EUR/USD Daily Forecast – Recovery Slows With Resistance in Play

Volatility jumped higher at the start of the week in several markets although currencies have continued to trade in their typical ranges. The S&P 500 posted the largest daily decline in two years yesterday while the price of gold rallied to a seven year high.

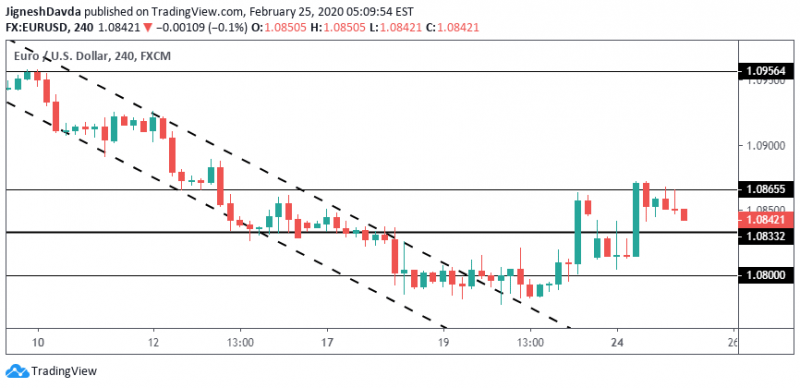

EUR/USD rallied firmly higher at the North American open on Monday but has since fallen into a range with horizontal resistance at 1.0865 drawing buyers.

GDP figures out of Germany today showed no growth in the fourth quarter and an overall growth rate of 0.6% for the year. The data did not have a significant impact on the exchange rate.

The Conference Board will report confidence figures later in the North American session.

The US dollar index (DXY) has eased lower from highs not seen since May 2017 but continues to hold on to a bulk of its gains for the month thus far. Considering that the recent spark of Coronavirus fears has not had a significant impact on the foreign exchange markets, it appears likely that the greenback will be bid on dips.

The euro had shown recovery potential but has started to come under pressure once again against some of its major counterparts. After the first hour of European trading today, bearish reversal candlestick patterns have printed for EUR/GBP and EUR/CHF.

Technical Analysis

EUR/USD has run into a hurdle at 1.0865 which is a level that provided support around the middle of the month.

The current short-term momentum remains to the upside and levels to watch below include 1.0833 followed by 1.0800. A drop below the latter would suggest that the pair has resumed to the downside, in line with the bearish trend that has dominated in February.

To the upside, a break above 1.0865 is likely to see some sellers at the 20-day moving average, currently near 1.0900. Beyond that, further resistance is seen at 1.0956.

Bottom Line

The EUR/USD recovery is hindered by resistance and a few cross rates point to euro weakness

Consumer confidence figures to be released by the Conference Board later today.

This article was originally posted on FX Empire

More From FXEMPIRE:

U.S. Dollar Index (DX) Futures Technical Analysis – Trader Reaction to 99.200 Pivot Sets the Tone

Price of Gold Fundamental Daily Forecast – Smart Money Looking for Value, Not Chasing Headlines

EOS, Ethereum and Ripple’s XRP – Daily Tech Analysis – 25/02/20

GDP Numbers and U.S Consumer Confidence Put the EUR and USD in Focus