Euro Inches Higher on German ZEW Survey Beat but Further Gains in Question

THE TAKEAWAY: German investor confidence improves to best level since March > Prospects for Euro-Zone growth over next six-months improve > EURUSD BULLISH

Data from the Euro-Zone’s core countries continues to improve, aiding the belief that the regional recovery will set in through the end of the year. Today’s data fits squarely in with this notion, after the August German ZEW Survey beat expectations all around, a sign that the strongest economy in Europe looks well-positioned ahead of the September German parliamentary elections.

Here are the German ZEW Survey (AUG) components helping the Euro this morning:

- Current Situation: 18.3 versus 12.0 expected, from 10.6

- Expectations: 42.0 versus 39.9 expected, from 36.3

Overall, it seems that, while the stronger than expected key data is helping the Euro, it simply isn’t provoking the type of optimism seen from ‘beats’ on data exhibited in June and July. The meager reaction feeds into the developing theme that the Euro has started to decouple from other European financial assets.

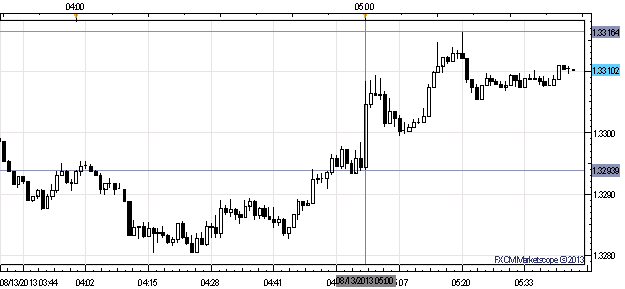

EURUSD 1-minute Chart: August 13, 2013

Charts Created using Marketscope – prepared by Christopher Vecchio

Following the data, the EURUSD rallied from $1.3294 to as high as 1.3316 (the session high). However, at the time this report was written, price had steadied and was seen ranging between 1.3305 and 1.3312. The most explosive move on the day goes to the EURJPY, which the survey helped bolster the move to session highs at ¥130.38; earlier today, price opened at 128.86.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.