This ETF Should Like the Intercept Pharma News

Shares of Intercept Pharmaceuticals (ICPT) surged nearly 29% during Thursday’s after-hours session after the company investigational product obeticholic acid (OCA) landed “breakthrough therapy designation” from the U.S. Food and Drug Administration (FDA) for the treatment of patients with nonalcoholic steatohepatitis (NASH) with liver fibrosis, according to a statement.

“The breakthrough therapy designation was created by the FDA to speed the availability of new therapies for serious or life-threatening conditions. Drugs qualifying for this designation must show credible evidence of a substantial improvement on a clinically significant endpoint over available therapies, or over placebo if there is no available therapy. The designation confers several benefits, including intensive FDA guidance and discussion and eligibility for submission of a rolling NDA,” said Intercept in the statement.

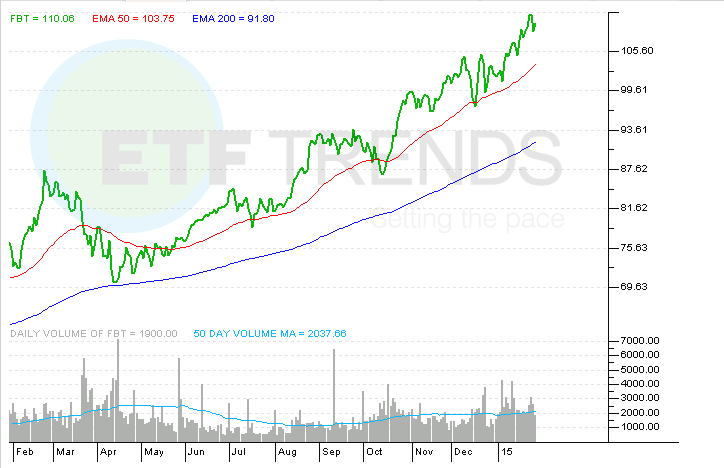

Good news for Intercept could prove to be good news for the already hot First Trust NYSE Arca Biotechnology Index Fund (FBT) . Of the five largest and oldest biotechnology exchange traded funds, FBT is currently the only one with a noteworthy weight to Intercept. The stock has a 3.7% weight in FBT, making it the ETF’s second-largest holding behind Pharmacyclics (PCYC) at 3.74%. [Tis The Season for Biotech ETFs]

FBT does not need the good news, but it is likely to be appreciated by the ETF’s investors. In 2014, each of the five major biotech ETFs ranked among the year’s top 10 sector ETFs and that group was led by FBT, which surged 47.5%.

FBT has followed up that stellar showing a gain of almost 8% to start 2015 and after adding $627 million in new assets last year, the ETF has seen 2015 inflows of $243 million. While all biotech ETFs have benefited this year from a spate of Food and Drug Administration approvals and a wave of mergers and acquisitions, FBT has frequently found itself at the right place at the right time.

Last year, FBT benefited from positive news from Vertex’s Phase III trials for its cystic fibrosis treatment, Puma confirming its experimental breast cancer treatment, neratinib, proved successful in a Phase III trial, Roche’s acquisition of InterMune and, most recently, Dow component Merck (MRK) announcing it will acquire Cubist Pharmaceuticals (CBST) for $9.5 billion. As for Intercept, the stock has been known to move biotech ETFs even when it is not a big part of those funds. On Jan. 9, 2014, the stock nearly quadrupled company’s liver disease treatment proved successful.

That sent shares of the SPDR S&P Biotech ETF (NYSEArca: XBI ) up 7% even though that ETF had a mere 1.6% weight to Intercept at the time of that announcement. [The One ETF Benefiting from the Intercept News]

First Trust NYSE Arca Biotechnology Index Fund

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.