ESSA Bancorp Inc Reports Mixed Fiscal Q1 2024 Results Amid Rising Interest Rates

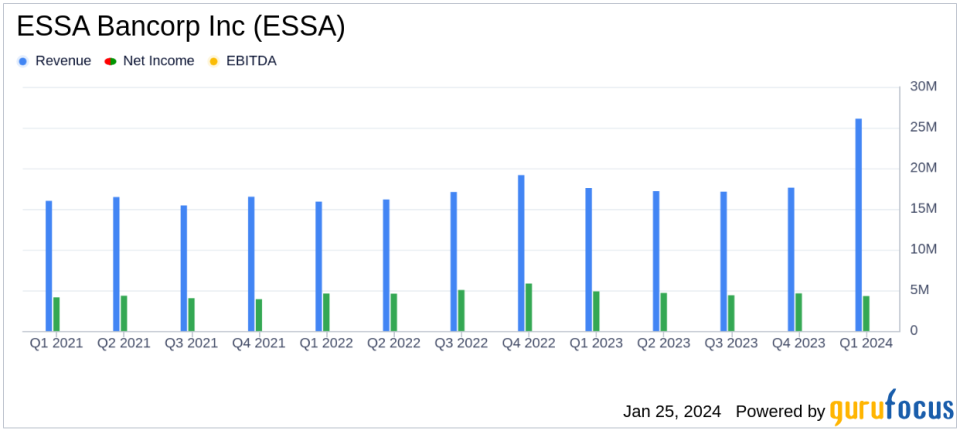

Net Income: ESSA Bancorp Inc (NASDAQ:ESSA) reported a net income of $4.3 million for Q1 2024, a decrease from $4.9 million in Q1 2023.

Earnings Per Share (EPS): Diluted EPS for Q1 2024 was $0.45, down from $0.50 in the same quarter last year.

Interest Income and Expense: Interest income rose to $26.1 million, while interest expenses increased significantly to $11.2 million due to higher interest rates.

Asset Quality: Nonperforming assets were slightly up at 0.64% of total assets, with a strong allowance for credit losses post-CECL adoption.

Loan Growth: Residential mortgage loans grew by 8% year-over-year, and commercial real estate loans increased by 20%.

Capital and Liquidity: Tier 1 capital ratio stood at 9.1%, with total stockholders equity increasing to $220.7 million.

On January 24, 2024, ESSA Bancorp Inc (NASDAQ:ESSA) released its 8-K filing, detailing the financial results for the fiscal first quarter ended December 31, 2023. The company, a full-service commercial and retail banking institution, reported a net income of $4.3 million, or $0.45 per diluted share, a decrease from the $4.9 million, or $0.50 per diluted share, reported in the same period last year. This decline is attributed to a significant increase in interest expenses, which rose to $11.2 million from $3.0 million, reflecting higher interest rates on deposits and short-term borrowings. Despite this, the company's asset quality remained robust, with low levels of nonperforming loans and negligible charge-offs.

ESSA Bancorp Inc is a holding company that operates through its subsidiary, ESSA Bank & Trust. It offers a range of financial services, including residential mortgage loans, commercial real estate loans, and commercial and industrial loans. The company also provides deposit accounts, asset management, trust services, and investment services, and operates ESSA Advisory Services, LLC, which offers insurance benefit consulting services.

Fiscal First Quarter 2024 Performance

The company's total interest income for the quarter increased to $26.1 million, up from $18.6 million a year earlier, driven by asset growth and a higher total yield on average interest-earning assets. However, the net interest income after the provision for credit losses decreased slightly to $14.9 million from $15.7 million in the first quarter of 2023. The net interest margin also contracted to 2.79% from 3.50% in the prior year's quarter.

Noninterest income saw a modest increase to $2.0 million, up from $1.9 million in the previous year, while noninterest expenses rose to $11.9 million from $11.4 million. The increase in noninterest expenses was primarily due to higher data processing costs, FDIC charges, and occupancy and equipment expenses.

Balance Sheet and Asset Quality

Total assets decreased slightly to $2.2 billion from $2.3 billion at the end of the previous quarter. The loan portfolio showed growth in residential and commercial real estate loans, while commercial loan levels declined. Asset quality indicators remained strong, with nonperforming assets representing 0.64% of total assets, and the allowance for credit losses to total loans standing at 0.90% after the adoption of the CECL accounting standard.

Deposits decreased to $1.59 billion from $1.66 billion, with a shift in the composition of core deposits. Borrowings also saw a slight decrease. The company's capital position remained solid, with a Tier 1 capital ratio of 9.1%, and stockholders equity increased to $220.7 million, up from $219.7 million at the end of the previous quarter.

ESSA Bancorp Inc's President and CEO, Gary S. Olson, commented on the results, emphasizing the company's sound earnings and shareholder value, diligent margin management, and superior asset quality. Olson also highlighted the company's focus on efficient operations, earning and retaining new deposits, and managing margins to support growth in value measures.

"The Company delivered sound earnings and shareholder value in fiscal first quarter 2024, which reflected diligent margin management, superior asset quality and continued emphasis on efficient and productive operations. The Bank demonstrated relative consistency in consecutive quarter margins and interest spread in a stabilizing interest rate environment," said Gary S. Olson, President and CEO of ESSA Bancorp Inc.

For investors and potential GuruFocus.com members, ESSA Bancorp Inc's latest earnings report presents a mixed picture. While net income has decreased due to rising interest expenses, the company's strong asset quality and strategic focus on efficiency and growth in a challenging interest rate environment may offer reassurance. The full financial tables and additional details can be found in the company's 8-K filing.

Explore the complete 8-K earnings release (here) from ESSA Bancorp Inc for further details.

This article first appeared on GuruFocus.