Espey Manufacturing & Electronics Corp (ESP): A Comprehensive Analysis of Dividend ...

Delving into ESP's Dividend History, Yield, and Growth Rates

Espey Manufacturing & Electronics Corp(ESP) recently announced a dividend of $0.15 per share, payable on 2023-10-10, with the ex-dividend date set for 2023-09-29. As investors eagerly await this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Leveraging data from GuruFocus, let's delve into Espey Manufacturing & Electronics Corps dividend performance and assess its sustainability.

Understanding Espey Manufacturing & Electronics Corp's Operations

Warning! GuruFocus has detected 2 Warning Signs with ESP. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

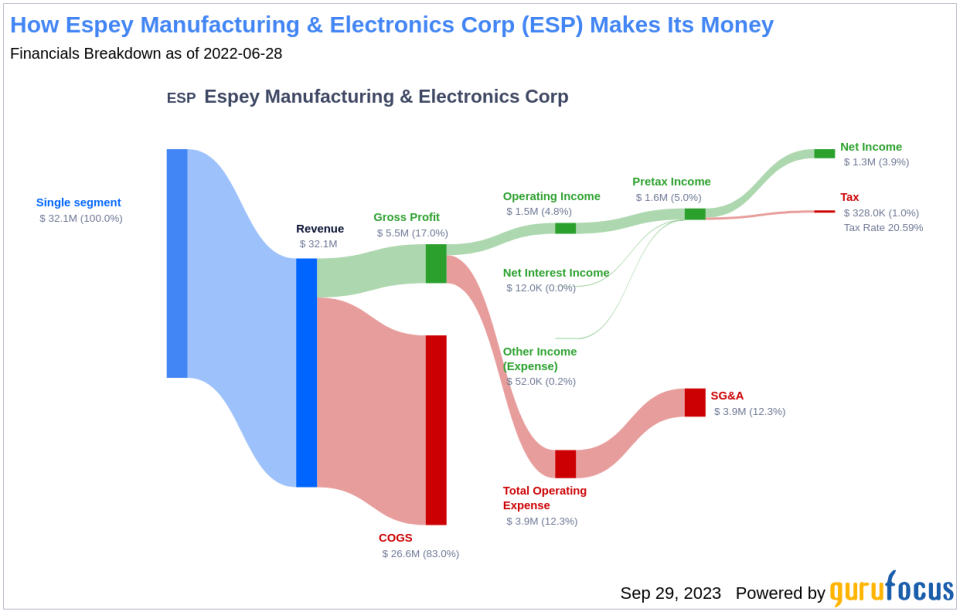

Espey Manufacturing & Electronics Corp designs, develops, tests, and manufactures specialized military and rugged industrial power supplies and transformers for use in harsh or severe environment applications. Its product portfolio includes power converters, power conditioning, high-voltage radar, contract manufacturing, custom engineering, and others. These products find applications in AC and DC locomotives, shipboard power, shipboard radar, airborne power, ground-based radar, and ground mobile power.

