Eton Pharmaceuticals (NASDAQ:ETON) shareholders have endured a 42% loss from investing in the stock a year ago

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Eton Pharmaceuticals, Inc. (NASDAQ:ETON) shareholders over the last year, as the share price declined 42%. That's disappointing when you consider the market returned 27%. Even if you look out three years, the returns are still disappointing, with the share price down31% in that time. Even worse, it's down 24% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Eton Pharmaceuticals

Eton Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Eton Pharmaceuticals saw its revenue grow by 3,694%. That's well above most other pre-profit companies. The share price drop of 42% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

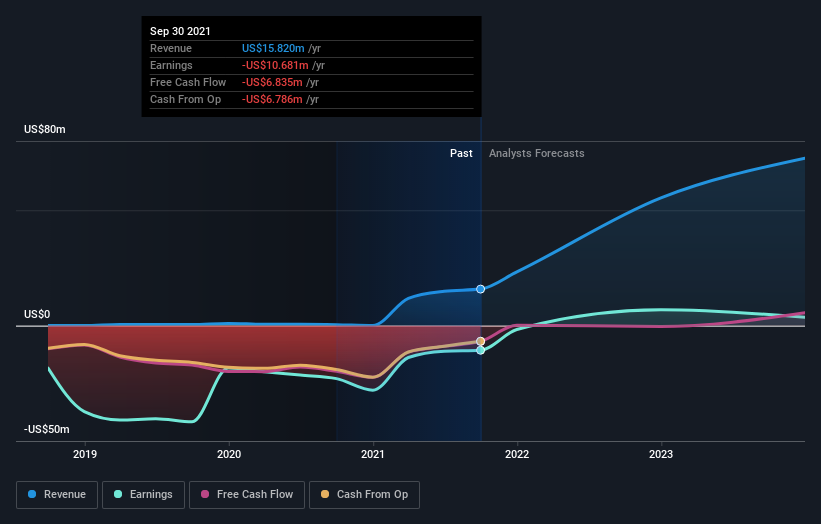

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, Eton Pharmaceuticals shareholders took a loss of 42%. In contrast the market gained about 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 9% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Eton Pharmaceuticals , and understanding them should be part of your investment process.

Of course Eton Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.