ETF Scorecard: September 7 Edition

To help investors keep up with the markets, we present our ETF Scorecard. The Scorecard takes a step back and looks at how various asset classes across the globe are performing. The weekly performance is from last Friday’s open to this week’s Thursday close.

A Brexit withdrawal treaty is much more likely to be achieved after Germany dropped its demand to have a future trade deal in place before the March 29 deadline. This means that chief aspects of the post-Brexit relationship between Britain and Europe will be negotiated later, during the two-year transition period. Emerging markets have moved into bear market territory this week, raising the prospects of contagion into developed markets. European inflation dropped to 2% in August from 2.1% in the prior month, hitting the European Central Bank’s target. But the ECB is not in a hurry to tighten monetary policy as core inflation hovers around 1%. The rise in inflation is largely due to higher energy prices, a temporary effect. British manufacturing PMI declined to 52.8 in August from 53.8 as fears of a no-Brexit deal has weighed on sentiment. The index reached a two-year low, with such levels not seen since the Brexit referendum vote. Meanwhile, British services PMI improved to 54.3 in August from 53.5. Analysts had expected a figure of 53.9. In the U.S., ISM’s manufacturing sentiment hit 61.6, a level not seen since March 2011, in a sign that the U.S. economy is firing on all cylinders. Analysts had forecasted a rise of 57.6. U.S. non-manufacturing PMI surged to 58.5 from 55.7, but the index is still lower compared to July. ADP forecasted the U.S. economy added 163,000 jobs in August, down from a revised 217,000 in July and lower compared with 195,000 forecasted by analysts. Crude oil inventories continued their drop this week, the third in a row. U.S. stockpiles dropped 4.3 million.

Risk Appetite Review

Risk assets (SPHB B-) had a bad week amid fears of contagion from an emerging markets selloff. (SPHB B-) dropped 1.86%, the worst performance from the pack. Low volatility assets (SPLV A) were in vogue, rising 1.13%. The broad market (SPY A) declined 0.58%. Sign up for ETFdb.com Pro and get access to real-time ratings on over 1,900 U.S.-listed ETFs.

Major Index Review

Major indexes were all down with one exception. Unsurprisingly, emerging markets (EEM A-) were hit the most, shedding 2.63% of their value in the past five days. A strong dollar combined with rising U.S. interest rates and American protectionism has deteriorated emerging markets’ prospects. Emerging markets are also the worst performers for the rolling month, down 5.9%. At the other end of the spectrum is blue-chip index Dow Jones (DIA A-), which rose 0.27%. Investors were allured by the index’s relative safety. (DIA A-) is also the best monthly performer, up 1.68%. To see how these indices performed a week before last, check out ETF Scorecard: August 31 Edition.

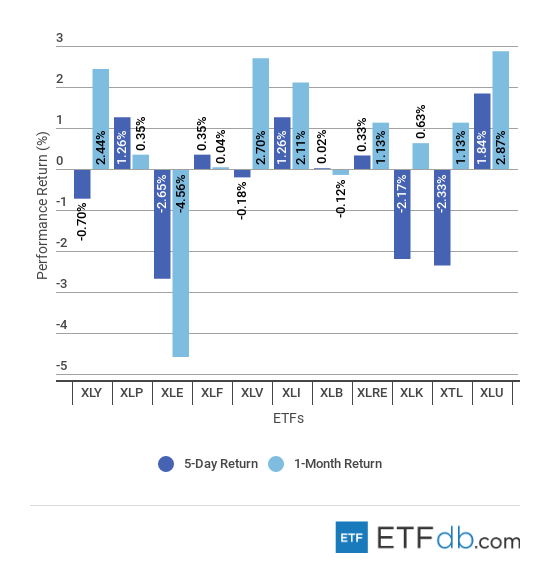

Sectors Review

Dragged down by oil and natural gas, the energy sector (XLE A) is the worst performer for the week with a decline of 2.65%. Combined with losses posted in previous weeks, (XLE A) became the worst performer for the rolling month as well, down 4.56%. Utilities (XLU A) are up 1.84% for the week, beating all other sectors, as investors sought safe-haven assets. (XLU A) is also the best monthly performer with a rise of 2.87%. Use our Head-to-Head Comparison tool to compare two ETFs such as (XLE A) and (XLU A) on a variety of criteria such as performance, AUM, trading volume and expenses.