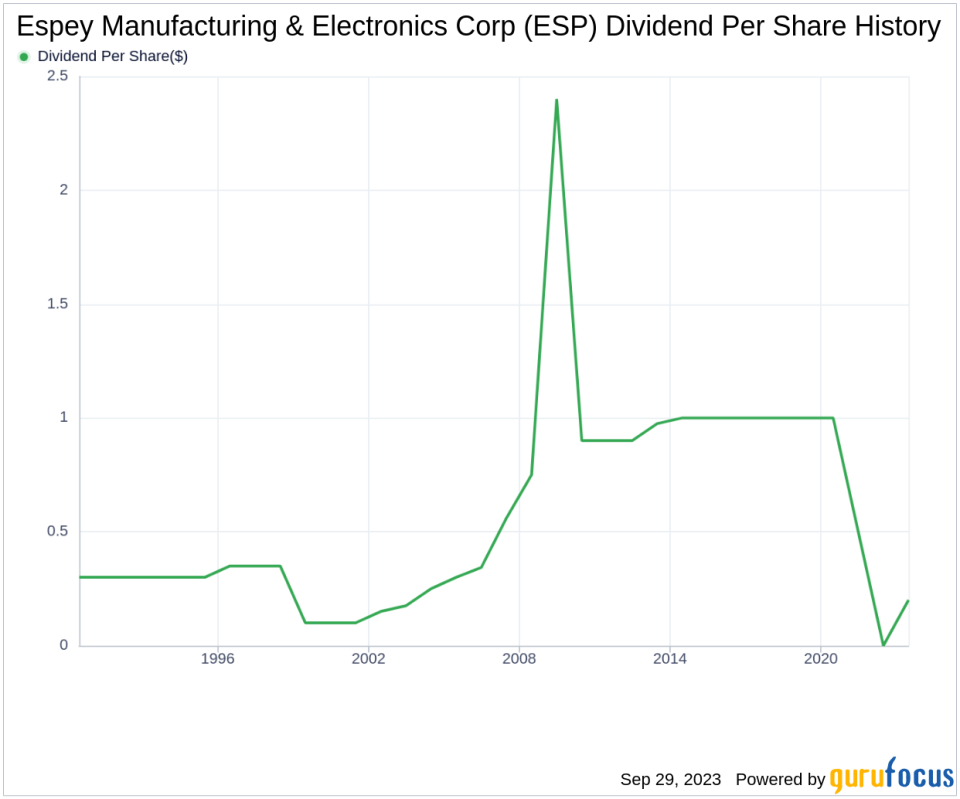

Overview of Espey Manufacturing & Electronics Corp's Dividend History

Espey Manufacturing & Electronics Corp has upheld a consistent dividend payment record since 2023, with dividends currently distributed on a quarterly basis. The following chart provides a historical perspective on the annual Dividends Per Share.

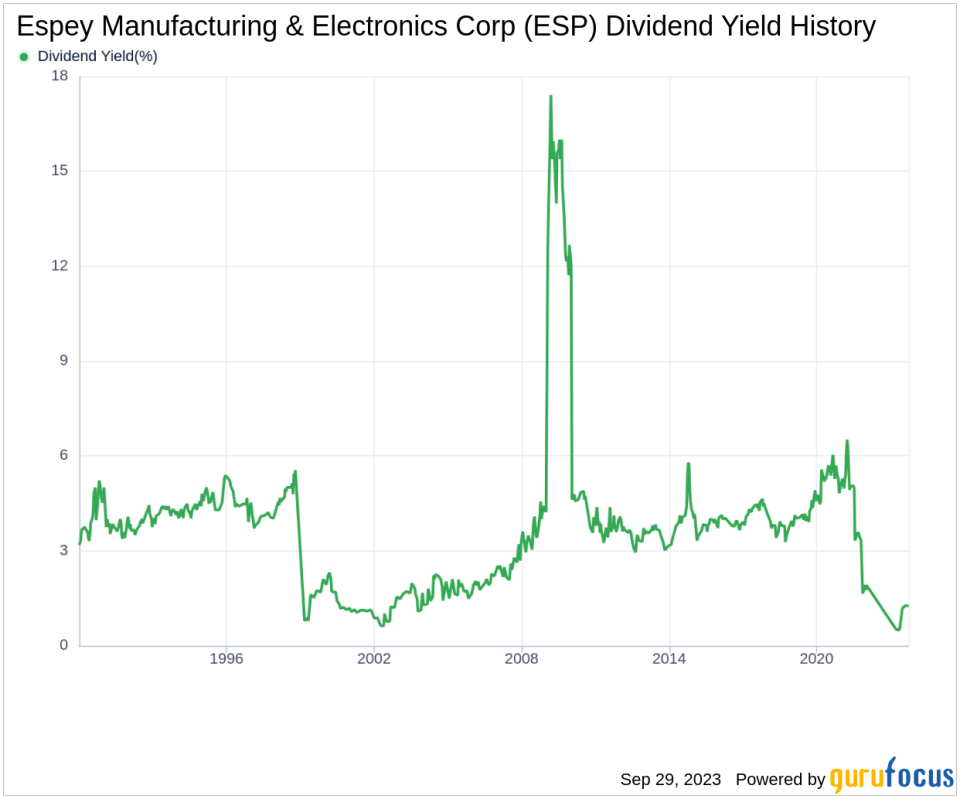

Scrutinizing Espey Manufacturing & Electronics Corp's Dividend Yield and Growth

As of today, Espey Manufacturing & Electronics Corp has a 12-month trailing dividend yield of 1.23% and a 12-month forward dividend yield of 2.19%. This suggests an expected increase in dividend payments over the next 12 months. However, the company's annual dividend growth rate over the past three years stands at -41.50%.

Based on Espey Manufacturing & Electronics Corp's dividend yield and five-year growth rate, the 5-year yield on cost of Espey Manufacturing & Electronics Corp stock as of today is approximately 1.23%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

Assessing the sustainability of dividends requires an understanding of the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio indicates that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Espey Manufacturing & Electronics Corp's dividend payout ratio is 0.13.

Espey Manufacturing & Electronics Corp's profitability rank of 7 out of 10 as of 2023-06-30 suggests good profitability prospects. The company has reported net profit in 9 out of the past 10 years.

Assessing Future Prospects: Growth Metrics

For dividends to be sustainable, a company must exhibit robust growth metrics. Espey Manufacturing & Electronics Corp's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors.

Espey Manufacturing & Electronics Corp's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. However, the company's 3-year EPS growth rate showcases a slower pace of earnings growth, a critical component for sustaining dividends in the long run.

Concluding Thoughts

Considering Espey Manufacturing & Electronics Corp's dividend payments, dividend growth rate, payout ratio, profitability, and growth metrics, it appears that the company has a balanced approach to sustaining dividends. However, the negative growth rate in recent years warrants careful monitoring. As always, potential investors are advised to conduct thorough research and consider their financial goals before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.