Ethan Allen Interiors Inc (ETD) Faces Sales Decline but Maintains Strong Margins in Q2 Fiscal 2024

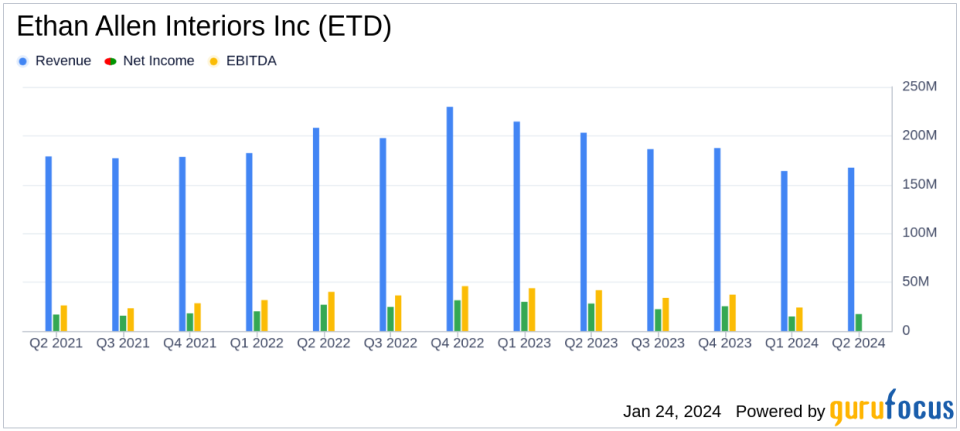

Net Sales: Reported at $167.3 million, a decrease of 17.7% from the previous year.

Gross Profit: Reached $100.6 million, down 18.9% year-over-year, with a gross margin of 60.2%.

Operating Income: GAAP operating income stood at $21.7 million, a 41.5% decline from the prior year.

Net Income: GAAP net income was $17.4 million, a decrease of 38.2% year-over-year.

Diluted EPS: GAAP diluted EPS came in at $0.68, compared to $1.10 in the previous year.

Cash and Investments: Ended the quarter with $167.8 million, a slight decrease from $172.7 million at the end of the last fiscal year.

Dividends: Paid out $31.1 million in cash dividends, including a special cash dividend and an increased regular quarterly dividend.

Ethan Allen Interiors Inc (NYSE:ETD) released its 8-K filing on January 24, 2024, detailing its financial results for the fiscal second quarter ended December 31, 2023. The company, known for its high-quality home furnishings and interior design services, reported a decrease in net sales by 17.7% to $167.3 million compared to the same period last year. Despite the sales downturn, Ethan Allen highlighted its strong gross margin of 60.2%, an improvement from 55.2% five years ago, and a robust balance sheet with $167.8 million in cash and investments.

Company Overview

Ethan Allen Interiors Inc. is a prominent U.S.-based company that designs, manufactures, and retails home furnishings and accessories. With a vertically integrated business model, Ethan Allen operates through its subsidiary, Ethan Allen Global, Inc., and its subsidiaries. The company's operations span across North America, Europe, Asia, and the Middle East, with a significant portion of its products produced in U.S. plants. Ethan Allen's business is divided between its Wholesale and Retail segments, with upholstered products generating the majority of wholesale revenue and the retail segment contributing the most to the company's overall revenue. The U.S. remains the largest market for Ethan Allen's products.

Financial Performance and Challenges

ETD's Chairman, President, and CEO, Farooq Kathwari, commented on the company's performance, noting the impact of the post-pandemic economy on sales but emphasizing the strength of gross and operating margins and the balance sheet. He remarked on the strategic initiatives undertaken during the pandemic, including investments in talent, marketing, service, technology, and social responsibility. Kathwari also highlighted the repositioning of the company's 173 North American design centers and continued investment in manufacturing and logistics.

"We are pleased to report our financial and operating results for the fiscal 2024 second quarter ended December 31, 2023, marked by lower sales, strong gross and operating margins and a robust balance sheet," said Farooq Kathwari, Ethan Allens Chairman, President, and CEO.

The company's financial achievements, such as the increased gross margin and strong cash position, are significant in the Furnishings, Fixtures & Appliances industry, where margins can be pressured by fluctuating raw material costs and consumer demand. ETD's ability to maintain a high gross margin indicates effective cost management and a strong value proposition to its customers.

Financial Details and Metrics

Key financial details from the Income Statement and Balance Sheet include:

Net sales for the quarter were $167.3 million, a decrease from the previous year's $203.2 million.

Gross profit was reported at $100.6 million, with a gross margin of 60.2%.

GAAP operating income stood at $21.7 million, while adjusted operating income was $21.5 million.

GAAP net income was $17.4 million, with a GAAP diluted EPS of $0.68.

Cash flows from operating activities were $13.6 million, up significantly by 439.9% from the previous year.

ETD's balance sheet remained strong with no debt outstanding as of December 31, 2023. The company's cash and investments totaled $167.8 million, despite a decrease due to cash dividends paid and capital expenditures. Inventory levels were managed down by 11.5% to $140.9 million, aligning with incoming order trends while maintaining service levels for customer orders.

Dividends and Shareholder Returns

Ethan Allen has continued its tradition of returning capital to shareholders through dividends. During the quarter, the company paid $31.1 million in cash dividends, including a special cash dividend of $12.7 million, or $0.50 per share, and regular quarterly cash dividends of $18.4 million, or $0.36 per share. This represents a 12.5% increase from the previous year's regular quarterly dividend.

Conclusion and Outlook

While Ethan Allen faces challenges in the post-pandemic economy, the company's strong margins and balance sheet position it well for the future. The focus on interior design services, technology, and a strong logistics network supports its strategy as the Interior Design Destination. With a cautious yet optimistic outlook, ETD is poised to continue its journey in the home furnishings industry.

For more detailed information and to participate in the conference call discussing these results, investors and analysts can visit Ethan Allen's Investor Relations website at https://ir.ethanallen.com.

Explore the complete 8-K earnings release (here) from Ethan Allen Interiors Inc for further details.

This article first appeared on GuruFocus.