ETF Scorecard: February 8 Edition

To help investors keep up with the markets, we present our ETF Scorecard. The Scorecard takes a step back and looks at how various asset classes across the globe are performing. The weekly performance is from last Friday’s open to this week’s Thursday close.

The biggest news this week was President Donald Trump’s State of the Union address, in which he praised the progress on signing a fresh trade deal with China. Trump said the new accord would have to protect American jobs while reducing U.S. trade deficit with the country. Trump and his Chinese counterpart Xi Jinping will meet later this month. The Bank of England has kept interest rates unchanged at 0.75% amid uncertainty regarding Brexit and increasing chances of a no deal with the European Union. The central bank forecasted the weakest economic growth rate in ten years for 2019, downgrading its expectations from 1.7% to 1.2% growth. The bank also sees a higher likelihood of the economy falling into recession in the second half of this year. European inflation is heading down, with the consumer price index falling from 1.6% to 1.4% in January. Energy prices have risen the most, up 2.6%, followed by food, alcohol and tobacco. Core inflation remained flat at 1.4%. In the U.S., another blockbuster jobs report has thrilled investors. The economy added 312,000 jobs in January compared with 165,000 forecasted. However, the strong figure for the prior month was revised down to 222,000. The unemployment rate grew from 3.9% to 4%, as the government shutdown forced some workers to join the ranks of the unemployed. Average hourly earnings, meanwhile, advanced 0.1% in January versus 0.3% expected, falling from 0.4% in December. The ISM Manufacturing PMI increased from 54.1 to 56.6, a sign sentiment in the industry is improving. Meanwhile, the Non-Manufacturing PMI slipped for the third consecutive month, from 57.6 to 56.7. Just in October, the index was hovering around ten-year highs. U.S. unemployment claims came in at 234,000 for the week ended February 2, down from 253,000 in the prior week.

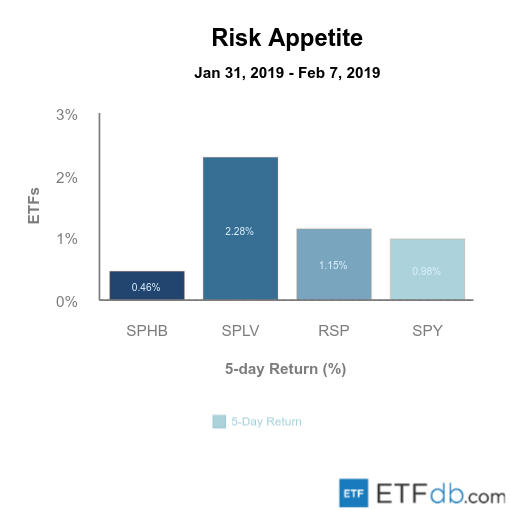

Risk Appetite Review

Markets posted a broad rally this week. The broad market (SPY A) advanced nearly 1% for the past five days and is among the strongest performers. Low volatility assets (SPLV A) surged 2.28% for the week, recording the best performance from the pack as investors shifted toward safer assets. Risk assets (SPHB B-) was the poorest performer, with a rise of just 0.46%.

Sign up for ETFdb.com Pro and get access to real-time ratings on over 1,900 U.S.-listed ETFs.

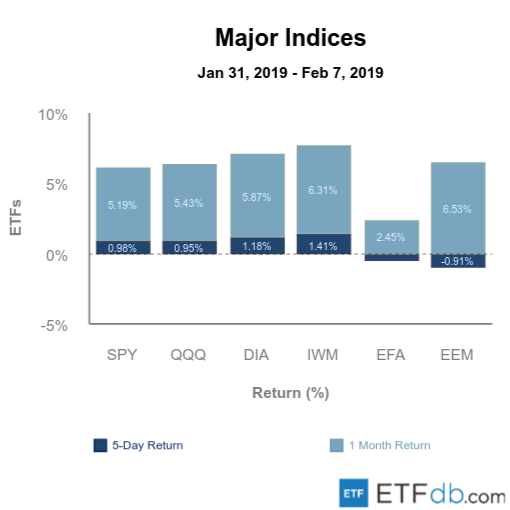

Major Index Review

Major indexes were mixed. Small-cap stocks (IWM B+) recorded the biggest rally this week, up 1.41%. Meanwhile, emerging markets (EEM A-) declined 0.91%, but it is still the best performer for the rolling month, up 6.53%. The index containing European and Australasians stocks (EFA A) remains the worst performer for the rolling month, up just 2.45%.

To see how these indices performed over the past year, check out ETF Scorecard: February 1 Edition.

