-quarter 2021 core funds from operations (FFO) per share of $3.07, beating the Zacks Consensus Estimate of $3.04. The figure also surpassed the midpoint of the company’s first quarter 2021 guidance range provided earlier by 4 cents per share. Sequentially, the company experienced lower cash concessions and delinquency, leading to a marginal improvement in same-property gross revenue and NOI.

UDR Inc. UDR reported first-quarter 2021 FFO as adjusted per share of 47 cents, missing the Zacks Consensus Estimate of 48 cents. Also, the figure is lower than the prior year’s 54 cents. Results reflect the adverse impacts of the coronavirus pandemic. A decline in revenues from mature communities affected top-line growth.

We now look forward to the earnings releases of another residential REITs — AvalonBay Communities, Inc. AVB — scheduled for today after the closing bell.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research