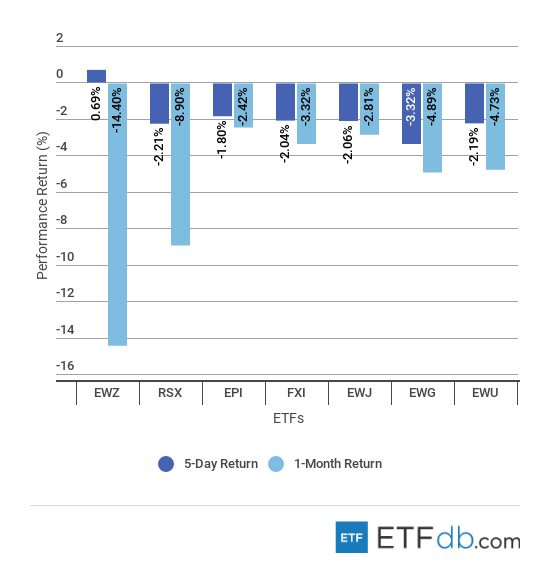

Foreign Equity Review

Foreign markets are almost all down. Brazil (EWZ B+) managed to deliver the surprise, advancing 0.69% for the week, the only asset to post gains. Yet Brazil is no safe haven. (EWZ B+) remains the worst monthly performer, tumbling as much as 14.4%. Germany (EWG B+) is decidedly the worst performer for the week, down 3.32%, amid a selloff in most foreign markets. India (EPI B+) is the best monthly performer, dropping just 2.42%. To find out more about ETFs exposed to particular countries, use our ETF Country Exposure tool. Select a particular country from a world map and get a list of all ETFs tracking your pick.

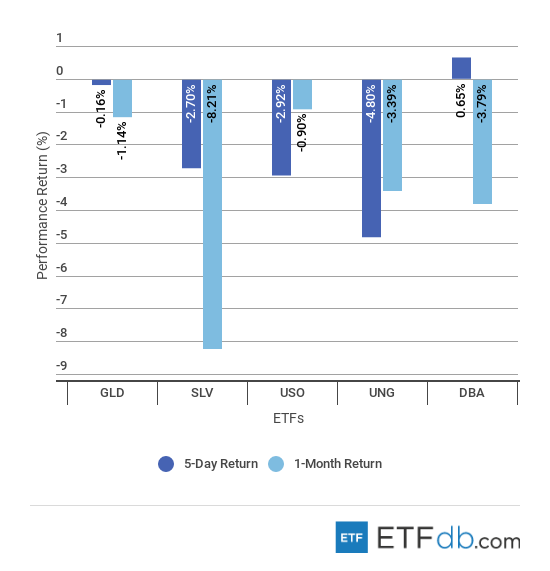

Commodities Review

Commodities were mostly in the red. The agricultural fund (DBA A) acted as a safe haven in a deep selloff, rising 0.65% for the week. Natural gas (UNG B-), meanwhile, is down 4.80% despite a U.S. inventory report that was in line with expectations. Silver (SLV C+) remains the worst monthly performer, declining as much as 8.21%. Thanks to strong gains in previous weeks, crude oil (USO A) posted the strongest performance for the rolling month, still dropping 0.90%.

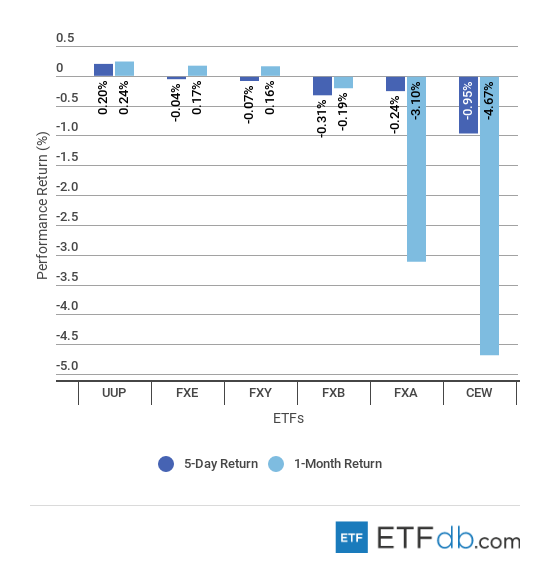

Currency Review

Currencies were all down, except the U.S. dollar. The U.S. dollar (UUP A) has advanced 0.20% for the week, extending monthly gains to 0.24%. A strong U.S. economy has increased bets that the Federal Reserve will hike interest rates at a faster pace than previously expected. Emerging markets currencies (CEW A) dropped the most this week, down 0.95%. Unsurprisingly, (CEW A) is also the worst performer for the rolling month with a decline of 4.67%.

For more ETF analysis, make sure to sign up for our free ETF newsletter.

Disclosure: No positions at time of writing.