Essex Property Trust Inc: A Detailed Analysis of Dividend Performance and Sustainability

Assessing the Dividend History, Yield, Growth, and Future Prospects of ESS

Essex Property Trust Inc (NYSE:ESS) recently announced a dividend of $2.31 per share, payable on 2023-10-13, with the ex-dividend date set for 2023-09-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Essex Property Trust Inc's dividend performance and assess its sustainability.

Company Overview: Essex Property Trust Inc

Warning! GuruFocus has detected 5 Warning Signs with ESS. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

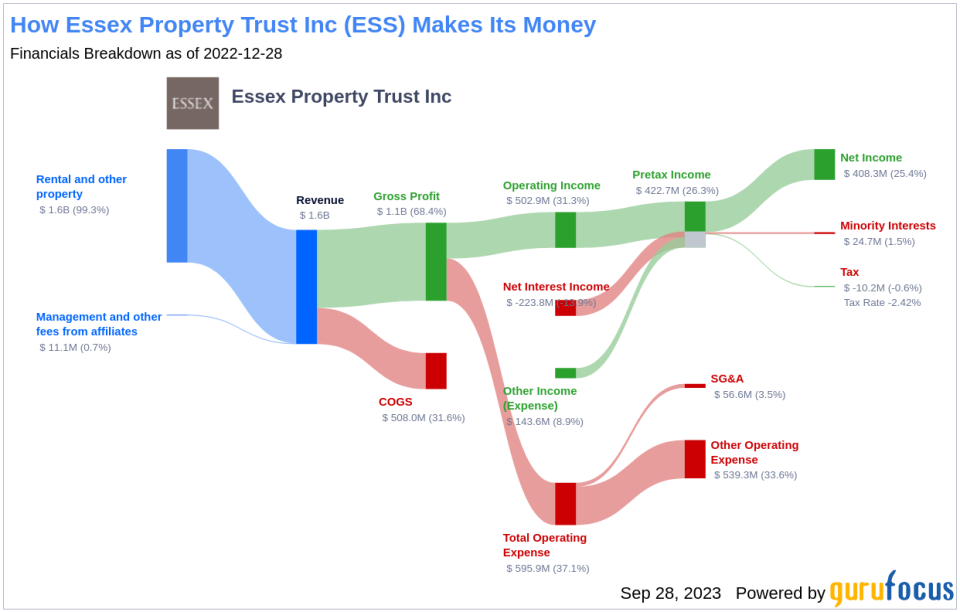

Essex Property Trust owns a portfolio of 252 apartment communities with over 62,000 units and is developing another property with 264 units. The company focuses on owning large, high-quality properties on the West Coast in the urban and suburban submarkets of Southern California, Northern California, and Seattle.

Understanding Essex Property Trust Inc's Dividend History

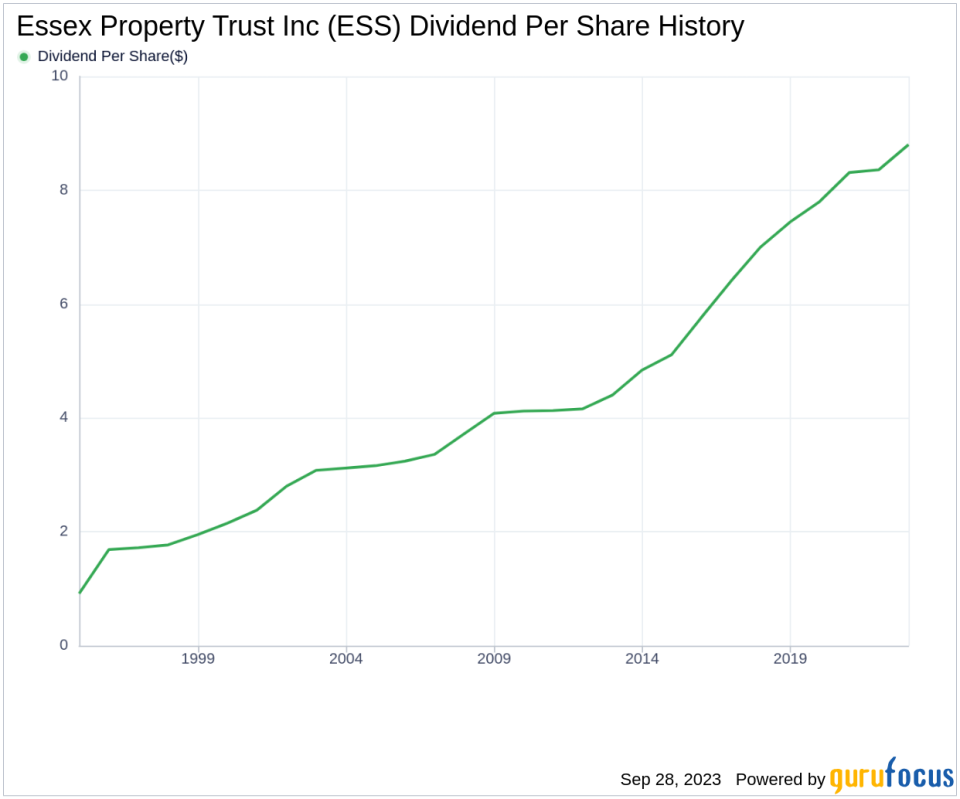

Essex Property Trust Inc has maintained a consistent dividend payment record since 1994. Dividends are currently distributed on a quarterly basis. The company has increased its dividend each year since 1994, earning it the status of a dividend aristocrat.

