Essent Group Ltd (ESNT) Reports Solid Q4 and Full Year 2023 Earnings; Increases Dividend

Net Income: Q4 net income reached $175.4 million, with full-year net income at $696.4 million.

Earnings Per Share (EPS): Q4 EPS stood at $1.64, while full-year EPS was $6.50.

Dividend: Quarterly cash dividend increased to $0.28 per common share.

New Insurance Written: Q4 saw $8.8 billion in new insurance written, a decrease from previous quarters.

Investment Income: Net investment income for Q4 was $50.6 million, marking a 34% increase from Q4 2022.

Insurance in Force: Reached $239.1 billion as of December 31, 2023.

Return on Average Equity: 14.6% for the full year 2023.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

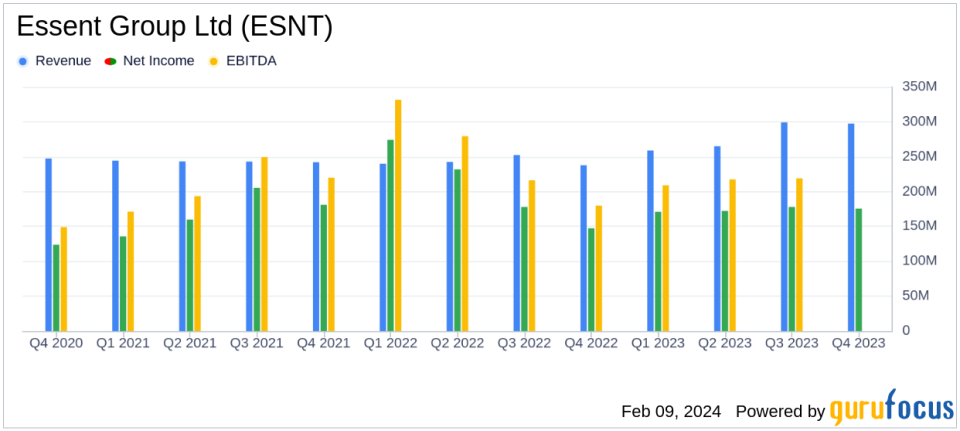

On February 9, 2024, Essent Group Ltd (NYSE:ESNT) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a net income of $175.4 million for the quarter, translating to $1.64 per diluted share, and a full-year net income of $696.4 million, or $6.50 per diluted share. This performance demonstrates a slight decrease from the previous year's net income of $831.4 million, or $7.72 per diluted share.

Essent Group Ltd is a prominent private mortgage insurance company in the United States, offering credit protection to lenders and mortgage investors. The company's services are crucial in the housing finance industry, enabling lenders to provide more mortgage financing to prospective homeowners. Essent operates across all 50 states and the District of Columbia, writing mortgage guaranty coverage and supporting the stability of the housing market.

Financial Performance and Challenges

The company's financial performance in the fourth quarter and throughout 2023 was marked by favorable credit performance and higher interest rates, which contributed to the solid results. However, Essent faced challenges such as a decrease in new insurance written, which dropped from $13.0 billion in Q4 2022 to $8.8 billion in Q4 2023. This decline reflects broader market trends and could signal a cooling in the housing market or increased competition.

Financial Achievements

One of the key financial achievements for Essent in 2023 was the significant increase in net investment income, which rose by 50% from the previous year, reaching $186.1 million. This growth is indicative of the company's effective investment strategies and the favorable rate environment. Additionally, Essent's insurance in force grew to $239.1 billion, up from $227.1 billion at the end of 2022, showcasing the company's ability to expand its coverage and market presence.

Key Financial Metrics

Essent's financial stability is further underscored by its strong balance sheet, with total assets amounting to $6.4 billion as of December 31, 2023. The company's return on average equity (ROAE) for the year was a robust 14.6%, reflecting its profitability and efficiency in generating shareholder value. Moreover, Essent's disciplined underwriting approach is evident in its low percentage of loans in default, which stood at 1.80% at the end of 2023.

"We are pleased with our fourth quarter and full year 2023 financial results, which benefited from favorable credit performance and higher interest rates," said Mark A. Casale, Chairman and Chief Executive Officer. "Our results continue to demonstrate the earnings power of our business and provide us with attractive levels of operating cash flows, indicating the overall strength and stability of our franchise."

Analysis of Company's Performance

Essent's performance in 2023, despite a decrease in new insurance written, reflects a company that has managed to navigate a challenging economic environment effectively. The increase in net investment income and insurance in force, coupled with a stable loan default rate, suggests that Essent maintains a strong position within the mortgage insurance industry. The company's ability to increase its quarterly dividend also signals confidence in its financial health and commitment to delivering shareholder value.

Essent Group Ltd's strategic focus on underwriting quality and risk management, as well as its solid financial position, positions it well for future growth and resilience in the face of economic uncertainties. Investors and stakeholders can look forward to the company's continued performance with cautious optimism.

For a more detailed breakdown of Essent Group Ltd's financial results and to access the full earnings report, please visit the company's investor relations website.

Explore the complete 8-K earnings release (here) from Essent Group Ltd for further details.

This article first appeared on GuruFocus.