Etsy Inc (ETSY) Reports Record Quarterly Revenue Amidst GMS Decline

Consolidated Gross Merchandise Sales (GMS): Slight year-over-year decline to $13.16 billion.

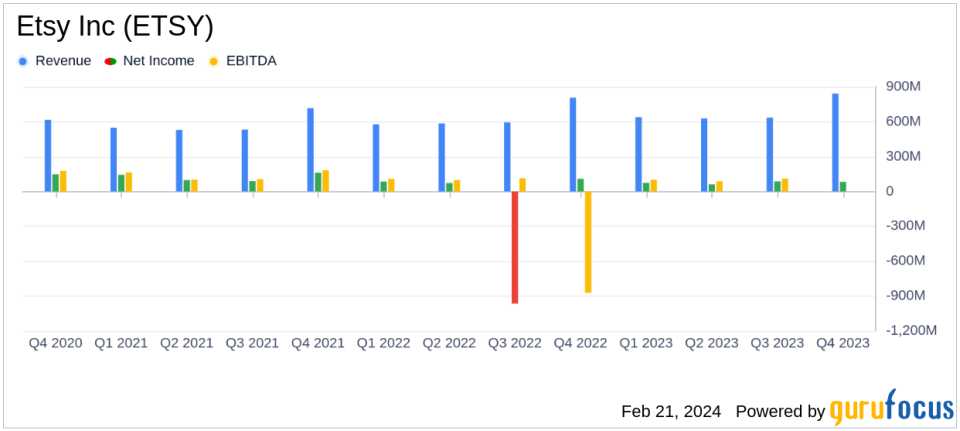

Revenue: Record high at $842.3 million for Q4, up 4.3% year-over-year.

Net Income: Decreased by 24% year-over-year to $83.3 million in Q4.

Adjusted EBITDA: Reached a record $235.5 million in Q4, margin relatively flat year-over-year.

Active Buyers: Increased to 96.5 million, up 1.5% year-over-year.

Stock Repurchase: Approximately $93 million worth of shares repurchased in Q4.

On February 21, 2024, Etsy Inc (NASDAQ:ETSY), a leading e-commerce marketplace for unique and creative goods, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing, revealing a mix of achievements and challenges in a dynamic retail environment.

Etsy operates a top-10 e-commerce marketplace in the U.S. and the U.K., with significant operations in Germany, France, Australia, and Canada. The company specializes in a niche market, connecting buyers and sellers for vintage and craft goods. With $13.3 billion in 2022 consolidated GMS, Etsy has established itself as a major player in the rapidly growing online retail space. The company generates revenue through listing fees, commissions, advertising services, payment processing, and shipping labels. By the end of 2022, Etsy connected over 95 million buyers and 7.5 million sellers across its platforms, including Etsy, Reverb, and Depop.

Financial Performance and Challenges

Despite achieving the highest-ever quarterly revenue of $842.3 million in Q4, a 4.3% increase from the previous year, Etsy faced a slight year-over-year decline in consolidated GMS, down 0.7%. The company attributed the GMS headwinds to a challenging macroeconomic environment affecting consumer discretionary spending, category mix on the Etsy marketplace, and a competitive retail landscape. Additionally, the divestiture of Elo7 posed a minor setback.

The Etsy marketplace GMS saw a 1.4% year-over-year decrease to $3.6 billion but experienced a 142% increase on a four-year basis. The holiday season brought some acceleration in GMS, with Cyber 5 showing a 4% increase year-over-year. Active buyers reached a new high of 92 million, with a 3% increase from the previous year. The company also reactivated nearly 10 million lapsed buyers, a 13% increase from the prior year, and acquired over 8 million new buyers.

However, GMS per active buyer on a trailing twelve-month basis was down 4% year-over-year to $126 in the fourth quarter. The number of habitual buyers remained stable sequentially at just over 7 million. GMS outside the U.S. domestic market for the Etsy marketplace was 47% of overall GMS, with a 4% year-over-year increase.

Financial Achievements and Importance

Etsy's financial achievements, particularly in revenue growth and Adjusted EBITDA, underscore the company's ability to monetize its platform effectively amidst a challenging retail environment. The record revenue and stable Adjusted EBITDA margin demonstrate Etsy's resilience and the strength of its business model, which is crucial for maintaining investor confidence in the cyclical retail sector.

Consolidated net income for Q4 was $83.3 million, a 24% decrease from the previous year, primarily due to restructuring and exit costs of $27 million recognized in the quarter. The net income margin was approximately 10%, down roughly 400 basis points year-over-year. Diluted earnings per share were $0.62.

Adjusted EBITDA reached a record $235.5 million in Q4, with a margin of approximately 28%, relatively flat compared to the previous year. For the full year, Etsy's operational discipline and capital-light business model allowed for approximately $754 million in consolidated Adjusted EBITDA, a 27.4% margin, converting nearly 90% of that Adjusted EBITDA to free cash flow.

Under Etsy's stock repurchase program, the company repurchased approximately $93 million worth of its common stock during Q4, signaling confidence in its stock value and a commitment to returning capital to shareholders.

Outlook and Analysis

Looking ahead, Etsy provided guidance for the first quarter of 2024, expecting a low-single-digit decline in GMS year-over-year, with a take rate estimated between 21-21.5%. The Adjusted EBITDA margin is projected to be around 26%. For the full year 2024, Etsy anticipates revenue growth to outpace GMS growth, with consolidated Adjusted EBITDA margins at least similar to 2023.

The company's performance reflects its strategic focus on product development, marketing investments, and operational efficiency. Etsy's ability to maintain healthy margins and generate significant free cash flow, even in a challenging macroeconomic environment, positions it well for future growth and continued investment in its platform.

Value investors and potential GuruFocus.com members may find Etsy's disciplined investment approach and resilient business model appealing, especially given the company's strong revenue growth and commitment to capital return strategies. Etsy's focus on strategic growth initiatives, such as enhancing its gifting capabilities and international expansion, could drive long-term value creation.

For a more detailed analysis and insights into Etsy's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Etsy Inc for further details.

This article first appeared on GuruFocus.