Examining Essex Property Trust Inc's Dividend Yield and Growth

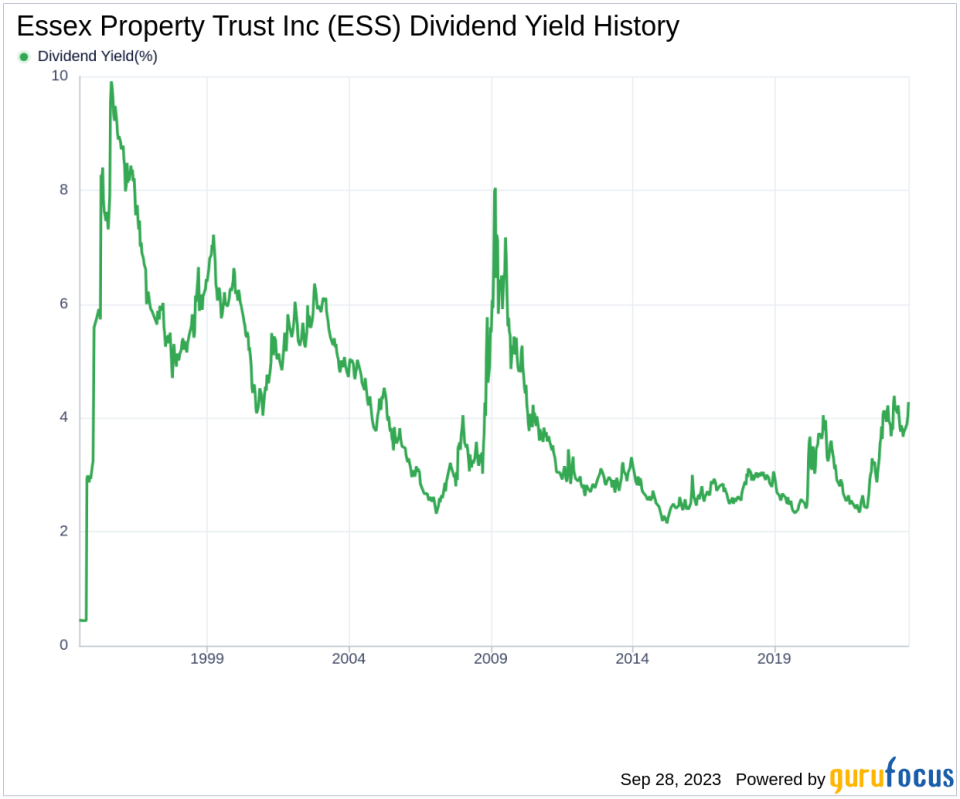

As of today, Essex Property Trust Inc currently has a 12-month trailing dividend yield of 4.29% and a 12-month forward dividend yield of 4.39%, suggesting an anticipated increase in dividend payments over the next 12 months. The company's dividend yield stands out as an attractive proposition for income investors, outperforming 19.23% of global competitors in the REITs industry.

Over the past three years, Essex Property Trust Inc's annual dividend growth rate was 4.10%, increasing to 4.60% per year over a five-year horizon. Over the past decade, the company's annual dividends per share growth rate stands at 7.40%.

Is Essex Property Trust Inc's Dividend Sustainable?

The sustainability of a dividend can be assessed by evaluating the company's payout ratio. As of 2023-06-30, Essex Property Trust Inc's dividend payout ratio is 1.10, suggesting potential challenges in sustaining the dividend. However, the company's high profitability rank of 8 out of 10 and a consistent record of positive net income over the past decade provide some reassurance.

Future Outlook: Essex Property Trust Inc's Growth Metrics

Essex Property Trust Inc's robust growth rank of 8 out of 10, combined with a strong revenue model and a positive 3-year EPS growth rate, suggest a promising future for the company. The company's 5-year EBITDA growth rate of 2.20% further solidifies its strong growth prospects.

Conclusion: A Balanced View on Essex Property Trust Inc's Dividend Performance

In conclusion, while Essex Property Trust Inc's high payout ratio raises questions about the sustainability of its dividend, the company's strong growth metrics, consistent dividend history, and high dividend yield present a compelling case for income investors. The company's performance in these areas underlines its commitment to returning value to its shareholders. However, investors are advised to keep a close eye on the company's payout ratio and net income trends, as these factors will play a crucial role in the sustainability of future dividends.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.