ESCO Technologies Inc: A Strong Contender in the Hardware Industry with a High GF Score

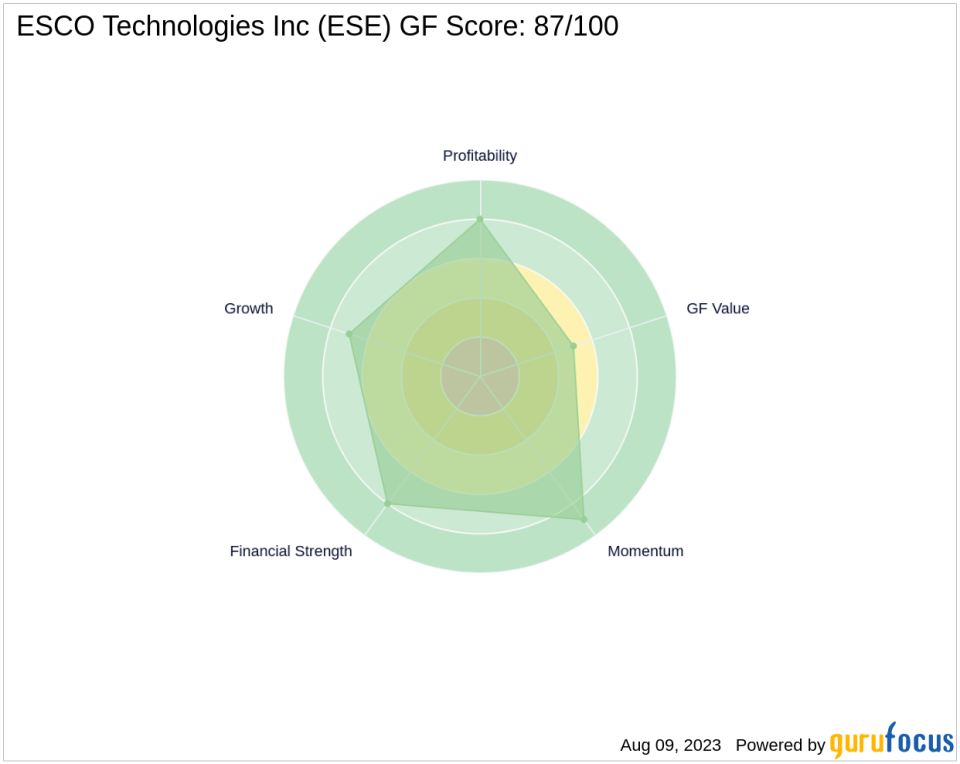

ESCO Technologies Inc (NYSE:ESE), a prominent player in the hardware industry, has been making waves with its impressive performance in the stock market. As of August 9, 2023, the company's stock price stands at $107.26, marking a gain of 4.59% for the day and an 8.82% increase over the past four weeks. With a market cap of $2.76 billion, ESCO Technologies Inc has a commendable GF Score of 87 out of 100, indicating good outperformance potential.

Financial Strength Analysis

The Financial Strength of a company is a crucial factor in determining its long-term viability. ESCO Technologies Inc boasts a Financial Strength Rank of 8/10, reflecting a robust financial situation. The company's interest coverage is 17.11, indicating its ability to meet its debt obligations. Furthermore, its debt to revenue ratio is a low 0.22, and its Altman Z score is a healthy 4.38, further reinforcing its financial strength.

Profitability Rank Analysis

ESCO Technologies Inc's Profitability Rank is 8/10, indicating a high level of profitability. The company's operating margin stands at 13.20%, and its Piotroski F-Score is 8, suggesting a healthy financial situation. Moreover, the company has shown consistent profitability over the past 9 years, further enhancing its attractiveness to investors.

Growth Rank Analysis

The company's Growth Rank is 7/10, reflecting steady growth in terms of revenue and profitability. The 5-year revenue growth rate is 3.60%, and the 3-year revenue growth rate is 5.70%, indicating a positive growth trajectory. The 5-year EBITDA growth rate is 3.00%, further demonstrating the company's growth potential.

GF Value Rank Analysis

The GF Value Rank of ESCO Technologies Inc is 5/10. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

ESCO Technologies Inc's Momentum Rank is 9/10, indicating strong momentum in its stock performance. This rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the company's ability to sustain its positive performance.

Competitor Analysis

When compared to its main competitors in the hardware industry, ESCO Technologies Inc stands out with its high GF Score. Itron Inc (NASDAQ:ITRI) has a GF Score of 57, Mesa Laboratories Inc (NASDAQ:MLAB) has a GF Score of 77, and Microvision Inc (NASDAQ:MVIS) has a GF Score of 51. This comparison further highlights the strong performance of ESCO Technologies Inc.

Conclusion

In conclusion, ESCO Technologies Inc's high GF Score of 87, robust financial strength, consistent profitability, steady growth, and strong momentum make it a compelling choice for investors. Its performance outshines its main competitors, further solidifying its position in the hardware industry. However, as with any investment, potential investors should conduct thorough research and consider various factors before making a decision.

This article first appeared on GuruFocus.