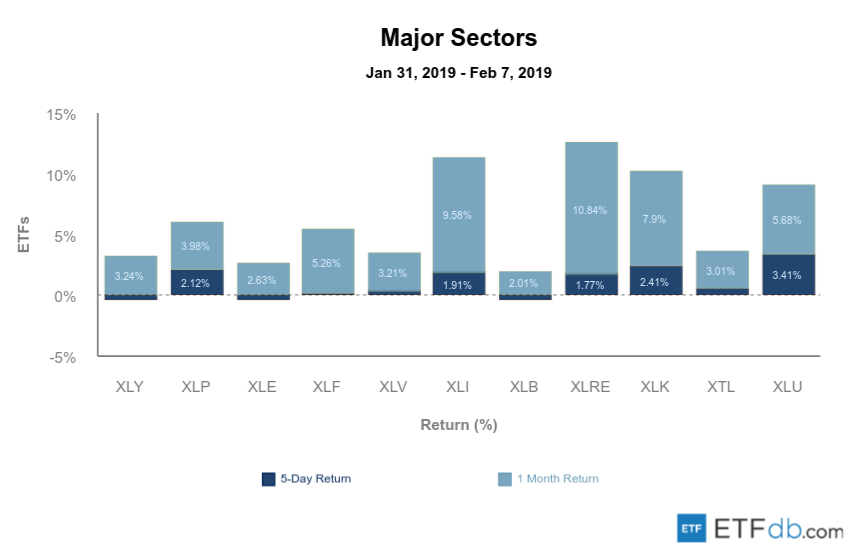

Sectors Review

Sectors posted mixed performance. In a sign investors are increasingly flocking to safety, utilities (XLU A) advanced 3.41% for the week, the strongest performance from the pack. The materials sector (XLB A), meanwhile, was the biggest faller, down 0.47%. The drop made (XLB A) the poorest performer for the rolling month as well, up just 2%. The real estate sector (XLRE ) posted a blockbuster performance for the rolling month, surging as much as 10%.

Use our Head-to-Head Comparison tool to compare two ETFs such as (XLU A) and (XLRE ) on a variety of criteria such as performance, AUM, trading volume and expenses.

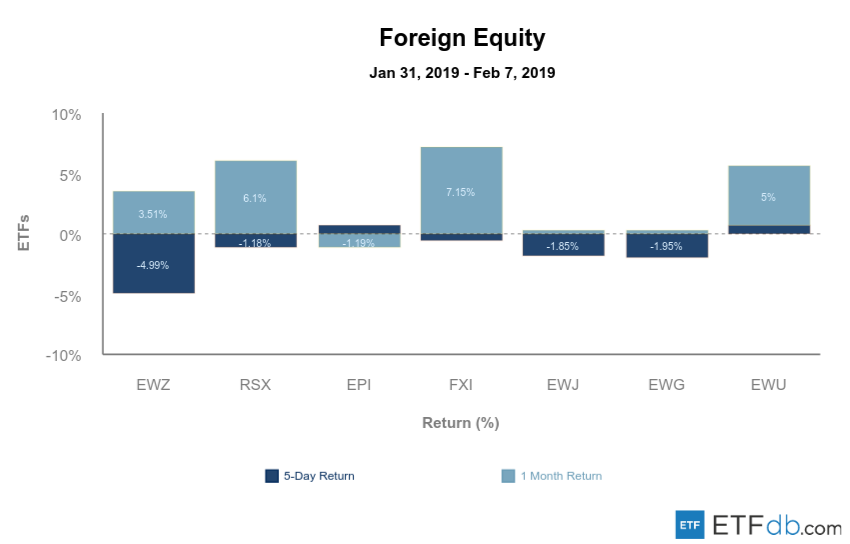

Foreign Equity Review

Foreign equities were almost all down. Britain (EWU A-) was surprisingly the best performer for the week, jumping 0.76%. After weeks of strong returns, Brazilian stocks (EWZ B+) are now the worst performers for the week, down nearly 5%. For the rolling month, India (EPI B+) is the only index that posted negative returns, while China (FXI A-) is the best performer with a gain of 7.15%.

To find out more about ETFs exposed to particular countries, check out our ETF Country Exposure tool. Select a particular country from a world map and get a list of all ETFs tracking your pick.

Commodities Review

Commodities were all down. The agricultural fund (DBA A) posted the smallest loss from the pack, slipping just 0.47% for the week. Natural gas (UNG B-) tumbled 10.6% for the past five days, despite low temperatures in parts of the U.S. and falling inventories. (UNG B-) is also the worst performer for the rolling month with a loss of 8.57%. Crude oil (USO A) is the best performer for the past 30 days, rising as much as 6.14%.

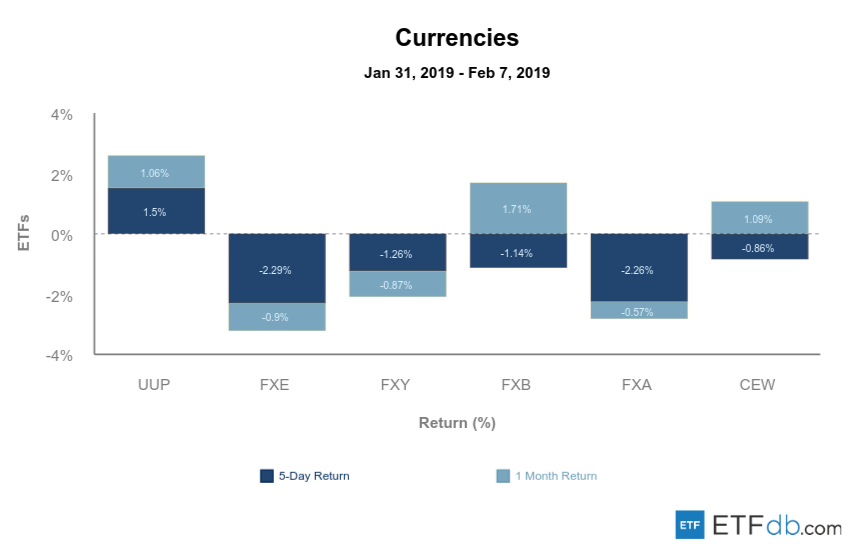

Currency Review

The U.S. dollar (UUP A) was the king this week, being the only riser with a gain of 1.50%. The European shared currency (FXE A) is the worst performer with a fall of 2.29%. The euro is also the worst performer for the rolling month, down 0.90%. The strongest performer for the rolling month is the British pound (FXB A-), which increased 1.71% despite the high likelihood of Britain leaving the EU without a deal.

For more ETF analysis, make sure to sign up for our free ETF newsletter.

Disclosure: No positions at time of writing.