The Euro Tech Holdings (NASDAQ:CLWT) Share Price Is Up 47% And Shareholders Are Holding On

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, Euro Tech Holdings Company Limited (NASDAQ:CLWT) shareholders have seen the share price rise 47% over three years, well in excess of the market return (37%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 14%.

Check out our latest analysis for Euro Tech Holdings

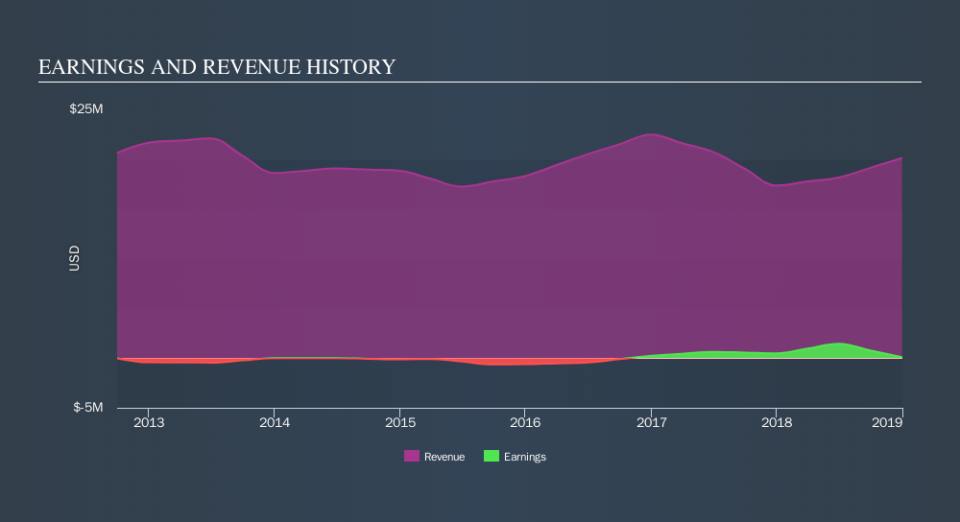

Given that Euro Tech Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Euro Tech Holdings actually saw its revenue drop by 2.7% per year over three years. The revenue growth might be lacking but the share price has gained 14% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered Euro Tech Holdings's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Euro Tech Holdings hasn't been paying dividends, but its TSR of 63% exceeds its share price return of 47%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Euro Tech Holdings shareholders have received a total shareholder return of 14% over one year. That's better than the annualised return of 2.6% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.